Corporate Finance Update - Issue 15

Issue 15, December 2023

Contents

Market integrity during fundraising and merger and takeover activityLodging prospectuses and other documents during the Christmas close-down period

‘Blackout period’ for members’ meetings

Greater vigilance required to combat cyber threats

Director ID: apply and stay up to date

Consulting on mandatory climate-related financial disclosures in Australia

Government consultation on draft Sustainable Finance Strategy

Market integrity during fundraising and merger and takeover activity

We’ve recently observed an increase in media reporting ahead of fundraising and merger and takeover activity and remind all parties involved in these market activities to vigilantly manage the risk of leaks or mishandling of confidential information.

We continue to monitor trading around significant market announcements to identify potential market misconduct, insider trading and continuous disclosure issues. We’re also paying close attention to some recent market activities where we suspect confidential information has been leaked to the media.

For market participants and corporate advisers

Sound and effective policies and procedures addressing behaviours and processes for handling confidential information are vital. These include:

- implementing and maintaining effective information barriers

- limiting access to information on a ‘need to know’ basis

- effectively wall-crossing staff who are made aware of confidential information

- maintaining insider lists

- having appropriate restrictions on and monitoring personal account dealing

- effective oversight by a compliance or control function.

For listed entities

Entities involved in fundraising and control transactions must proactively manage information about the transaction. This includes:

- requiring consultants and contractors to enter confidentiality agreements

- having appropriate arrangements to handle confidential information, including limiting access on a ‘need to know’ basis

- recording who has been provided with the confidential information – and when

- actively monitoring and meeting continuous disclosure obligations in relation to fundraising and control transactions.

We strongly recommend entities put in place a formal leak policy outlining steps to prevent, monitor and react to any leaks of proposed transactions.

Advisers to listed entities, including lawyers and others engaged to work on transactions, must have policies, procedures and appropriate controls to limit access to confidential information to only those who require it.

Sunsetting legislative instruments on takeovers, compulsory acquisitions and relevant interests remade

We’ve remade seven legislative instruments relating to takeovers, compulsory acquisitions and relevant interests. These instruments were due to automatically expire (‘sunset’) on 1 October 2023 if not remade.

The relief is contained in the following seven legislative instruments:

- ASIC Corporations (Changing the Responsible Entity) Instrument 2023/681

- ASIC Corporations (Takeover Bids) Instrument 2023/683

- ASIC Corporations (Compulsory Acquisitions and Buyouts) Instrument 2023/684

- ASIC Corporations (Bidder Giving Substantial Holding Notice) Instrument 2023/685

- ASIC Corporations (On-Sale Disclosure Relief for Scrip Bids and Schemes of Arrangement) Instrument 2023/686

- ASIC Corporations (Warrants: Relevant Interests and Associations) Instrument 2023/687, and

- ASIC Corporations (Replacement Bidder’s and Target’s Statements) Instrument 2023/688 (together, the Instruments).

The relief was remade following public consultation in Consultation Paper 365 Remaking ASIC class orders on takeovers, compulsory acquisitions and relevant interests (CP 365) which was issued in November 2022 (22-331MR).

Based on consultation feedback, we considered that the sunsetting instruments were operating effectively and efficiently and continue to form a necessary and useful part of the legislative framework. Accordingly, the relief contained in the Instruments is on substantially the same terms as the sunsetting instruments with several amendments to improve their operation as described in REP 773 Response to submissions on CP 365 Remaking ASIC class orders on takeovers, compulsory acquisitions and relevant interests (REP 773).

Lodging prospectuses and other documents during the Christmas close-down period

While our offices will be closed during the Christmas close-down period, documents (including prospectuses) can still be lodged through the ASIC Regulatory Portal.

Lodgements made between 3 pm AEDT on Friday 22 December 2023 and 8 am AEDT on Tuesday 2 January 2024, may not appear on the register and the Offer Notice Board until 2 January 2024.

We remind issuers that prospectuses lodged during this time will automatically have the exposure period extended.

