|

Operator of crossing system |

Crossing system identifier |

Date of commencement |

Publicly available crossing system information |

|---|---|---|---|

|

BestEx Pty Ltd |

- |

March 2015 (ceased operation June 2015) |

- |

|

BestEx Pty Ltd - Block Event |

2011 | 26 November 2015 (ceased operating 28 February 2020) |

- |

| BGC Partners (Australia) Pty Limited | BGC1 | April 2023 | BGC Partners (Australia) Pty Limited (PDF 158 KB) |

|

Citigroup Global Markets Australia |

- |

- |

- |

|

– Crossing System 2 |

2032 |

July 2013 (ceased operation 1 July 2019) |

- |

|

– Crossing System 1 |

- |

February 2006 (ceased operation July 2014) |

- |

|

CLSA Australia Pty Ltd |

2311 |

October 2012 |

|

|

Commonwealth Securities Limited |

- |

- |

- |

|

– Crossing System 3 |

- |

November 2012 (ceased operation April 2014) |

- |

|

– Crossing System 2 |

- |

May 2011 (ceased operation October 2013) |

- |

|

– Crossing System 1 |

- |

May 2011 (ceased operation February 2014) |

- |

|

Credit Suisse Equities (Australia) Limited |

- |

- |

- |

|

– Crossing System 2 |

- |

May 2009 (ceased operation October 2016) |

- |

|

– Crossing System 1 |

1101 |

April 2006 (ceased operation October 2023) |

- |

|

Deutsche Securities Australia Limited |

- |

- |

- |

|

– Crossing System 2 |

2102 |

June 2011 (ceased operation March 2020) |

Deutsche Securities Australia Limited (PDF 51 KB) |

|

– Crossing System 1 |

- |

June 2010 (ceased operation May 2013) |

- |

|

E*TRADE |

- |

February 2013 (ceased operation May 2013) |

- |

|

Goldman Sachs Australia Pty Ltd |

SIGA |

January 2010 |

|

|

ICAP Futures (Australia) Pty Limited |

- |

- |

- |

|

– Crossing System 2 |

CAP 2 | August 2017 | ICAP Futures (Australia) Pty Ltd - Equities Volume Matching |

| – Crossing System 1 | CAP 1 | September 2015 | ICAP Futures (Australia) Pty Ltd - Energy Futures Matching |

|

Instinet Australia Pty Limited |

- |

- |

- |

|

- Crossing System 2 |

BLXA |

14 May 2024 |

|

|

- Crossing System 1 |

2171 |

April 2011 (ceased operation 11 October 2022) |

|

|

J.P. Morgan Securities Limited |

- |

- |

- |

|

- Crossing System 2 |

2972 |

6 August 2018 |

|

| - Crossing System 1 |

- |

August 2011 (ceased operation June 2016) |

- |

|

Liquidnet Australia Pty Ltd |

9991 |

February 2008 |

|

|

Macquarie Securities (Australia) Limited |

- |

- |

- |

| - Crossing System 2 | 1562 | March 2018 (ceased operating August 2021) |

- |

|

- Crossing System 1 |

1561 |

September 2010 (ceased operating August 2021) |

- |

|

Merrill Lynch Equities (Australia) Limited |

3661 |

August 2010 (ceased operation 6 March 2017) |

|

|

Morgan Stanley Australia Securities Limited |

2991 |

March 2010 |

|

|

State One Stockbroking Ltd |

6781 |

November 2012 (ceased operation 9 May 2025) |

- |

|

UBS Securities Australia Ltd |

- |

- |

- |

|

– Crossing System 2 |

- |

August 2012 (ceased operation January 2016) |

- |

|

– Crossing System 1 |

1501 |

August 2005 |

- |

|

Virtu ITG Australia Ltd |

3451 |

May 2010 |

Crossing systems registered with ASIC

On this page, ASIC publishes a record of crossing systems and their operators and provides information on what should be disclosed under item 5 of Rule 5A.2.1(2) of the Securities Markets Rules and 5.2.1(2) of the Futures Markets Rules.

