A significant uptake in small business restructurings (SBRs) over the last few years, and other data, suggest the SBR regime is playing an important role in assisting struggling small businesses to survive, a new ASIC report reveals.

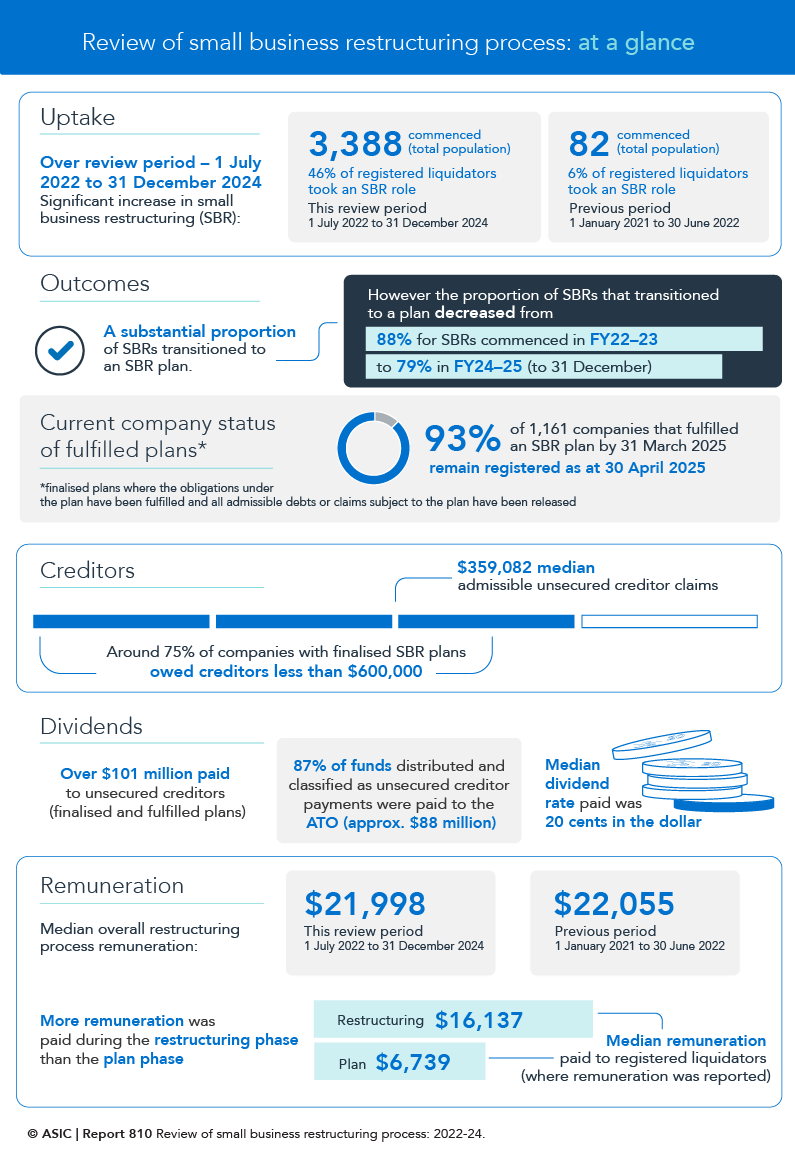

Report 810 Review of small business restructuring process: 2022–24 (REP 810) showed there were 3,388 SBR appointments that commenced between 1 July 2022 and 31 December 2024 (the review period). This is a significant increase from the 82 SBR appointments from 1 January 2021 to 30 June 2022 revealed in Report 756 Review of small business restructuring process (REP 756).

The number of appointments continues to increase each year, with 448 appointments in 2022-23, 1,425 in 2023-24, and appointments for 2024-25 expected to be around 3,000.

Around half of all SBR appointments during the review period came from the Construction (27%) and Accommodation and Food Services (23%) industries.

From those 3,388 SBR appointments, 2,820 transitioned to small business restructuring plans (SBR plans), while the majority of the remaining 568 appointments were terminated as a result of creditors rejecting the proposed plan.

The SBR regime provides a streamlined process for directors of struggling small companies to restructure their debts, while remaining in control of the company.

ASIC Commissioner Kate O’Rourke said: ‘After a slow start, the recent growth of SBRs and other data in our report shows that the SBR regime is starting to deliver on the intended policy objective of reducing the complexity and costs involved in insolvency processes for small businesses and ultimately helping them to survive.

‘Safeguards against the misuse of the SBR process are important. In addition to the statutory safeguards, where we can, ASIC has tested questions raised by some stakeholders about the potential misuse of the SBR process. At this stage, we have not found evidence that indicates widespread misuse of the SBR process.

‘We will continue to monitor the uptake of SBRs and their effectiveness. We are committed to ensuring that the SBR regime provides a cost-effective restructuring option that supports the survival of small business while minimising the risk of misuse.’

There was over $101 million in dividends distributed to unsecured creditors from fulfilled SBR plans. Approximately 87% (approximately $88 million) of these funds were distributed as dividends to the Australian Taxation Office.

The median remuneration paid for the restructuring process remained stable overall during the review period at $21,998, similar to the $22,055 reported in REP 756.

Downloads

Report 810 Review of small business restructuring process: 2022–24 (REP 810)

Review of small business restructuring process: at a glance

Background

In 2020, the Government introduced legislation which changed Australia’s insolvency framework for small businesses from 1 January 2021. This included creating a new simplified debt restructuring process for eligible small businesses whereby control of the insolvent company is left in the hands of the directors and not the appointed registered liquidator.

As a result, small business restructurings (SBRs) now occur in two phases:

- Appointment of a registered liquidator as the restructuring practitioner, where:

- directors of a company appoint a restructuring practitioner if the company meets the eligibility criteria, and the directors resolve that the company is insolvent or likely to be insolvent and that a restructuring practitioner should be appointed, and

- a restructuring proposal period of 20 business days commences where the company proposes a restructuring plan.

- Entering into a restructuring plan (if one is approved).

In January 2023, ASIC released REP 756 Review of small business restructuring process covering the 82 small business restructuring (SBR) appointments from 1 January 2021 to 30 June 2022.