Market Integrity Update - Issue 80 - March 2017

- Share Investing pays $130,000 infringement notice penalty

- ASIC accepts enforceable undertaking from Westpac and ANZ to address inadequacies within their FX businesses

- Former Morgan Stanley Wealth Management adviser permanently banned from providing financial services

- BGC Partners pays $90,000 infringement notice penalty

- Celebrating equality

- ASIC’s enforcement report highlights key outcomes from the second half of 2016

- Disclosure of business models in IPO prospectuses

- Enhancing consumers’ financial literacy

- Stories from the beat

Share Investing pays $130,000 infringement notice penalty

Share Investing Limited (Share Investing) has paid a $130,000 infringement notice penalty for failing to prevent the entry of orders for a client that it should have suspected were placed with the intention of:

Share Investing Limited (Share Investing) has paid a $130,000 infringement notice penalty for failing to prevent the entry of orders for a client that it should have suspected were placed with the intention of:

- supporting or maintaining the price of the shares, and

- creating a false and misleading appearance of active trading in, or price of, the shares.

In April and May 2013, a client of Share Investing traded in the shares of a small energy company using its automated order processing system. The orders appeared to be inconsistent with the client’s previous trading, but were consistent with the client’s interest in maintaining the value of its holding by supporting the price of the shares.

The orders materially altered the price of the shares, including trading at the highest price on each day and/or setting the closing price. They also appeared to have been timed to create a price impact at minimal cost.

The Markets Disciplinary Panel (MDP) was satisfied that:

- Share Investing had a corporate culture that supported compliance with the market integrity rules, and

- had in place post-trade surveillance alerts and procedures for small orders that displayed traits attributable to market manipulation.

The conduct occurred after employees (including designated trading representatives) failed to properly follow the procedures for preventing intended market manipulation by the client, both before and after a management decision to closely monitor the client’s trading.

Compliance with the infringement notice is not an admission of guilt or liability, and Share Investing is not taken to have contravened subsection 798H(1) of the Corporations Act 2001 (Corporations Act).

ASIC accepts enforceable undertaking from Westpac and ANZ to address inadequacies within their FX businesses

We have accepted enforceable undertakings (EUs) from Westpac Banking Corporation (Westpac) and Australia and New Zealand Banking Group Limited (ANZ) in relation to their wholesale foreign exchange (FX) businesses.

We have accepted enforceable undertakings (EUs) from Westpac Banking Corporation (Westpac) and Australia and New Zealand Banking Group Limited (ANZ) in relation to their wholesale foreign exchange (FX) businesses.

Following an investigation we became concerned that, between 1 January 2008 and 30 June 2013, both banks had failed to ensure that their systems and controls were adequate to address risks relating to instances of inappropriate conduct identified by ASIC.

ASIC Commissioner Cathie Armour said, ‘The foreign exchange market is a systemically important market that depends on all participants acting with integrity and fairness. ASIC is committed to ensuring that major financial institutions have the systems in place to ensure their employees are trained to be fair, honest and efficient.’

Under the EU, Westpac and ANZ will each develop a program of changes to their existing systems, controls, monitoring and supervision of employees within their FX business. The programs and their implementation will be assessed by an independent consultant appointed by ASIC.

Westpac will also make a community benefit payment of $3 million to support the financial capability of vulnerable people, including women experiencing family violence, the elderly and youth at risk. ANZ will make a community benefit payment of $3 million to Financial Literacy Australia.

Our FX investigation has also seen ASIC accept EUs from National Australia Bank Limited and the Commonwealth Bank of Australia. These institutions made voluntary contributions totalling $5 million to fund independent financial literacy projects in Australia.

Former Morgan Stanley Wealth Management adviser permanently banned from providing financial services

We have permanently banned Andrew Peter Panayiotides from providing financial services after finding that he failed to act in the best interests of clients.

We have permanently banned Andrew Peter Panayiotides from providing financial services after finding that he failed to act in the best interests of clients.

Mr Panayiotides provided advice to clients of Morgan Stanley Wealth Management on exchange traded options (ETOs) that was inappropriate considering their financial circumstances and objectives. His conduct left clients’ superannuation accounts significantly exposed to short cash covered ETO positions that were contrary to their risk profile declarations.

Mr Panayiotides knew, or should have known, that there was a conflict of interest between the financial benefit he received (in the form of brokerage) from the ETO transactions he advised clients to enter into and their best interests.

As well as failing to give priority to his clients’ interests, Mr Panayiotides:

- improperly made payments into clients' bank accounts using his own funds

- issued a false invoice

- provided unethical advice to a client on a superannuation fund withdrawal, and

- entered into a personal loan arrangement with a client in return for offering reduced brokerage while at another firm.

