Published by the Stockbrockers Association of Australia in the Stockbrokers Monthly, June 2016.

Benefits of client education

Better informed investors make better clients. They are less likely to invest in products they don't understand, less likely to take on unsuitable risk and less likely to panic when markets fluctuate over the short-term.

Talking to your clients about shares, exchange traded funds (ETFs), hybrid securities or any type of investment is much easier once they have a basic understanding of the product or type of investment.

Financially literate clients are better able to focus on the strategy and advice you are giving, making interactions more productive for both you and the client.

Financial literacy helps reduce the incidences of poor consumer outcomes. It has also been shown to boost participation in financial services and markets, with a positive flow-on effect to the broader economy.[1]

How ASIC's MoneySmart can help your clients

How ASIC's MoneySmart can help your clients

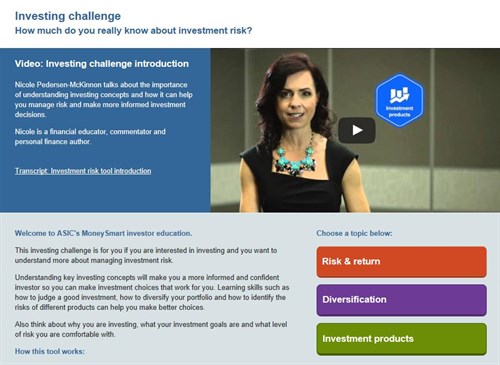

ASIC's MoneySmart website can help your clients to better understand their investments and their money. The website provides free, independent financial guidance and easy to use tools. It has been created by an experienced team of finance professionals, consumer educators and digital resource specialists, and is informed by research and expert advice.

ASIC's MoneySmart has an investing section that provides information on simple investments like shares and property, as well as complex investments like ETFs and hybrid securities.

It also offers a full suite of financial calculators and apps, including our very popular budget planner, retirement planner, mortgage calculator, and innovative apps like TrackMySPEND and TrackMyGOALS.

The site even has an investing challenge that tests your knowledge of investment risk.

Broadening a client's basic financial management skills will give them greater confidence when investing and setting financial goals.

Familiarise yourself with the broad range of information and tools available on ASIC's MoneySmart website so that you can tailor suggested content to suit your clients' needs.

What is financial literacy?

Financial literacy is having the financial knowledge, skills, attitudes and behaviours necessary to make sound financial decisions.[2] Financial literacy is a core life skill that must be maintained in order to navigate changing personal circumstances, new product offerings and the evolving financial services landscape.

ASIC has the responsibility of managing Australia's National Financial Literacy Strategy. The strategy encompasses initiatives across government, business, community, and the education sectors. Find out more about the strategy at the National Financial Literacy website.

[1] OECD, PISA 2012 Financial literacy assessment framework, April 2012; and Report 229 Australian National Financial Literacy Strategy.

[2] Report 403 National Financial Literacy Strategy 2014–17.