Gatekeeper expectations and pump and dump activity

Pump and dump activity

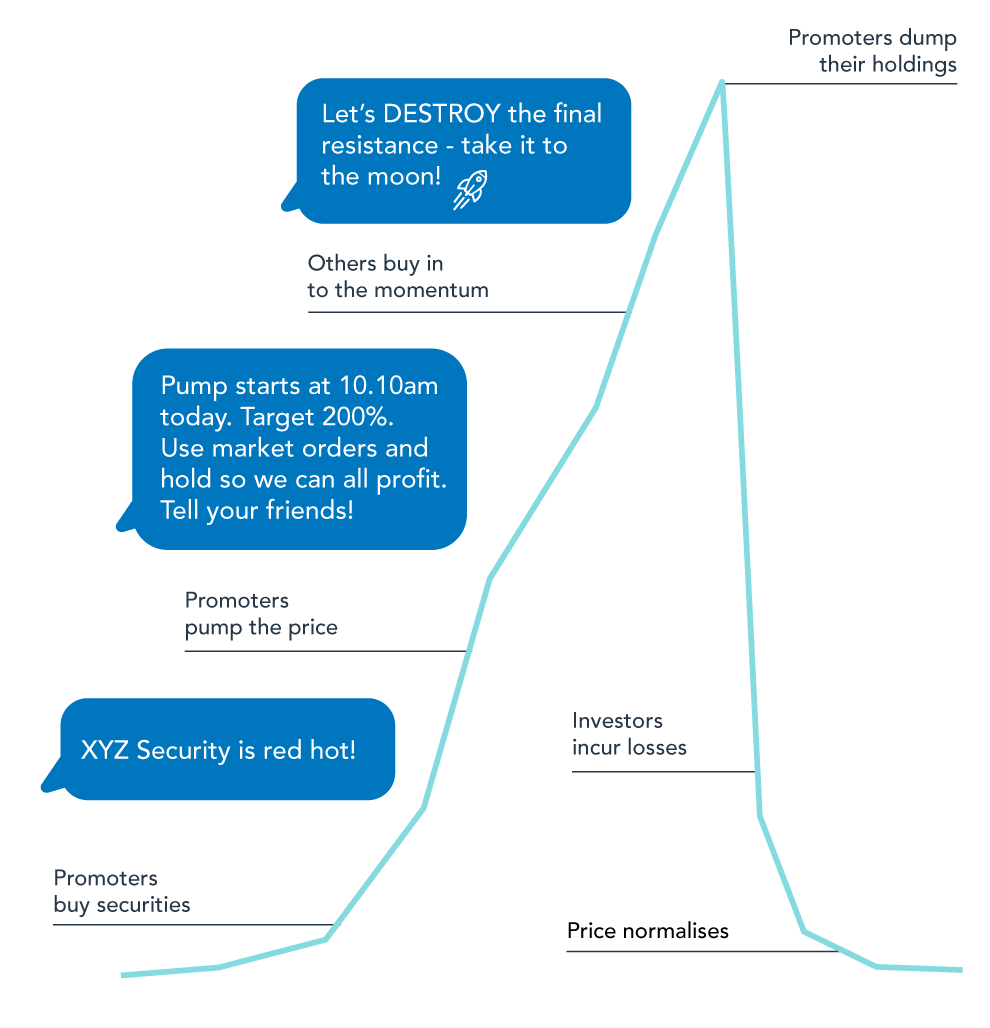

Pump and dump activity typically involves one or more promoters buying securities in a listed entity and then starting or coordinating an organised program of increasing (or 'pumping up') the price of the listed entity's securities. They do this by creating a sense of excitement about the security or spreading false news about a listed entity’s prospects.

If the promoter is successful in raising the price of a listed entity's securities, they sell out (or ‘dump’) their securities. While the promoter may profit, other shareholders lose when the pumping activity and demand for the securities fall away and the price of the security normalises.

While pump and dump activity is not new, we have observed an increase since the start of the COVID-19 pandemic. This includes the use of social media by promoters to broaden the audience and range of participants.