In 2018, we issued ASIC Corporations (ASIC Close Down Period) Instrument 2018/1034. This instrument continues to automatically extend the exposure period to 14 days for disclosure documents lodged between:

- 5 pm AEDT on Friday 15 December 2023, and

- 9 am AEDT on Tuesday 2 January 2024.

Issuers should consider this carefully when lodging fundraising documents during this period.

‘Blackout period’ for members’ meetings

We recommend companies avoid holding members’ meetings between Monday 18 December 2023 and Friday 12 January 2024 (inclusive).

This view is based on the requirement in section 249R of the Corporations Act 2001 that ‘a meeting of a company’s members must be held at a reasonable time and place’. This means that a company should provide an opportunity for the maximum number of shareholders to attend and consider resolutions and any other matters that are to be put to the meeting.

Greater vigilance required to combat cyber threats

We’re calling on organisations to prioritise their cyber security after our report into the cyber capability of corporate Australia identified significant gaps.

The report summarises the results of ASIC’s recent cyber pulse survey. The results of the voluntary self-assessment survey have exposed deficiencies in cyber security risk management of critical cyber capabilities, indicating that organisations are reactive rather than proactive when it comes to managing their cyber security.

Encouragingly, participating organisations indicated well-developed capabilities in identity and access management, governance and risk management, and information asset management, with large organisations consistently self-reporting more mature cyber capabilities.

Understandably, due to competing demands for limited human and financial resources, small organisations lagged behind larger entities in third-party risk management, data security, consequence management, and adoption of industry standards.

Ninety-five per cent of survey participants opted to receive an individual report which provided important insights on how their cyber resilience compared to their peers. This demonstrates a commitment to improving their organisation’s cyber resilience.

