Corporate Finance Update - Issue 10

Issue 10, September 2022

Contents

Recent developments in sustainable finance

Research findings: Prospectus forecasts – use, accuracy and disclosure issues

ASIC intervenes in mining fundraisings

Minimum subscriptions improve investor confidence

Fundraising activity from January to June 2022

In-principle decision to refuse relief from section 606 for the issue of shares under a DOCA

Regulatory carve-out in takeover bid conditions

Unacceptable fetters on ‘fiduciary outs’ in schemes of arrangement

Material adverse change conditions

Matching periods in control transactions

Disclosure and on-sale relief for foreign regulated merger

Merger and acquisition activity from January to June 2022

New disclosure requirements for ASX-listed oil and gas issuers

Expert’s conduct in preparing its report

In-principle decision to facilitate virtual-only general meetings

Continuous disclosure is important for unlisted disclosing entities too

Managing cyber risk in supply chains

‘Blackout period’ for members’ meetings

Sustainable finance

Recent developments in sustainable finance

Developments in sustainable finance continue to move at a rapid pace both domestically and internationally. As investor demand for both sustainability-related information and financial products continues to grow, strong and effective governance and disclosure are critical to support well-informed decision making.

Climate change

ASIC continues to strongly encourage directors of listed companies to take a probative and proactive approach to the assessment, management and mitigation of the potential impact of climate change on the business of the company. This extends to both the physical impacts of climate change hazards and the transition to a lower carbon economy. We note:

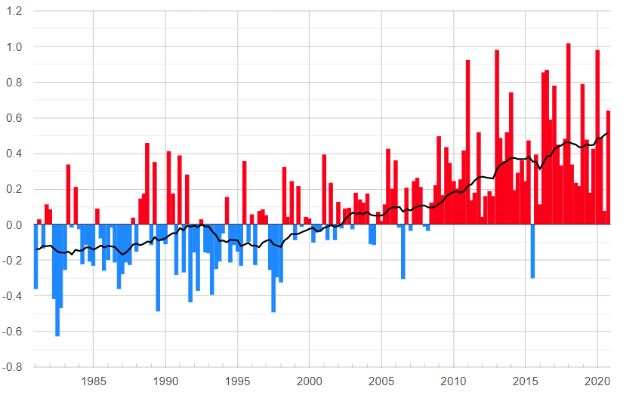

- the Australian Actuaries Climate Index reached a record level in autumn: see Actuaries Institute, Australian Actuaries Climate Index Record for extreme weather reflects a season of severe flooding (PDF 216 KB), media release, 28 July 2022. This index produces an objective measure of extreme weather conditions and changes to sea levels to help policymakers and Australia’s businesses assess how the frequency of weather extremes is changing over time.

Figure 1: Australian Actuaries Climate Index

Australia wide. The current index value for this region for the overall climate index is 1.01

Source: Actuaries Institute (https://actuaries.asn.au/)

- in May the Australian Government filed an update to Australia’s nationally determined contribution (NDC) under Article 4 of the Paris Agreement of the United Nations Framework Agreement on Climate Change, increasing the ambition of Australia’s 2030 target, committing to reduce greenhouse gas emissions 43% below 2005 levels by 2030. This target was subsequently legislated by the Australian parliament.

Greenwashing

On 14 June 2022 ASIC released Information Sheet 271 How to avoid greenwashing when offering or promoting sustainability-related products (INFO 271) to help issuers avoid ‘greenwashing’ when offering or promoting sustainability-related financial products. INFO 271 will help issuers to provide investors with the information they require to make informed decisions. While INFO 271 is for responsible entities of managed funds, corporate directors of corporate collective investment vehicles (CCIVs), and trustees of registrable superannuation entities, its principles may apply to other entities that offer or promote financial products that take into account sustainability-related considerations—for example, companies listed on a securities exchange or entities issuing green bonds.

ASIC has also published new information to help investors assess if their values and goals align with a sustainability-related or ESG product.

ASIC expects issuers to review their practices against INFO 271 and appeals to industry and investors to alert ASIC if they see suspected greenwashing in financial products. ASIC is prioritising greenwashing misconduct for enforcement action and will use its regulatory toolbox where instances of greenwashing are identified.

