The Federal Court today imposed a penalty of $10.5 million against Active Super for greenwashing misconduct.

In June 2024, the Federal Court found that Active Super contravened the law when it invested in various securities that it had claimed were eliminated or restricted by its environmental, social and governance (ESG) investment screens.

ASIC Deputy Chair Sarah Court said, ‘This is a significant penalty that sends a strong message to companies making sustainable investment claims that those claims need to reflect the true position.

‘This case demonstrates ASIC’s commitment to taking on misleading marketing and greenwashing claims made by companies promoting financial services. It is our third greenwashing court outcome, and we will continue to keep greenwashing in our sights.’

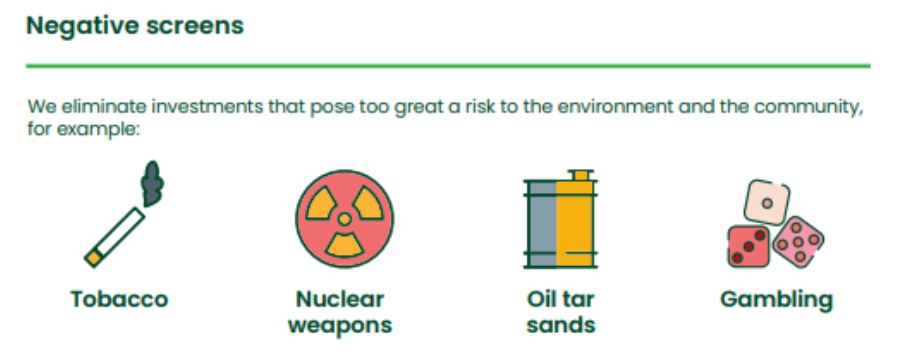

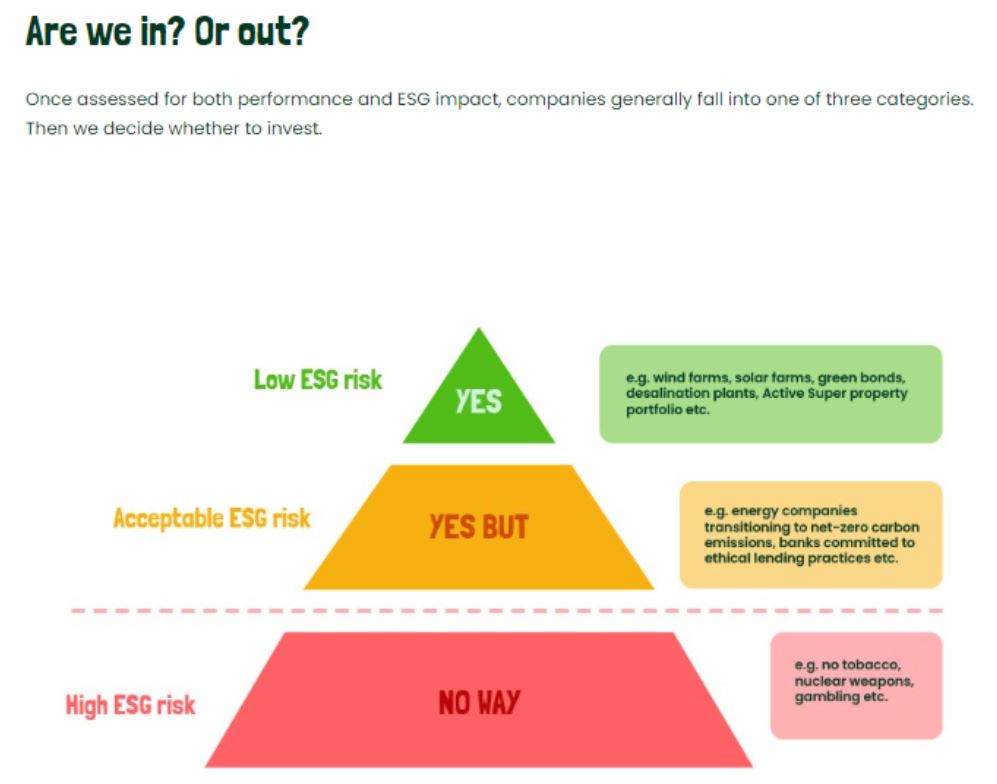

Active Super claimed in its marketing that it eliminated investments that posed too great a risk to the environment and the community, including gambling, coal mining and oil tar sands. Following the invasion of Ukraine, Active Super also made representations that Russian investments were ‘out’.

