ASIC today released its review of the life insurance sector's handling of claims. The review found that, while life insurers are paying the considerable majority of claims, there are significant shortcomings in a number of areas of life insurance claims handling, and there is a clear need for public reporting on life insurance claims outcomes – at an industry and individual insurer level.

'Life insurance is a vitally important financial product that helps support consumers and their families at times of significant stress. Not being able to successfully claim on a life insurance policy can be financially devastating for the consumer and/or their family, so it's important that the industry operates in a way that is fair and transparent,' said Peter Kell.

ASIC's review examined 15 insurers covering more than 90 per cent of the market. The six-month review analysed three years' of data on the four major life insurance policy types – term life cover, total and permanent disablement (TPD), trauma, and income protection. ASIC worked closely with APRA during the review. We note APRA's media release today.

ASIC sought to identify whether there were systemic issues across the industry, as well as concerns relating to particular products or firms. The review also assessed whether industry data indicated the need for further, more targeted surveillance work.

Findings

ASIC found that approximately 90% of claims are paid in the first instance with around $8.2billion in net policy payments made in the year ending 30 June 2016.

While not finding evidence of cross-industry misconduct, ASIC's review identified issues of concern in relation to higher claims denial rates and claims handling procedures associated with:

- particular types of policies: The rates of declined claims were highest for TPD cover (average declined claim rate of 16%) and trauma cover (average declined claim rate of 14%)

- a considerable variation in declined claims among insurers, with TPD denial rates being as high as 37% and trauma (up to 25%) for some types of cover

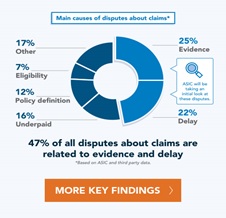

- the most common types of life insurance disputes were about the evidence insurers require when assessing claims (including surveillance), and delays in claims handling.

ASIC's review also found that there were higher claims denial rates in relation to insurance policies sold direct to consumers with no financial advice (compared to policies sold through advisers and group insurance policies).

Actions to raise claims handling standards

ASIC has set out the following actions to improve standards in life insurance claims handling:

- establishing, with APRA, a new public reporting requirement for life insurance industry claims data and claims outcomes

- recommending to Government the strengthening of the legal framework covering claims handling

- recommending the consumer dispute resolution framework for claims handling be strengthened

- targeted follow-up ASIC reviews on areas of concern including individual insurers with high decline and dispute rates, as well as a new major review of life insurance sold directly to consumers without personal advice; and

- strengthening industry standards and practices, including through extension and enhancement of the life insurance code of practice.

Public reporting of life insurance claims

To improve public trust, there is a clear need for better quality, more transparent and more consistent data on life insurance claims. ASIC's review found that data limitations, including inconsistent definitions across insurers, mean that care must be taken with current comparisons and follow up work will be required to better understand the claims performance of particular insurers or policies.

ASIC and APRA will work with insurers and other stakeholders over 2017 to establish a consistent public reporting regime for claims data and claims outcomes, including claims handling timeframes and dispute levels across all policy types. Data will be made available on an industry and individual insurer basis.

Strengthening the regulatory framework for claims handling

Currently 'insurance claims handling' is explicitly exempted from the financial services conduct provisions of the Corporations Law. ASIC is recommending that this exemption be removed by the Government and that more significant penalties for misconduct in relation to insurance claims handling are also included in the current review of ASIC's penalty powers.

Strengthening the dispute resolution framework for claims handling

ASIC is recommending that the coverage of life insurance claims by dispute resolution schemes should be considered as part of the current inquiry into external dispute schemes (the Ramsay Review). In particular, ASIC has highlighted the need to:

- ensure better and more effective consideration of issues of fairness to supplement the existing jurisdiction; and

- give better access to consumers with complaints about delays in claims handling and ensure better remedies when these complaints are found in favour of the consumer.