For more information, please see How to avoid ‘greenwashing’ for superannuation and managed funds (22-141MR).

International Sustainability Standards Board

At COP 26, the International Financial Reporting Standards (IFRS) Foundation Trustees announced the establishment of the International Sustainability Standards Board (ISSB) to develop a high-quality global baseline for sustainability and climate-related disclosures for capital markets.

ASIC has previously welcomed the establishment of the ISSB and encouraged Australian stakeholders to participate in the consultation process for Exposure Draft IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and Exposure Draft IFRS S2 (Climate-related Disclosures) (exposure drafts). As part of our membership of the Council of Financial Regulators, we submitted a comment letter to the ISSB on 27 July 2022 expressing, among other things, our broad support for the objectives of the ISSB, the climate first approach being taken by the ISSB and the incorporation of the recommendations of the Task Force on Climate-related Financial Disclosures (TFCD) in the exposure drafts. We also expressed our in-principle support for the adoption of the exposure drafts (subject to their final form) as reporting standards in Australia, noting that the commencement, scope and mandatory nature of any new reporting regime are matters for the Australian Government to determine.

Climate-related disclosure

Furthermore, the Australian Government’s updated NDC includes a commitment to the application of new standardised and internationally aligned reporting requirements for climate risks and opportunities for large businesses. In the meantime, ASIC continues to encourage listed companies, directors and their advisers to consider climate risk and voluntarily report climate-related information in accordance with the recommendations of the TCFD.

ASIC recently concluded another surveillance exercise on TCFD climate-related disclosures by our larger listed companies. While we observed continued improvement in the standard of governance and disclosure, we continue to see a lack of consistency, comparability and structure when looking across the market as a whole. As we have observed previously, we have seen some selective adoption of the TCFD recommendations as well as a lack of consistency in the scenarios applied and timescales adopted in relation to climate resilience or scenario analysis disclosure—all of which impedes the utility of information for investors.

While many large listed entities report (either fully or partially), or are preparing to report, under the TCFD recommendations or disclose climate-related risks in their operating and financial review under the Corporations Act, there are still many small and medium-sized listed entities that are not making any disclosure on climate-related risks and opportunities. It is critical that directors and advisers engage with sustainability and climate-related risks in a proactive manner.

Fundraising

Research findings: Prospectus forecasts – use, accuracy and disclosure issues

Forecasts contained in prospectuses are a very important feature of primary capital raisings in Australia and receive high levels of regulatory and market scrutiny. Missing prospectus forecasts can have a profound negative share price impact.

To better understand the use and prevalence of forecasts, their accuracy and related disclosure issues, we have reviewed prospectus forecasts for all issuers who sought an initial public offering (IPO) on ASX and were listed during the three-year period from 1 July 2018 to 30 June 2021.

Observations on IPO forecasting practices

From our review, we observed the following:

- Forecasts are an established feature of the IPO market – 30% (or 72 of 243) of ASX IPOs (excluding listed investment companies, listed investment trusts and exchange traded funds) contained a formal forecast.

- Forecasts are included in prospectuses at the large end of the market – more than 80% of prospectuses for issuers seeking to raise above $100 million contained a forecast. This drops to 15% for those issuers seeking to raise $10 million to $25 million.

- Average duration of forecasts dropped due to COVID uncertainties – the average length of forecasts was 9.2 months in FY 21, down from 11.9 months in FY 19.

- 19% of issuers downgraded forecasts, 4% withdrew and 19% upgraded forecasts – we expected to see a large number of downgrades and withdrawals due to the difficulties encountered by many issuers as a result of COVID, but there was symmetry between those upgrading and downgrading forecasts. We did not observe any systemic bias towards overstating forecasts.

- Only 26% of issuers continued to formally forecast after the end of the forecast period – there appeared to be a strong preference to provide narrative outlooks rather than formal forecasts.

Observations on announcements and market updates

In testing the accuracy of forecasts, we examined pro-forma revenue and pro-forma profit measures (and statutory measures if there was no pro-forma forecast for the period). Pro-forma adjustments are generally used in IPO prospectuses and adjust the statutory numbers in a prospectus to better align historical results with forecasts. Examples of common pro-forma adjustments include:

- aggregating/consolidating acquisitions made at IPO in the historical financial information

- removing ‘one-off’ items, such as IPO costs, that will not be part of the business going forward post-IPO

- aligning accounting policies in the forecast and historical financial information.