This is at a time when we are seeing:

- a higher number of younger and first-time investors entering the retail investment market

- an increase in retail investors turning to social media as a key source of information about investing

- an increase in day trading by retail investors

- a growth in social media influencers who promote listed entities and investment products, often in return for payments, commission or other benefits

- the emergence of well-known social media platforms being used to promote and coordinate pump and dump activity, and

- an apparent increase in momentum ignition trading behaviour in small-cap securities. That is, the practice of aggressive purchasing by one or several accounts that have a significant impact on price, which encourages other traders to participate in the buying activity. This activity further impacts the price of the underlying security.

Recent pump and dump activity is most prevalent in listed securities that have one or more of the following attributes:

- small market capitalisation

- thinly traded

- a limited free float

- concentrated share ownership.

Figure 1: Pump and dump activity taking place on social media platforms

We all have a role to play in market integrity

Pump and dump activity impacts market integrity. It can also harm investors who buy pumped securities just before promoters sell out and the price falls back to normalised levels. This can result in rapid and significant losses for investors and reduce confidence in our market. This conduct may amount to market manipulation in breach of the Corporations Act 2001.

Market integrity is in everyone's best interest and we all have a role to play.

- Market operators actively monitor this kind of activity and can help to reduce it by engaging with the listed entity that is targeted by promoters to see if there is a basis for the sudden price move. This may require some additional disclosure or placing the listed entity's securities into a temporary trading halt.

- At ASIC, we monitor the market in real-time and are enhancing our monitoring of social media to identify trends and connections. Additionally, we have issued warnings to investors about the risks of participating in pump and dump activity. We will take enforcement action where there is sufficient evidence of a breach of the law, and it is in the public interest to do so.

- Market participants, as gatekeepers to the market, have an important role in monitoring orders submitted to the market.

Expectations of market participants

We expect market participants to take active steps to identify and stop potential market misconduct (including pump and dump activity) and to promptly report suspected misconduct to ASIC. Market participants should use a combination of pre-trade filters and post-trade reviews of trading.

If market participants see unexplained price movements, together with unusual or unexplained trading by one or more clients, they should also consider if there is discussion on social media or other channels that may suggest a coordinated plan by promoters or groups of individuals to manipulate the market.

Market participants should:

- consider the circumstances of all orders as required under the manipulative trading provisions in Rule 5.7.2 of the ASIC Market Integrity Rules (Securities Markets) 2017 and

- be aware of the indicators of manipulative trading outlined below

- report suspicious activity to ASIC.

What should market participants look for?

Market participants should look out for the following indicators, which may individually or collectively be indicative of pump and dump or other manipulative activities.

- Coordinated activity by clients. This may include coordinated new account openings, timing of orders, direction of orders, price of orders and location of the source of orders (e.g. IP addresses). Clients may be referred by the same person, have the same account contact details, or transfer funds between themselves.

- Clients who trade ahead of significant security price movements that are unexplained based on the announcements of the listed entity, financial news or broader market dynamics, especially where the client realises a profit.

- Clients who aggressively cross the bid offer spread and where the trading ignites momentum in the price of a security.

- Clients wanting to trade in securities with a running price when there is no news from the listed entity.

- Clients whose trading activity is inconsistent with their history and profile. For example, a pattern of isolated and timely short-term profits in securities/sectors not previously traded, or trading in large amounts that are generally inconsistent with the profile of the client (e.g. a student with limited savings/assets).

- Possible misinformation or excessive social media commentary about a listed entity or security.

- Trading activity that may be indicative of pump and dump, such as layering of orders on an order book.

Report suspicious activity

Market participants have an obligation to report suspicious activity to ASIC as soon as practicable. This means once you become aware of the activity, not after you have investigated it. We expect market participants to seek explanations, challenge suspicious behaviour and promptly report suspicious activity where you see any potential market misconduct.

Where there is suspected market manipulation and an opportunity for the market participant and/or ASIC to disrupt the conduct as it's occurring, we encourage you to promptly call ASIC's Market Supervision team to share the information. This can then be followed up with a written suspicious activity report.

It is not unusual for ASIC staff who are involved in the real-time monitoring of markets to make urgent enquiries with market participants by phone or email. We request that you prioritise these enquiries and respond as quickly as possible (ideally within the day). For example, we may seek to understand whether one or multiple clients are responsible for several trades.