ASIC Corporate Insolvency Update - Issue 2

Issue 2, December 2016

Tranche 1 of insolvency law reform commences 1 March 2017

Law reform training

Law reform training

You will be aware that parts of the Insolvency Law Reform Act 2016 and related legislative instruments commence on 1 March 2017. The balance of the reforms commence on 1 September 2017.

We strongly encourage registered liquidators (RLs) to prepare now for the reforms commencing on 1 March 2017 because they significantly impact your liquidator registration and other lodgement requirements.

We note that ARITA is delivering training opportunities to its members throughout Australia during February and March 2017. We encourage you to attend these sessions.

Further information on the reforms commencing on 1 March 2017

We will provide further information on the reforms and how they might affect you in the New Year.

Renewal of registered liquidator registration

All current RLs need to apply to renew their registration in the first 12 months from 1 March 2017. If RLs don't renew their registration on time, they cannot accept new appointments.

When applying to renew, RLs must provide evidence that they maintain adequate and appropriate

PI and Fidelity insurance and that they have met their ongoing professional development requirements. We recommend you review your insurances and training records before your renewal date.

This week, ASIC will send a hardcopy renewal application form to those RLs whose renewal falls due on or shortly after 1 March 2017. We're working hard to ensure that, from 1 March 2017, RLs can renew their registration through the liquidator portal.

Declaration of relevant relationships and declaration of indemnities (DIRRIs)

From 1 March 2017, RLs appointed as either voluntary administrators or creditors’ voluntary liquidators (including replacement appointees) must lodge their DIRRI with ASIC.

A new form will be available on the liquidator portal. We will also ask RLs to complete questions about their independence and indemnities received (if any).

Communicating with RLs

During 2017, we are moving to greater use of email to communicate with RLs. We will use email addresses recorded in the liquidator register.

We intend writing to all RLs in late January with further details including how you can update your email address by lodging a Form 905A.

What RLs had to say at our October liaison meeting

ASIC holds regional liaison meetings (RLMs) with RLs and lawyers within the insolvency profession.

ASIC holds regional liaison meetings (RLMs) with RLs and lawyers within the insolvency profession.

At our October meetings, discussions centred on:

- our Corporate Plan. For the first time, the plan includes 'what good looks like' for the insolvency industry.

- the Government's proposed industry funding model; noting the industry's concerns and the Government's invitation to make a submission by 16 December

- RLs' preparedness for the insolvency law reforms which take effect from 1 March and 1 September 2017

- ASIC's Phoenix Working Group and interagency work, including initiatives focused on disrupting facilitators of illegal phoenix activity

- guidance from recent enforcement outcomes

- concern arising from our RL surveillance activities - including inadequate independence disclosure, strategic insolvency appointments, making appropriate enquiries of work referrers following an appointment, properly documenting investigations and decisions, remuneration reporting and communication with creditors

- the valuable assistance from RLs on insolvency related ASIC investigations funded through the Assetless Administration Fund (AAF).

Industry representatives indicated:

- our improved communication to RLs

- some delays in payment from the AAF

- a quieter than usual insolvency market

- their concerns with the pre insolvency advice market

We continue reviewing the matters raised at the RLMs. In particular, we reviewed the AAF payment process and identified opportunities to further improve efficiencies and reduce payment timeframes.

Independence: Perceptions are important

RL independence continues to be a key focus.

RL independence continues to be a key focus.

It is almost certain that a hint of a potential conflict of interest will attract attention from a stakeholder who then alerts ASIC. ASIC must then review the RL’s independence.

RL obligations include undertaking necessary enquiries and relying on their own assessment prior to accepting an appointment.

It is reasonable to assert that you can more readily identify and avoid a real conflict of interest than a perception of conflict.

Perceptions of conflict tend to be more complex because of inherent subjectivity. If a RL accepts an appointment in circumstances where they may be seen as conflicted, it does not necessarily negate the appropriateness of their appointment. RLs should actively anticipate and consider other parties' perceptions. Documenting decisions allows a RL to demonstrate that they properly considered the relevant issues.