We found the comparison of prospectus pro-forma forecasts against year-end results difficult, in some cases, for a range of reasons, including:

- some issuers are judging performance based on their own view of the most relevant profit measure (such as EBITDA), and are only presenting those pro-forma measures in announcements, without a full reconciliation to NPAT (as is disclosed in the prospectus)

- issuers who issued short duration forecasts in response to COVID, that did not align with statutory half year or year-ends, were not necessarily updating the market at the end of the forecast period. A similar issue was observed where an issuer optionally included a calendar year forecast, but did not fully present these calendar year results at period end (instead, focusing on the half year results)

- an issuer who announced interim downgrades, no longer referring to prospectus forecasts in its year-end announcements at all

- one issuer going back and making further retrospective adjustments to prospectus forecasts in its year-end presentations

- another issuer made errors in its year-end presentation, suggesting it was not prepared with due care and attention.

We are concerned about these observations. We believe that good practice requires that where a forecast is included in a prospectus, an announcement should be made at the end of the forecast period comparing forecast and actual results. Where a pro-forma forecast is included in a prospectus, at the end of the forecast period a full income statement reconciliation (or key line items) should be included comparing statutory and pro-forma results in any announcement the company publishes. The pro-forma results should be compiled on the same basis as the prospectus. Many issuers already include these reconciliations.

We believe these announcements and the reconciliations are key accountability and transparency measures that should be disclosed.

We expect announcements at the end of the forecast period (usually year-end) are of a high quality, and results are fully reconciled back to the prospectus forecasts. IPO advisers should make these requirements clear to their clients.

We will continue to review these announcements as part of our routine surveillance and may take regulatory action if we consider them to be misleading or deceptive.

ASIC intervenes in mining fundraisings

We have continued to intervene in mining fundraisings in the recent period to secure improved disclosures for investors. These interventions resulted in retractions and clarifications of disclosure given to investors.

Issuers are reminded to:

- avoid disclosing historical or non-JORC mineral resource estimates unless they are of sufficient quality and materiality to warrant disclosure under ASX Listing Rules 5.10–12

- only disclose mineral resource estimates reported under JORC Code 2012 for a key project in the prospectus, where they have the consent of the competent person responsible for that estimate

- review any information that is released in connection with the offer, including the investor and marketing information released by advisers, as we may seek the retraction of information that is inconsistent with the prospectus. For example, we recently required the retraction of non-JORC information related to the issuer’s project on an adviser’s website

- update investors on whether the assumptions and outcomes of technical studies completed for material projects remain current and, if not, the work that is being done to update them noting the evolving environment and the impacts on supply chains and costs in industry.

We continue to monitor disclosures in fundraising offers by mining issuers and will intervene where appropriate.

Minimum subscriptions improve investor confidence

We recently intervened in a rights issue that resulted in the issuer changing the terms of its offer to include a minimum subscription. This minimum subscription was set at a level where the issuer could disclose that it could continue as a going concern if this amount was raised.

This information can be critical for investors to enable them to invest confidently. Issuers raising funds should provide information to investors to enable them to understand:

- whether the company can continue as a going concern based on the minimum subscription funds raised (where relevant)

- how the company will use the funds raised on both full and minimum subscription amounts, and to understand what activities may be scaled back (see also Regulatory Guide 228 Prospectuses: Effective disclosure for retail investors (RG 228) at RG 228.147–RG 228.148)

- the pro-forma financial position of the issuer following the offer, and issuers should ensure any pro-forma adjustments accurately reflect any concurrent and material transactions including other equity or debt fundraisings or the conversion of debts to equity.

Fundraising activity from January to June 2022

Table 1: Fundraising activity (January to June 2022)

| January to June 2022 | Previous period (July to December 2021) |

| 245 original disclosure documents lodged, $7.23 billion sought | 382 original disclosure documents lodged, $10.25 billion sought |

| 56 IPOs, $0.79 billion sought (value by original disclosure document) | 123 IPOs, $7.05 billion sought (value by original disclosure document) |

|

Top 10 fundraisings completed raised $7.56 billion[1] |

Top 10 fundraisings completed raised $6.98 billion |

[1] Note: Some issuers in the Top 10 increased (in some cases, doubled) the value sought in the replacement disclosure document lodged with ASIC.