Mr Panayiotides' conduct was not of an isolated nature, was not inadvertent and occurred over a long period of time causing his clients to suffer significant losses. We have reason to believe that Mr Panayiotides is not of good fame or character and is likely to contravene financial services law in the future.

ASIC Commissioner Ms Cathie Armour said, 'Financial advisers are expected to act in the best interests of clients. ASIC will ensure appropriate enforcement action is taken against advisers who fail in this duty.'

ASIC acknowledges Morgans' cooperative approach to improving its compliance standards and addressing ASIC's concerns. Mr Panayiotides has the right to appeal to the Administrative Appeals Tribunal for a review of ASIC's decision.

BGC Partners pays $90,000 infringement notice penalty

BGC Partners (Australia) Pty Limited (BGC) has paid a total penalty of $90,000 to comply with an infringement notice given to it by the MDP for failing to comply with Rule 3.3.1A(1) and 3.3.2 of the ASIC Market Integrity Rules (ASX 24 Market) 2010.

BGC Partners (Australia) Pty Limited (BGC) has paid a total penalty of $90,000 to comply with an infringement notice given to it by the MDP for failing to comply with Rule 3.3.1A(1) and 3.3.2 of the ASIC Market Integrity Rules (ASX 24 Market) 2010.

These rules deal with pre-negotiated business orders in the ASX 24 futures market. Where a market participant has written authority from a client to engage in pre-negotiated business on behalf of the client, the participant can withhold the implementation of instructions from the client in order to solicit instructions from other clients.

Where the participant seeks to execute pre-negotiated business on the market, the participant must make an enquiry through the message facility of the market, wait until 30 seconds has elapsed, and then enter the matching orders that reflect the pre-negotiated business for execution on the market.

The MDP found that on three occasions BGC transacted pre-negotiated business orders on the ASX 24 market but failed to make the required enquiry through the message facility of the ASX 24 trading platform. The MDP also found that BGC did not have written authorisations to transact pre-negotiated business with some of the clients.

The purpose of these rules is to strike a balance between facilitating pre-negotiated business and ensuring a fair, open and transparent trading system by requiring market participants to give others notice of intention to trade.

The compliance with the infringement notice is not an admission of guilt or liability, and BGC is not taken to have contravened subsection 798H(1) of the Corporations Act.

Celebrating equality

Rain-clogged clouds held out long enough for the Rainbow Regulators to dance and wave their way through the streets of Darlinghurst on the night of 4 March.

Rain-clogged clouds held out long enough for the Rainbow Regulators to dance and wave their way through the streets of Darlinghurst on the night of 4 March.

Taking part in Mardi Gras for the first time, ASIC joined the Australian Prudential Regulation Authority and the Reserve Bank of Australia to celebrate the LGBTQI community in style.

Mardi Gras has become one of the world’s leading showcases of LGBTQI strength and diversity. With 185 floats and 12,000 marchers, the atmosphere was electric and our people were greeted by roaring crowds. Spirits were high for the Rainbow Regulators, proud of how far the three agencies had come in supporting the diversity and inclusion of their people.

The theme of this year’s festival and parade was creating equality, which celebrated the progress the community has made so far, and highlighted areas where the LGBTQI community is fighting for equality.

By its very definition, equality ensures everyone is treated fairly and equally – and no-one is discriminated against for their sexuality, sex, gender identity, race, beliefs, age or abilities.

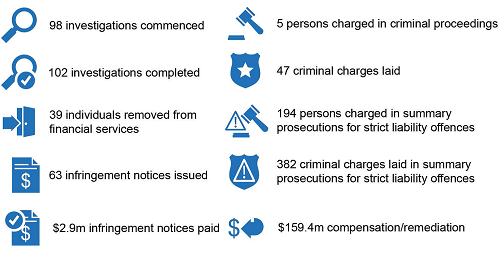

ASIC’s enforcement report highlights key outcomes from the second half of 2016

We have published our latest enforcement report for the period 1 July 2016 to 31 December 2016. Enforcement results over the six-month period include:

The report also covers ASIC’s key priorities and long-term challenges going forward, including:

- aligning conduct in a market-based system with investor and consumer trust and confidence

- digital disruption and cyber resilience in our financial services and markets

- structural change in our financial system

- complexity in financial markets and products, and

- globalisation of financial markets, products and services.

Some of our key outcomes over the last six months are covered in detail, in areas such as insider trading (Hochtief AG, Oliver Curtis), consumer credit (Cash Converters, Mintabie), protecting retail investors (21st Century), and continuous disclosure (Padbury Mining).