We recently dealt with a matter involving a lack of disclosure in the DIRRI, contributing to a perceived conflict of interest. This perception later materialised as an actual conflict of interest resulting in the appointee's resignation. In that case, the appointee failed to disclose a series of essential facts such as the:

- appointee's firm acting as the registered office for the director's associated company

- nature of services the appointee's firm rendered to that associated company

- full extent of the referral relationship

- relevant relationships with the company's secured creditors, and

- origin of an up-front payment made to one of the creditors

ASIC continues to prosecute directors for not providing RATA and records

We assist RLs through our liquidator assistance program, to ensure that company officers comply with their obligations to prepare a report on a company’s affairs (RATA) for the liquidator, provide books and records, and generally assist liquidators. The program also aids our supervision of RLs.

We assist RLs through our liquidator assistance program, to ensure that company officers comply with their obligations to prepare a report on a company’s affairs (RATA) for the liquidator, provide books and records, and generally assist liquidators. The program also aids our supervision of RLs.

Access to records and a RATA is an important first step in initiating an investigation. They assists a RL identify wrong-doing or identify assets for the benefit of creditors.

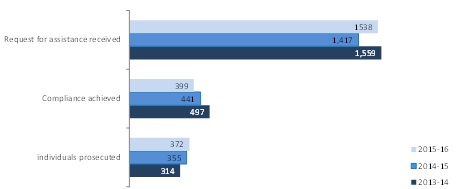

Figure 1: requests for assistance

We can see that over the last three years requests for assistance has remained relatively stable at or around the 1,500 mark. The figures suggest a trend where director compliance has fallen away. We've seen a corresponding increase in the number of prosecutions against the non-compliant directors.

The following statistics show that an increase in prosecutions resulted in a corresponding increase in court imposed fines:

2013-14 $768,000

2014-15 $914,675

2015-16 $1,019,336

As an example of the action we take, read about the director of Middlebrook Estate Pty Ltd (in liquidation) who the Adelaide Magistrates’ Court sentenced after pleading guilty to three charges, brought by ASIC, for failing to provide a RATA and deliver books and records to the company's liquidator.

ASIC releases report on corporate insolvencies

![]() External administrator investigations strongly support asset recovery, determining reason's for failure and facilitating reporting both to creditors and ASIC. From ASIC's perspective, this work is valuable in supporting ASIC's public reporting. To that end, ASIC published its annual overview of corporate insolvencies based on statutory reports lodged by external administrators for the 2015–16 financial year.

External administrator investigations strongly support asset recovery, determining reason's for failure and facilitating reporting both to creditors and ASIC. From ASIC's perspective, this work is valuable in supporting ASIC's public reporting. To that end, ASIC published its annual overview of corporate insolvencies based on statutory reports lodged by external administrators for the 2015–16 financial year.

Report 507 Insolvency statistics: External administrators’ reports (July 2015 to June 2016) (REP 507) is ASIC's eighth report and provides information on the nature of corporate insolvencies, supplementing the monthly statistics that ASIC publishes on its website.

The report summarises information from 9,465 external administrator reports during the 2015–16 financial year and includes ASIC's response to their reports of alleged misconduct.

The latest insolvency statistics

ASIC's quarterly insolvency statistics for the first quarter of the 2016/17 financial year show a small increase of 0.7% in companies entering external administration (EXAD). Appointments totalled 2,299 compared to 2,283 in the previous quarter. The quarterly total was 22.3% lower than the 2015 September quarter (2,960).

ASIC's quarterly insolvency statistics for the first quarter of the 2016/17 financial year show a small increase of 0.7% in companies entering external administration (EXAD). Appointments totalled 2,299 compared to 2,283 in the previous quarter. The quarterly total was 22.3% lower than the 2015 September quarter (2,960).

The percentage of companies entering into external administration for the quarter, relative to new incorporations, remains below 4%.