The largest offers over the period included the National Australia Bank Limited hybrid security offer (raising $2 billion), the Commonwealth Bank of Australia hybrid security offer (raising $1.75 billion), the Westpac Banking Corporation hybrid security offer (raising $1.51 billion) and the Australia and New Zealand Banking Group Limited hybrid security offer (raising $1.31 billion). The remaining offers included large IPOs, fundraisings by unlisted issuers, and an entitlement issue.

Disclosure relief

Below is a summary of the outcomes of applications for relief from the requirements of Chapter 6D of the Corporations Act to provide prospectuses and other disclosure documents for the period 1 January to 30 June 2022.

Table 2: Outcome of disclosure relief applications determined (1 January to 30 June 2022)

| Approved | Refused | Withdrawn |

| 48 | 0 | 16 |

| 75% | 0% | 25% |

Note: The statistics reported are based on individual relief decisions, rather than a singular head of power under which several decisions may be made (as demonstrated in our previous reporting).

Mergers and acquisitions

In-principle decision to refuse relief from section 606 for the issue of shares under a DOCA

We made an in-principle decision to refuse relief where the administrator of an unlisted public company sought an exemption from section 606 of the Corporations Act in connection with the issue of shares under a creditor’s deed of company arrangement (DOCA).

The administrator submitted that the shares had no value and that the DOCA was the only means by which shareholders might receive a return on their investment. The administrator also cited the decision made by the Takeovers Panel in Pasminco Ltd (Administrator Appointed) (2002) 41 ACSR 511 (Pasminco) in which our decision to refuse a similar application was overturned.

We made an in-principle decision to refuse relief as:

- the deed proponent had lawful means at its disposal under which it could acquire control of the company, such as a Pt 5.1 scheme, item 7 resolution or debt-for-equity swap in accordance with section 444GA

- the DOCA would result in control being passed without the shareholder protections of court oversight and the preparation of an independent expert report (IER)

- we consider that the introduction of section 444GA (and accompanying policy) is a relevant distinguishing factor from Pasminco. We note that the section 444GA regime provides the shareholder protections of both court oversight and the provision of an IER.

Regulatory carve-out in takeover bid conditions

We remind prospective bidders that they must include a carve-out for regulatory action by ASIC and the Takeovers Panel in the conditions of a takeover bid. If a carve-out is not included, relief may be required to amend the offer terms.

Takeover bids typically include a condition that there is no regulatory action taken by a public authority in connection with the offer before the end of the offer period. We consider it standard market practice to include an appropriate carve-out for ASIC and the Takeovers Panel in this condition. The effect of this carve-out ensures that the condition is not triggered by action taken by ASIC or the Takeovers Panel.

Part 6.6 of the Corporations Act enables a bidder to vary an off-market takeover bid, but only once offers have been dispatched. The Corporations Act also stipulates that offer terms must be dispatched on the same basis as the terms lodged with ASIC.

In a recent example, we required BidCo to include this carve-out following our review of the bidder’s statement for an off-market takeover bid. Relief was needed to amend the conditions of the offer to include the carve out because it was an amendment to the conditions of the offer prior to dispatch and the offer terms would be different to what was lodged with ASIC. For more information on amending offer terms prior to dispatch, please refer to Regulatory Guide 9 Takeover bids (RG 9) at RG 9.570–RG 9.575.

Unacceptable fetters on ‘fiduciary outs’ in schemes of arrangement

We recently had concerns about a fetter on a ‘fiduciary out’ applying to exclusivity clauses in the implementation deed for a proposed scheme of arrangement. The ‘fiduciary out’ clause required the directors of the scheme proponent to ‘act reasonably’ in making the relevant determinations required to rely on the ‘fiduciary out’.

The board of a scheme proponent should not be subject to unacceptable fetters in acting in accordance with their fiduciary duties. Additional requirements to determining what the board’s fiduciary or statutory obligations are, and whether failing to comply with those additional requirements would constitute a breach of those duties, may be unacceptable.