Follow up ASIC surveillances and reviews

ASIC will target the areas of concern we have identified from our review, applying targeted surveillances of particular insurers that have the highest decline rates and highest proportional dispute numbers, and examining TPD claims procedures and timeframes.

ASIC will also conduct a major review of the life insurance sold without personal advice (also known as 'direct' life insurance).

Strengthen industry standards and practices

ASIC has made a number of recommendations for the insurance sector to undertake including:

- immediately review the currency and appropriateness of policy definitions

- examine and ensure advertising and representations about the cover align with the definitions and the policy, and report any discrepancies to us

- ensure that claims timeframes are consistent with industry standards and expected claims timeframes are adequately communicated to policyholders

- ensure that incentives and performance measurements for claims-handling staff and management do not conflict with the obligation to assess each claim on its merit.

These recommended responses should supplement the development of and compliance with the Life Insurance Code of Practice, to improve claims handling standards. As part of their ongoing development of the code, ASIC notes that industry could consider seeking approval of their code under ASIC's Regulatory Guide 183, Approval of financial service sector codes of conduct, as a signal to consumers that this is a code they can have confidence in.

Download

- Report 498 Life insurance claims: An industry review

- Media release 16-348MR Update on ASIC's investigation into CommInsure

- Infographic – ASIC's work so far

- Infographic – A snapshot of ASIC's review

- Read APRA's media release

Background

In March 2016, the ABC Four Corners program and Fairfax Media publications jointly reported on a number of concerns about the life insurance claims handling practices of The Colonial Mutual Life Assurance Society Limited (trading as CommInsure).

ASIC is also undertaking a separate investigation into the activities of CommInsure, following allegations in media coverage. An update on that review is also released today.

In addition to our investigation of CommInsure, we undertook a review of claims handling practices across the life insurance industry. We reviewed data on claims from 15 insurers, estimated to make up over 90% of the life insurance market. The insurers included in this review are:

- AIA Australia Limited;

- Allianz Australia Life Insurance Limited;

- AMP Life Limited;

- Clearview Life Assurance Limited;

- Colonial Mutual Life Assurance Society Limited;

- Hannover Life Re of Australasia Ltd;

- Macquarie Life Limited;

- Metlife Insurance Ltd

- MLC Limited;

- OnePath Life Limited;

- St Andrew's Life Insurance Pty Ltd;

- Suncorp Life & Superannuation Limited;

- TAL Life Limited;

- Westpac Life Insurance Services Limited;

- Zurich Australia Limited.

We also conducted an analysis of claims-related disputes and reports of misconduct and undertook a targeted review of Product Disclosure Statements (PDSs) and policy documents to supplement the information provided by insurers.

Our review covered the three year period from 1 January 2013 to 31 December 2015, and assessed the four most common life insurance products:

- life cover (also known as 'term life cover' or 'death cover')

- total and permanent disablement (TPD)

- trauma, and

- income protection cover.

The review also assessed claims outcomes and trends by distribution channels, for the three main channels:

- group cover made available to members of superannuation funds, employees and members of master trusts (group policies)

- individual cover sold by financial advisers (retail policies), and

- individual cover sold directly by insurers or third parties (e.g. through a call centre or online) without advice (direct or non-advised policies).

Our review and this report follows another ASIC report reviewing life insurance products: see ASIC Report 413 Review of retail life insurance advice published in 2014. This report found unacceptable levels of poor-quality advice and a strong correlation between high upfront commissions and poor consumer outcomes, including in situations where the recommendation was to switch products. Our follow-up work on this report is ongoing.

Consumers who have concerns about their life insurance claim should contact their insurer's internal dispute resolution team. Consumers can also take a life insurance claim dispute to the Financial Ombudsman Service or, if the claim is in relation to a life insurance policy held through a superannuation fund, the Superannuation Complaints Tribunal. Other queries about your life insurance cover can be raised with your insurer, your financial adviser, or your superannuation fund.

See ASIC's MoneySmart website for information about life insurance.