However, contrary to these representations, Active Super held direct and indirect investments in companies such as SkyCity Entertainment Group Ltd (gambling), Gazprom PJSC (Russian entity), Shell Plc (Oil tar sands) and Whitehaven Coal (Coal mining).

His Honour, Justice O’Callaghan said:

‘It was not disputed that LGSS’s contraventions were serious. LGSS benefitted from its misleading conduct by misrepresenting the “ethical” nature of a significant part of its investments, which on any view enhanced its ability to attract investors to the Active Super fund and enhanced its reputation as a provider of investment funds with ESG characteristics. As a result, investors lost the opportunity to invest in accordance with their investment values.

‘Further, the contravening conduct continued over an extensive period of time (approximately two and a half years); the likely causes of it were never explained; it concerned substantial investments; it was likely to have led to investors losing confidence in ESG programs; and the failure by LGSS to have in place properly functioning systems and processes designed to ensure that its representations were not false or misleading was the responsibility of senior management. Further, when confronted with the allegations by ASIC, LGSS ran a host of contrived arguments in its defence at trial.’

Download

Background

Active Super was a profit to member superannuation fund that merged with Vision Super on 1 March 2025. Prior to its merger, as at 30 June 2024, Active Super managed approximately $14.7 billion in superannuation assets for 86,547 members.

The below two visual representations were published in Active Super’s Impact Report and are subject of ASIC’s proceeding:

[Click image to enlarge]

[Click image to enlarge]

The contravening representations were made in:

- the Active Super fund’s website (the Website)

- an email sent to 45,621 members of Active Super, that was also published on the Website

- the Impact Report for 2021/22

- Product Disclosure Statement (PDS) Fact Sheets issued in 2021

- PDS Fact Sheets issued in 2022

- the Responsible Investment Report for 2021/22

- the Sustainable and Responsible Investment Policy which was available in three separate versions during the period 10 August 2022 to May 2023, and

- an interview with the CEO of Active Super in Investment Magazine.

ASIC’s Information Sheet 271 How to avoid greenwashing when offering or promoting sustainability-related products (INFO 271) provides information for responsible entities of managed funds and super fund trustees about how to avoid greenwashing when offering or promoting sustainability-related or ethical products and investments.

ASIC’s Moneysmart website has a range of tools and resources to help people understand money and how to manage it. Find out more about ESG investing and how it works.

Companies that ASIC alleges investor funds were exposed to:

- Skycity Entertainment Group Ltd – Skycity is one of two major publicly listed casino operators in Australasia, Skycity operates integrated entertainment complexes in New Zealand and Australia, each featuring casino gaming facilities

- PointsBet Holdings Ltd – PointsBet is an ASX listed sports wagering operator and iGaming provider, offering sports and racing products and services via its cloud-based technology platform

- Tabcorp Holdings Ltd –Tabcorp is a betting and entertainment experiences business. Their brands include TAB, Sky Racing and MAX

- Gazprom PJSC– Russian company Gazprom operates gas pipeline systems and carries out the exploration, production and transportation of gas

- Rosneft Oil Company – Russian company Rosneft Oil Company engages in the exploration, development, production and sale of crude oil and gas

- Shell Plc – Shell is an energy and petrochemical company which supplies crude oil and natural gas, as well as oil sands activities

- Whitehaven Coal Limited – Whitehaven Coal Limited operates 4 coal mines producing metallurgical and thermal coal for export across North and Southeast Asia.

The above summaries are taken from company annual reports and other publicly available information.