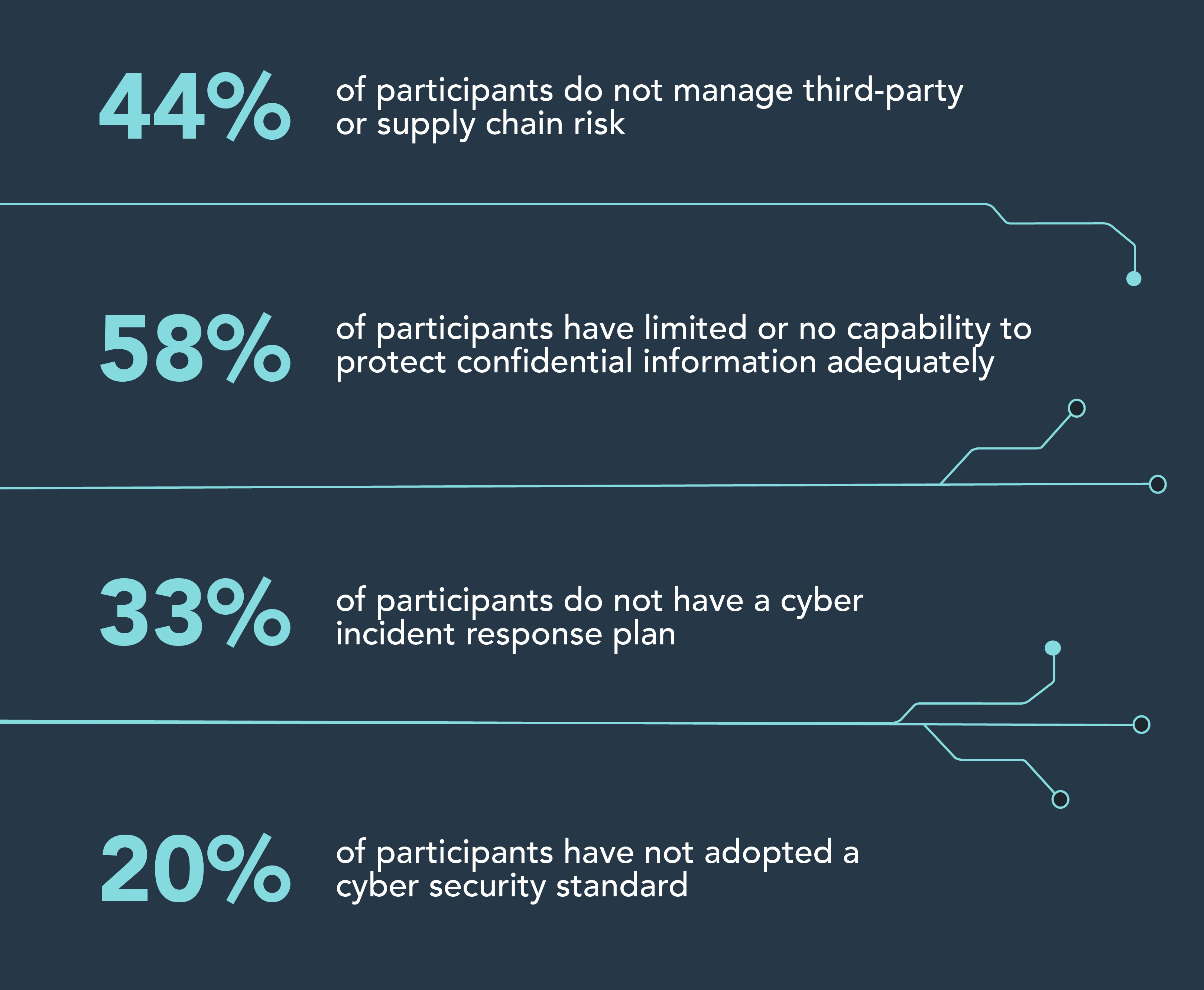

Survey result highlights

Survey result highlights - text version

- 44% of participants do not manage third-party or supply chain risk

- 58% of participants have limited or no capability to protect confidential information adequately

- 33% of participants do not have a cyber incident response plan

- 20% of participants have not adopted a cyber security standard

- Read the media release

Director ID: apply and stay up to date

As previously discussed in the Corporate Finance Update, you need a director ID if you’re an eligible officer of:

- a company registered under the Corporations Act 2001 (Corporations Act)

- an Aboriginal and Torres Strait Islander corporation registered under the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act).

An eligible officer is a person who is appointed as either a director or an alternate director who is acting in that capacity.

A director must apply for a director ID before being appointed. The fastest way to get a director ID is to apply online using the myGovID app. Once a director has applied online, they can view their director ID or update their details anytime by logging on.

Australian Business Registry Services (ABRS) is responsible for delivering the director ID initiative. ASIC is responsible for enforcing director ID offences set out in the Corporations Act. It is a criminal offence if directors do not apply on time and penalties may apply.

A director ID is a unique identifier which will help prevent the use of false or fraudulent director identities.

Visit the ABRS website for more information and to apply.

Consulting on mandatory climate-related financial disclosures in Australia

The Australian Accounting Standards Board (AASB) has released Exposure Draft ED SR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information (ED SR1) for public comment. ED SR1 includes three draft Australian Sustainability Reporting Standards (ASRS Standards):

- [draft] ASRS 1 General Requirements for Disclosure of Climate-related Financial Information

- [draft] ASRS 2 Climate-related Financial Disclosures

- [draft] ASRS 101 References in Australian Sustainability Reporting Standards

ED SR1 is open for comment until 1 March 2024.

We encourage all stakeholders to participate in the ongoing consultation process in relation to the proposed introduction of mandatory climate-related financial disclosures in Australia.

Government consultation on draft Sustainable Finance Strategy

The Australian Government recently consulted on its draft Sustainable Finance Strategy.

The strategy proposes a range of measures to underpin the development of Australia’s sustainable finance markets. It consists of several policies and tools grouped under three key pillars:

- Pillar 1: Improve transparency on climate and sustainability to provide more credible and comprehensive information about sustainability opportunities, risks and impacts

- Pillar 2: Increase the financial system’s capabilities to ensure all stakeholders are sufficiently equipped to participate in an efficient sustainable finance ecosystem and can adapt to a rapidly changing environment

- Pillar 3: Strengthen government leadership and engagement on sustainable finance.

Consultation on the strategy closed on 1 December 2023.

The government will now consider the feedback, which will inform its ongoing policy development and regulatory engagement on sustainable finance in Australia, and will publish an implementation roadmap for the strategy.