ASIC Commissioner Cathie Armour said, ‘ASIC is working hard to protect all participants in our markets and financial services industry from those that would seek to break the law. This report demonstrates our ongoing dedication to that cause.’

ASIC’s future areas of focus remain consistent, including:

- ensuring gatekeepers adhere to the high standards required by law, particularly where breaches indicate poor corporate culture or governance

- enforcing responsible lending practices in the credit industry, including a focus on systemic breaches by licensees, and

- conduct risk and the integrity of financial market benchmarks.

Disclosure of business models in IPO prospectuses

Issuers and their advisers should ensure that prospectuses clearly explain the issuer’s business model so that retail investors can assess the potential risks and returns associated with the offer.

Issuers and their advisers should ensure that prospectuses clearly explain the issuer’s business model so that retail investors can assess the potential risks and returns associated with the offer.

Recently, we have seen a number of prospectuses that failed to clearly explain the issuer’s business model and/or sufficiently analyse its components. In some cases, our surveillances have revealed key information about a business model that was omitted from a prospectus.

In the case of issuers operating in heavily regulated industries – for example, in gaming, gambling or medicinal marijuana industries – we have also seen instances where the legality of the business operations and associated risks were not properly dealt with in the prospectus.

Regulatory Guide 228 Prospectuses: Effective disclosure for retail investors outlines what we expect a prospectus to explain, including:

- the main components of the issuer’s business model

- the key assumptions underlying the model

- the associated risks.

We also expect to see a substantive analysis of the components of an issuer’s business model. That analysis should:

- not simply be a description of the components

- explain how the business model works (i.e. how the components relate to each other)

- explain the issuer’s ability to make money and generate income or capital growth for investors, or to otherwise meet their objectives.

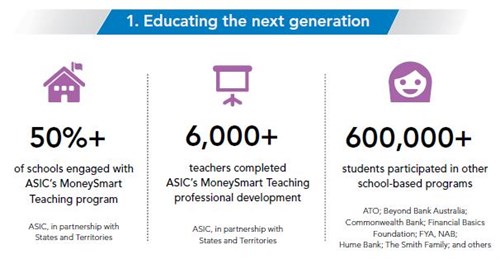

Enhancing consumers’ financial literacy

With a growing range of financial products and services being made available to investors and consumers, financial literacy empowers individuals to master the complexities of decision-making around these products – allowing them to take full advantage of the benefits that flow from financial innovation.

With a growing range of financial products and services being made available to investors and consumers, financial literacy empowers individuals to master the complexities of decision-making around these products – allowing them to take full advantage of the benefits that flow from financial innovation.

In February, the Minister for Revenue and Financial Services the Hon. Kelly O’Dwyer MP launched the National Financial Literacy Strategy Annual Highlights Report 2015-16 (PDF 3 MB).

The report paints a national picture of financial literacy programs and initiatives delivered by a wide range of organisations across the government, education, industry and community sectors in support of the National Financial Literacy Strategy, led and coordinated by ASIC’s Financial Capability Team.

Together the initiatives assisted over 700,000 people through targeted financial literacy activities.

The National Financial Literacy Strategy highlights the importance of providing people with tailored resources and tools, and of responding to the financial issues facing vulnerable sectors of the community.

The five priorities set out in the strategy are:

- educate the next generation, particularly through the formal education system

- increase the use of free, impartial information, tools and resources

- provide quality targeted guidance and support

- strengthen coordination and effective partnerships

- improve research, measurement and evaluation.

Check out the highlights from the report!

Stories from the beat

We recently reviewed trading in a listed entity before the release of its annual results, after the market reacted positively to the news.

We recently reviewed trading in a listed entity before the release of its annual results, after the market reacted positively to the news.

We identified a trader – who was an employee of the company – and sought details about them from the broker, including order details, client trading history and contact and account opening details.

We also reviewed the trading history of the employee and asked ourselves the following questions:

- When was the account opened?

- How often did they trade?

- Were trades made ahead of scheduled or unscheduled announcements?

- Was a profit realised following the announcement?

- Was the order consistent in size with past trades?

We then approached the company to obtain access to internal communications and documents. The employee was a junior in the organisation and did not have access to the results ahead of the announcement. While the share trading policy applied a blackout ahead of the announcement, this did not extend to the employee because they were not one of the key management personnel.

We interviewed the employee and confirmed the reasons for the trade were unrelated to knowledge of the results ahead of the announcement.

While we were satisfied there was no insider trading in this case, we consulted with the company about amending their share trading policy to cover all employees. This would have prevented the employee from trading – and saved time and expense for ASIC, the broker, the company and the employee.

For more information about employee share trading, read our latest article for the Stockbrokers and Financial Advisers Monthly.