We required the scheme proponent to remove the requirement to act reasonably from the clause. We will continue to monitor fetters on ‘fiduciary outs’ in schemes of arrangement and take action on unacceptable fetters.

Material adverse change conditions

A material adverse change or effect (MAC) condition is a means of protecting one or more parties from significant changes in the prospects of the target or bidder.

We expect MAC conditions to contain objective and quantifiable standards by which the parties to a transaction, and their securityholders, can determine whether a material adverse change has occurred.

However, we have recently seen a trend of uncertain MAC conditions in control transactions, where a ‘material adverse change’ is circularly defined as a ‘material adverse change’.

An uncertain MAC condition which contains subjective or unclear thresholds poses a material risk that the condition may contravene section 629 of the Corporations Act: see Goodman Fielder Limited 01 (2003) 44 ACSR 254. That inherent uncertainty also means the risks associated with the triggering of such conditions may not be able to be adequately disclosed, contrary to the principle in section 602 of the Corporations Act requiring the acquisition of control to place in an ‘informed market’.

Securityholders are entitled to an adequate level of disclosure about the terms of an offer, so they can make an informed decision on the merits of the transaction, including on the likelihood of a MAC occurring and the transaction subsequently proceeding.

Parties to control transactions should ensure they follow the established market practice of including objective and quantifiable standards in MAC conditions.

Matching periods in control transactions

We recently observed a transaction implementation agreement that extended a five-business-day matching period by a further three business days to provide the bidder with a second opportunity to put forward an equivalent or superior proposal to a competing bidder. The bidder was also a substantial shareholder of the target. We considered the additional three business days to allow the bidder a second opportunity to put forward an equivalent or superior proposal was likely to be an unacceptable lock-up device which may inhibit the acquisition of control taking place in an efficient, competitive and informed market.

In Ross Human Directions Ltd [2010] ATP 8 at [53]–[54], the Takeovers Panel considered that any material extension to the five-business-day matching period prevalent in implementation agreements is likely to be unacceptable because of the effect the provision has on the willingness of a third party to put forward a competing proposal. The anti-competitive effect of any matching period may be further exacerbated where the bidder has an existing or substantial interest in the shares of the target.

We remind target directors that they should be satisfied of the commercial and competitive benefits to shareholders before entering into any agreement for a control transaction. ASIC will continue to intervene where it appears transaction agreements are being used as unacceptable lock-up devices in control transactions.

Disclosure and on-sale relief for foreign regulated merger

We recently granted conditional disclosure and on-sale relief for scrip offered as consideration under a merger that was to be regulated under the laws of Delaware, US, where Australian residents of the target company held more than 10% of the bid class securities: see Regulatory Guide 72 Foreign securities disclosure relief (RG 72) at RG 72.16–RG 72.18. The bidder was an Australian-incorporated company listed on ASX and the target was a Delaware corporation listed on ASX.

We granted relief despite the Delaware statutory merger not having the same essential characteristics as a Part 5.1 scheme and Australian residents holding more than 10% of the bid class securities because:

- the target shareholders would be given prospectus-level disclosure via a Form S-4 Registration Statement to be lodged with the U.S. Securities and Exchange Commission and a notice of meeting for the purposes of obtaining shareholder approval for the proposed merger

- both the bidder and target were subject to the continuous disclosure regime in Australia

- the target shareholders residing in Australia accepted the jurisdiction of Delaware by investing in a Delaware corporation.

In these circumstances, the cost and administrative burden of the bidder providing an Australian prospectus or wrap prospectus to the target Australian shareholders outweighed the benefits of compliance.

Merger and acquisition activity from January to June 2022

There was a significant decrease in both the number of merger and acquisition transactions this period and their total value:

Table 3: Merger and acquisition activity (January to June 2022)

| January to June 2022 | Previous period (July to December 2021) |

|

36 independent control transactions comprising:

|

46 independent control transactions comprising:

|

|

Total estimated value: $29.95 billion |

Total estimated value: $64.28 billion |

The decreased value of transactions arguably reflects a return to normal levels after significantly high transactions in the previous period as well as the prevailing economic conditions.