Each crossing system is assigned a code identifying the crossing system for regulatory data purposes.

From November 2013, each crossing system operator will provide a link to an external webpage to provide the public with information for each of its crossing systems, as required by Chapter 5A of the ASIC Market Integrity Rules (Securities Markets) 2017 and Chapter 5 of the ASIC Market Integrity Rules (Futures Markets) 2017. The requirements are explained in more detail in Regulatory Guide 265 Guidance on ASIC market integrity rules for participants of securities markets and Regulatory Guide 266 Guidance on ASIC market integrity rules for participants of futures markets.

The purpose of this guidance is to clarify ASIC’s intent in relation to the new rules that require information about crossing systems to be made publicly available by participants that operate crossing systems (i.e. ‘crossing system operators’). In particular, that crossing system operators disclose where orders may be transmitted to, or received from, another crossing system operator (either directly or via an ‘aggregator’).

Rule 5A.2.1 of the ASIC Market Integrity Rules (Securities Markets) 2017 (Securities Markets Rules) and Rule 5.2.1 of the ASIC Market Integrity Rules (Futures Markets) 2017 (Futures Markets Rules) requires a market participant that operates a crossing system to make certain information about its crossing system publicly available on a website. In particular, the website should state:

(a) the code identifying the crossing system

(b) the date the crossing system began to operate in Australia

(c) the types of financial products traded on the crossing system

(d) the criteria used to determine eligibility to use the crossing system, and

(e) the codes identifying other crossing systems to which orders may be transmitted, or from which orders may be received.

The purpose of these rules is to improve transparency about crossing systems and to ensure there is publicly available information about:

(f) where client orders may be matched or executed (i.e. in the crossing system operated by the participant, or in other crossing systems operated by third parties), and

(g) the types of entities, based on the eligibility criteria referred to in item (d), whose orders may access the crossing systems in which clients' orders may be matched or executed.

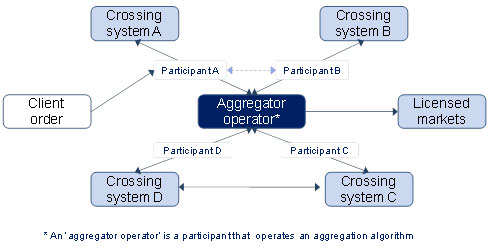

Example of how orders may be transmitted or received

We have received questions from participants about the information that should be disclosed under item e) in circumstances where a crossing system operator (e.g. participant ‘A’):

(h) transmits orders directly to another crossing system operator (e.g. participant ‘B’) for matching or execution in participant B’s crossing system (i.e. the orders are transmitted from participant A and not from participant A’s crossing system), or

(i) receives orders directly from participant B for matching or execution in participant A’s crossing system (i.e. the orders are transmitted to participant A directly from participant B and not from participant B’s crossing system).

To ensure transparency of the matters set out in (f) and (g) above, we encourage that in the circumstances set out in (h) and (i), participant A would disclose the full legal name of participant B, a code that uniquely identifies participant B’s crossing system, and information about whether the orders are transmitted to, and/or received from participant B.

We have also received questions from participants about the information that should be disclosed under item (e) in circumstances where a crossing system operator (e.g. participant ‘A’):

(j) transmits orders to an ‘aggregator’ (i.e. a participant that operates an aggregation algorithm), who may in turn transmit all or part of the order to one or more crossing system operators (marked as B, C or D in the diagram), or to a licensed market, for matching or execution, or

(k) receives orders from an ‘aggregator’, where those orders may have been transmitted to the aggregator by one or more crossing system operators.

In the circumstances set out in (j), we would encourage participant A to disclose the full legal name of the operators of crossing systems B, C and D and a code that uniquely identifies crossing systems B, C and D. In the circumstances set out in (k), we would encourage participant A to disclose the same information, however if this is not possible, we would encourage participant A to disclose the full legal name of the participant that operates the aggregator and the code that uniquely identifies that participant's crossing system.