A new mobile phone app – MoneySmart Cars - developed by ASIC will support Australians with the financial decisions associated with buying a car.

ASIC's MoneySmart Cars app is a free education tool to help people understand the real costs of buying and running a car. It will assist consumers with their research to make informed choices.

The new app gives impartial guidance on:

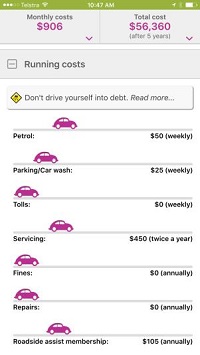

- The real cost of buying a car, including interest, extras and ongoing costs;

- Avoiding common car buying traps, such as being sold extras you don't need or want;

- Finding alternate ways to finance a car and;

- Making informed financial decisions prior to purchase.

'With the average car debt per household at about $19,500[1], buying a car, particularly for young drivers, is an exciting but expensive financial commitment. Our research found that while price is a key consideration, other costs such as loan interest, insurance, servicing and fuel are generally not considered', said Mr Peter Kell, ASIC Deputy Chairman.

'Knowing how much owning a car will cost you, including the cost of interest and add-ons you might not think about, will help you make informed decisions about how much you can afford and ensure you get value for money', said Mr Kell.

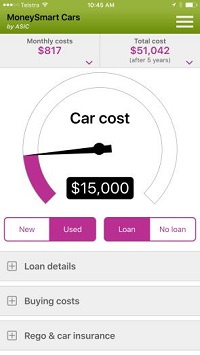

For example, using ASIC's MoneySmart Cars app reveals that purchasing a $15,000 used car on finance, will cost $817 per month, and a total of over $50,000 over 5 years, with interest and running costs taken into account.

'We also know that many consumers fall prey to poor financial decisions, when in a car yard for example, because they may be solely focussed on the car or overwhelmed by information overload. ASIC's new app is a practical tool that puts you in the driver's seat', Mr Kell said.

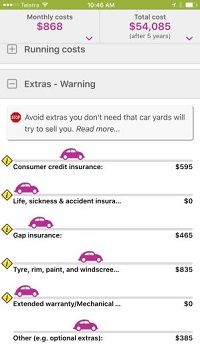

The app will support and complement ASIC's ongoing regulatory work on consumer protection issues by alerting consumers to the risks of add-on insurance products and other hidden costs. For example, a recent ASIC report[2] found that consumers can pay up to 18 times more for life insurance purchased through a car dealer, compared to insurance available elsewhere, and there was a low level of awareness of add-on insurance products.

ASIC's MoneySmart Cars app is available now on the App Store and Google Play. The app will be promoted online and shared with external stakeholders in the car industry.

ASIC's promotion of the app will be supported by a series of videos for use on social media, featuring V8 SuperCar driver Craig Lowndes who introduces some key features.

'Buying a car is a big financial commitment and it's easy to be overwhelmed by the choices on offer. Having a resource at your fingertips can help you make the right decision. Whether it's a sedan, a hatch or an SUV you're interested in, before you shop around consult ASIC's MoneySmart Cars app.

It's the perfect tool to assist with your research so the car you buy meets your need', said Craig Lowndes.

To see ASIC's financial tips on car loans and car insurance visit ASIC's MoneySmart website.

Images of ASIC's MoneySmart Cars app:

|

|

|

|

Background

ASIC is the Australian Government agency responsible for financial literacy, consistent with its strategic priority to promote confidence and trust in the financial system. Financial literacy is about having the knowledge, skills, attitudes and behaviours to make good financial decisions. ASIC leads and coordinates the National Financial Literacy Strategy, which sets out a national framework for financial literacy work in Australia.

ASIC has produced two reports on add-on insurance products and the sale of life insurance components of consumer credit insurance (CCI) sold through car dealers (car yard life insurance).

The Buying add-on insurance in car yards: Why it can be hard to say no[3] report summaries ASIC's analysis of research commissioned to understand the experience of consumers who bought add-on insurance products when buying a vehicle through a dealership.

The sale of life insurance through car dealers: Taking consumers for a ride[4] report presents findings in relation to the sale of the life insurance components of consumer credit insurance (CCI) sold through car dealers (car yard life insurance). The report reviewed the sale of add-on insurance products through car dealers. It found that life insurance sold through car dealers is often substantially more expensive than comparable life insurance products, provides very low claim payouts relative to premiums, can be sold when it is not necessary (e.g. to young people with no dependants) and is sold by car dealers who are paid high commission by insurers on sales.

ASIC has taken action recently to ban a number of individuals for misconduct in selling add-on insurance products (refer: 15-189MR; 15-312MR; and 15-374MR).

[1] ASIC Report 470 Buying add-on insurance in car yards: Why it can be hard to say no, 26 February 2016