Merger and acquisition relief

Below is a summary of the outcomes of applications for relief from the requirements of Chapter 6 of the Corporations Act for the period 1 January to 30 June 2022.

Table 4: Outcome of merger and acquisition relief applications (1 January to 30 June 2022)

| Approved | Refused | Withdrawn |

| 43 | 0 | 14 |

| 75% | 0% | 25% |

Note: The statistics reported are based on individual relief decisions, rather than a singular head of power under which several decisions may be made (as demonstrated in our previous reporting).

Experts and mining

New disclosure requirements for ASX-listed oil and gas issuers

ASX’s revised Listing Rules in Chapter 5 and the updated Guidance Note 32 have now been in effect since 1 July 2022.

This follows consultation in 2021 by ASX on proposed changes to the reporting requirements for oil and gas entities. These changes were made to give effect to the July 2018 revisions to the Petroleum Resources Management System and improve the disclosure framework, such as in relation to disclosing forecast financial information.

ASIC will be focusing on compliance with these new disclosure requirements in corporate finance transaction documents, where applicable.

Expert’s conduct in preparing its report

We recently observed a transaction where the draft independent expert report was provided to the acquirer for comment and the value range was relied on during the renegotiation of the offer consideration. We were concerned that this could have the appearance of undermining the expert’s independence but were ultimately satisfied that the draft report was largely complete, and the comments did not impact the expert’s analysis of the transaction or their conclusions.

Our policy in Regulatory Guide 112 Independence of experts (RG 112) states that experts should only provide a full draft copy of the report to the commissioning party for fact-checking when the expert is reasonably assured that the conclusions in the report are unlikely to change: see RG 112.55. It is likely we will consider an expert’s independence has been compromised where an expert is attending discussions on the development of the transaction, the merits of the transaction or on strategies to be adopted by the commissioning party, as well as accepting analysis from the commissioning party or any interested party on the transaction.

We expect experts to avoid circumstances and communications such as these as they may undermine or appear to undermine the expert’s independence.

This approach is consistent with the obligations of a holder of an Australian financial services (AFS) licence to manage conflicts of interest.

Corporate governance

In-principle decision to facilitate virtual-only general meetings

We made an in-principle determination under section 253TA(2) of the Corporations Act to allow a listed company to hold a virtual-only general meeting of its members in circumstances where its constitution did not permit virtual-only meetings. The determination was sought in connection with a proposed extraordinary general meeting to vote on a capital return that would be held at the conclusion of a virtual-only scheme meeting (if the scheme was voted down). Our in-principle decision was subject to court orders convening a virtual-only scheme meeting.

We were satisfied that an ASIC determination to facilitate a virtual-only meeting was appropriate because:

- the company had demonstrated that there were practical difficulties outside of the control of the company that prevented it from amending its constitution to allow for virtual-only meetings by the required date

- we did not wish to act in a manner that was inconsistent with orders made by a court

- refusing relief would have imposed an additional burden on the company by requiring it to hold a hybrid or in-person meeting directly after a virtual-only scheme meeting

- relief available to listed entities under ASIC Corporations (Virtual-only Meetings) Instrument 2022/129 was due to expire on 31 May 2022, six days before the proposed virtual-only meeting.

The application was later withdrawn.

Continuous disclosure is important for unlisted disclosing entities too

We recently considered whether to provide an unlisted disclosing entity with an exemption from its continuous disclosure obligations.

While uncommon, we have in the past received applications seeking exemptions from the continuous disclosure requirements. The continuous disclosure obligations are fundamental to maintaining the integrity of the market by ensuring transparency and equal access to information. Given its importance, we have generally indicated that we would only provide relief where it could be demonstrated that compliance would impose a significant level of detriment that outweighed any benefit. We consider such circumstances would be very rare.

We take this opportunity to highlight that we consider continuous disclosure is also important for unlisted disclosing entities. Companies should be mindful of their obligations and provide disclosure to shareholders as soon as practicable where material corporate events arise, such as entry into agreements for material transactions. Companies should also note that Regulatory Guide 198 Unlisted disclosing entities: Continuous disclosure obligations (RG 198) encourages unlisted disclosing entities to place all material information on their website as it may be a more effective means of communicating information to shareholders in a timely fashion.

