ASIC Chairman, Greg Medcraft today launched a new free mobile app – First Business by ASIC's MoneySmart – to support young Australians starting a small business.

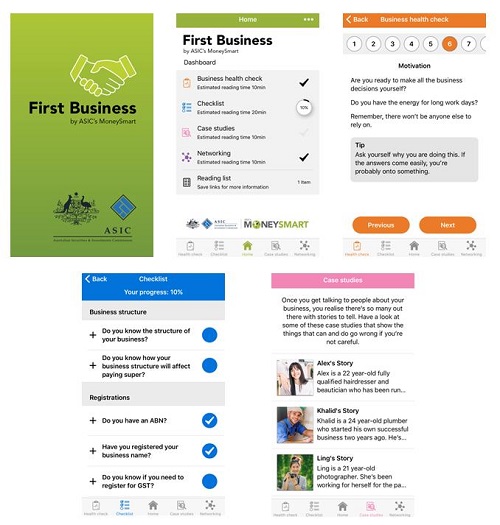

First Business was developed by ASIC in collaboration with the Australian Taxation Office, to assist young people considering going into business for themselves. The mobile app provides practical tips, checklists, case studies and links to additional information relating to developing and running a small business.

'ASIC's vision is to allow markets to fund the real economy and economic growth. Small businesses play an essential role in this and account for around 45% of employment and 35% of output nationally,' [1] said Mr Medcraft.

'We also know that a large number of new sole trader and micro-businesses are started by young adults. A lack of business knowledge, experience and planning are some of the challenges they face when starting out.'

'For its part, ASIC wants to support young people to be successful in business by providing access to tools and resources to build their financial capability and help them with the financial decisions they'll need to make,' he said.

The key features of the new mobile app include:

- a business health check to help young people decide if they are ready to start a business;

- a starting your business checklist to assist with ongoing obligations, including registrations, licences, tax and super responsibilities and legal requirements;

- business case studies including advice on what can go wrong and how to avoid this; and

- a networking section with tips and ideas on how to develop your business network.

ASIC's First Business app is available now on the App Store and Google Play.

The mobile app will be promoted online and shared with external stakeholders, including the education sector.

Background

ASIC is the Australian Government agency responsible for financial literacy, consistent with its strategic priority to promote confidence and trust in the financial system. Financial literacy is about having the knowledge, skills, attitudes and behaviours to make good financial decisions. It is part of ASIC’s strategic priority to promote consumer trust and confidence in the financial system.

ASIC leads and coordinates the National Financial Literacy Strategy, which sets out a national framework for financial literacy work in Australia. The Strategy highlights the importance of providing people with tailored resources and tools, and of responding to the financial issues facing vulnerable sectors of the community. People experiencing high financial stress and crisis are identified as one of a number of priority audiences in the National Strategy.

ASIC’s MoneySmart website provides impartial and trusted financial guidance and tools to support informed financial decision-making for all Australians.

[1] National Small Business Statistics, Small Business Data Card, Department of the Treasury, 23 September 2016