Published by the Stockbrockers Association of Australia in the Stockbrokers Monthly, June 2014.

ASIC would like to notify industry of two issues of current concern to us and actions we are taking to address them. Australian financial markets are in good health and well regarded both at home and abroad. By taking action to address issues such as these proactively, ASIC can prevent potential deterioration in market integrity, reinforcing confidence in our markets.

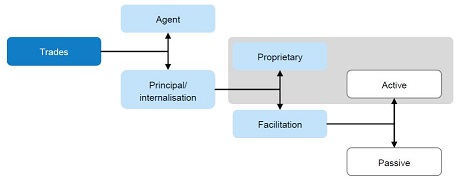

Principal trading and facilitation

In March 2013, ASIC released Report 331 Dark Liquidity and high-frequency trading (REP 331) and Consultation Paper 202 Dark liquidity and high-frequency trading: Proposals (CP 202). REP 331 and CP202 identified potential areas for conflicts where a market participant is trading with clients against its own account.

We refer to this as principal trading and facilitation. This activity may be in response to a client request (passive facilitation) or it may involve a market participant taking a position in a stock in anticipation of client demand (active facilitation).

Market participants may benefit at the expense of clients when information asymmetries arise. Market participants may also benefit from internalising orders to increase volumes through their internal crossing systems which can also create conflicts of interest with client orders. We are particularly concerned about situations where employees of participants who undertake facilitation activities also perform other trading roles which give them knowledge of the client order book and client's trading intentions.

ASIC's Market and Participant Supervision team has met with a number of market participants who engage in principal trading and client facilitation to determine (a) the nature and extent of their facilitation and principal trading activities in Australia, (b) who undertakes the principal trading and facilitation activities and (c) arrangements for managing information flows and conflicts of interest.

Among the firms we have spoken with, facilitation is seen as a necessary part of their service offering. Indeed, facilitation is a service that a number of institutional clients expect their broker to provide. However, clients are not always advised that they are trading against the house and may not be aware of the potential for conflicts.

In coming months, ASIC will provide additional updates and feedback on our review principal trading and facilitation activities.

Selective disclosure of confidential information

Company briefings to market participants (including their research analysts) and investors are a significant risk area for selective disclosure of confidential, price-sensitive information. Too often, we are seeing price movements and volume increases before a formal company announcement is made. Where companies engage in selective briefings and disclose confidential, price-sensitive information to only a portion of the market, it creates opportunities for insider trading and undermines other investors’ confidence in the market as a level playing field.

Briefings must comply with the laws relating to continuous disclosure and insider trading. Continuous disclosure obligations are designed to prevent the leakage and selective disclosure of confidential, price-sensitive information, which can affect the integrity of our markets.

Listed entities should provide broad access to briefings, including recordings and transcripts. Listed entities should exercise caution when conducting smaller and less formal briefings with market participants and investors to ensure that there is no selective disclosure of information. Likewise, analysts should exercise good judgment when attending briefings and have a responsibility to verify that information is publically available.

In May 2014, ASIC released a report on the handling of confidential information. We are currently monitoring analyst rating changes to identify whether selective briefings are occurring and will be looking at how research analysts are supervised. Where we identify inappropriate disclosures, we will take enforcement action.

ASIC Market Supervision Updates

We would like to invite readers to subscribe to ASIC's Market Supervision Update. This free, monthly publication highlights current issues in market supervision and surveillance. It is essential reading for anyone working in financial markets! Click here to subscribe.