If we identify investor harms from non-compliance, we will consider taking regulatory action.

Managing cyber risk in supply chains

Organisations in the financial services and markets sectors are more interconnected, interdependent and vulnerable to cyber threats in the supply chain than ever before.

Entities must be able to identify risks relevant to their business and have defined their risk appetite. This is key to entities being able to put in place mitigants to manage this risk appropriate to the nature, scale and complexity of their business.

Five key themes emerged from our recent roundtable discussions with industry, and we encourage you to consider if these have been accounted for in your risk frameworks.

- Finding your weakest link isn’t always easy.

- Innovation and cyber security can coexist.

- People are the greatest defence against cyber risk.

- Becoming cyber literate helps.

- Accessing the right information at the right time is critical.

For further information on these themes, please visit Cyber resilience good practices (good practice 4) on the ASIC website.

We recognise that challenges within the supply chain do vary, and that solutions must be tailored to the nature, scale and complexity of each business. Additional guidance on managing cyber supply chain risk can be found on the Australian Cyber Security Centre website.

‘Blackout period’ for members’ meetings

We recommend companies avoid holding members’ meetings between Monday 19 December 2022 and Friday 13 January 2023 (inclusive).

This view is based on the requirement in section 249R of the Corporations Act that ‘a meeting of a company’s members must be held at a reasonable time and place’. This means that a company should provide an opportunity for the maximum number of shareholders to attend and consider resolutions and any other matters that are to be put to the meeting.

ASIC Annual Forum 2022: Registrations open

ASIC’s Annual Forum is back for the first time since 2019.

Registrations are now open for the ASIC Annual Forum and Annual Dinner on 3–4 November 2022. The Annual Forum is ASIC’s premier event for the financial services and markets sectors and brings together regulators, industry and thought leaders from Australia and abroad, and the theme for this year is New Directions.

Join us in Sydney as we explore how the finance sector has evolved in recent years. Hear from over 40 prominent speakers discussing key issues, trends and essential topics such as superannuation, wholesale market conditions, climate change, crypto, AI and data, enforcement priorities and the regulatory toolkit and more.

The Annual Forum and Annual Dinner will be held at the Hilton Sydney. Early bird ticket discounts are available until 29 September 2022 and group discounts are also available.

For more information and to register, visit ASIC Annual Forum 2022.

Related party transactions

Content requirements for related party notices of meeting

With the annual general meeting season approaching, we remind companies to ensure notices of meetings lodged with ASIC seeking member approval to give financial benefits to related parties satisfy the requirements set out in Chapter 2E of the Corporations Act and our policy in Regulatory Guide 76 Related party transactions (RG 76).

Meeting materials must provide sufficient information to members to enable them to decide whether or not the financial benefit to be given to a related party is in the best interests of the company. As stated in RG 76, we expect companies and their directors to consider and disclose:

- details of the value of the financial benefit, including in dollar terms, valuation methodology and principal assumptions behind the valuation

- the nature of the financial benefit, reasons for giving the benefit and the basis on which it is given. This includes addressing why or how the benefit was chosen, the existing interests of the related party and a clear explanation of the substantive effect of the transaction

- the terms of the financial benefit and, if relevant, the consequence or cost to the company and its members if the terms of the benefit are not met

- each director’s recommendation, particularly the director’s view whether the value of the financial benefit is reasonable and why. If there are alternative options, the director’s reasons for why the related party transaction is the preferred option is also relevant.

Lodgement process

On 5 September 2022, the questions in our regulatory portal were updated to enable you to select multiple types of financial benefit for which the company is seeking member approval, as well as to confirm if you have included a valuation of the financial benefit(s) and, if not, the ability to explain why not.

We also remind companies that the proposed notice, explanatory statement, any expert reports and proxy form must be lodged in final form (not draft) and signed in accordance with section 351 of the Corporations Act.

Where there are material amendments made to any resolution or explanatory information, the proposed notice of meeting materials with any associated application for abridgement will need to be relodged with new fees payable as the notice convening the meeting must be the same, in all material respects, as the notice lodged under section 218 of the Corporations Act. Companies may wish to consider providing the notice of meeting materials to ASX before ASIC to avoid re-lodgement with ASIC due to revisions required by ASX.