ASIC Corporate Insolvency Update - Issue 6

Issue 6, December 2017

Cloud computing and interaction with Liquidator Assistance Program

![]() With the proliferation of cloud computing, registered liquidators (RLs) face increasing challenges and risks, in particular with securing a company's books and records. ASIC reminds RLs of the ability to ask ASIC for help in obtaining books and records in the possession of:

With the proliferation of cloud computing, registered liquidators (RLs) face increasing challenges and risks, in particular with securing a company's books and records. ASIC reminds RLs of the ability to ask ASIC for help in obtaining books and records in the possession of:

- officers of a company (s530A(1)(a)); and

- a third party (s530B)

ASIC notes that s530B allows a RL to serve a notice. The notice must specify the books and records the person must produce. While the notice is often used to recover books and records held by accountants, lawyers and, increasingly, cloud providers, the power to compel production under this section only relates to the records of the company the RL is appointed to.

When requesting ASIC assistance, RLs should heed the following tips:

- Take quick and assertive action (vital when seeking company data from third parties)

- Provide all correspondence (letters and notices) issued to directors and third parties with your request for assistance – proof of service is important

- Be clear in your request (don’t be ambiguous) – specify:

- What you seek, and

- Who you seek it from

- ASIC will email you an appropriate template statement or affidavit to complete if required. Avoid using a previous template.

- Stick to the facts and be concise in your affidavits/statements

- Check your sources – your evidence must support your statements

- Notify ASIC immediately if the director or third party complies whether this is before a prosecution is commenced or during the court process.

ASIC's aim is to ensure officers and third parties comply with obligations. Our priority is to assist you achieve compliance.

Read our previous article about ASIC's prosecution of directors who don't provide RATAs and records.

If you wish to discuss how ASIC can assist, see contact details below:

Vic, Tas & ACT

Lisa Trinh ph: (03) 9280 4146 or email: lisa.trinh@asic.gov.au

Dimitra Romas ph: (03) 9280 3594 or email: dimitra.romas@asic.gov.au

SA, WA, NSW, Qld & NT

Alfi Dilger ph: (08) 8202 8478 or email: alfi.dilger@asic.gov.au

For further information, refer to ASIC’s website page: Liquidator assistance program: Report as to affairs, books and records

Regional liaison meetings

![]() ASIC holds regional liaison meetings (RLMs) with RLs and lawyers within the insolvency profession.

ASIC holds regional liaison meetings (RLMs) with RLs and lawyers within the insolvency profession.

At our December RLM, discussions centred on:

Industry Funding Model

- While practitioners questioned why Government adopted the current system, and its ability to improve behaviour, they now need to work within that model in the form legislated.

- The ex post model is challenging. ASIC continues working with industry to adapt to the model.

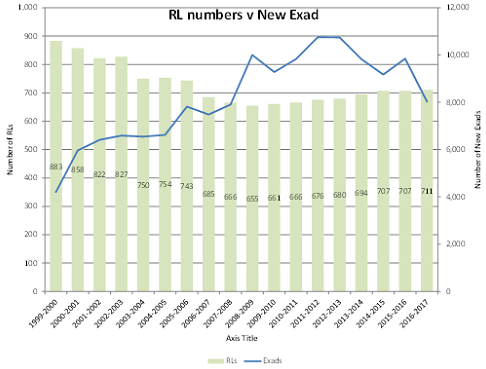

- RLs exiting the industry tend to be those with a very limited number of appointments over the last 12 months. Overall RL numbers have only fallen marginally, especially when viewed in conjunction with falling external appointments. See graph below

- ASIC is monitoring the number of RLs who decide not to renew their registration and who only remain RLs until they complete their existing external administrations. We are aware of industry's concerns about the impact of law reform and the industry funding model on RL numbers and will review this further at the end of the first quarter in 2018.

- The RLs ability and options to recover costs from an external administration and the recently published ARITA article included three options.

- Requests for clarity about the costs to RLs. ASIC will issue Cost Recovery Implementation Statements (CRIS) each October which will outline forecasted regulatory costs to regulate each subsector. In the following March, ASIC will issue indicative levies, also at the subsector level. ASIC acknowledged the view expressed that the model requires a heightened level of transparency concerning ASIC's costs.

- The meeting noted the reduction in advertisement costs for the Published Notices Website to $5 but that the costs to the RL in making this payment are unchanged. ASIC is currently testing an IT solution involving a zero cost (subject to regulatory changes reducing the fee from $5 to zero).

Figure 1: Registered liquidator numbers v New Exad

Insolvency law reform

What opportunities exist to:

- streamline the number of forms for lodgement

- have an email address for each corporation on the corporate register to facilitate notifications by RLs to stakeholders (noting increased mail delivery times)

- restrict lodgements against the corporate register after a company enters into external administration to RLs only

We undertook to refer the above to our registry team to consider as part of our current 'Regulatory Transformation' initiative.

- improve creditor reporting given the growing size of some reports (including remuneration reports). What opportunities exist to revisit these report templates (noting ASIC's current project aimed at improving creditor information)?

- noted that the high level of insolvency related law reform challenges industry in adapting to change.

Safe harbour legislation

- commentary that safe harbour provisions would have little impact on small VAs / CVLs

- benefits in defining what is a 'specialist'

Creditor powers

- need for a proper purpose to replace an RL

- impact of related party creditor voting

- abuse of power by creditors to obtain information for legal proceedings

Fees-for-service

The industry funding model requires those, who create the need for regulation, to fund the majority of ASIC's costs associated with the provision of regulation. From 2017-18 onwards, around 90% of ASIC’s regulatory activities will be recovered through ASIC and APRA levies on industry. From 2018-19, the remaining 10% of ASIC's costs associated with regulatory activities will be recovered via Fees-for-Service charges (FFS) (subject to legislation).

The industry funding model requires those, who create the need for regulation, to fund the majority of ASIC's costs associated with the provision of regulation. From 2017-18 onwards, around 90% of ASIC’s regulatory activities will be recovered through ASIC and APRA levies on industry. From 2018-19, the remaining 10% of ASIC's costs associated with regulatory activities will be recovered via Fees-for-Service charges (FFS) (subject to legislation).

FFS recover the regulatory costs attributable to a single, identifiable entity and typically apply to licensing and professional registrations, applications for relief, and review of corporate finance transaction documents. The current fees for these activities do not reflect their actual cost and as a result of the Government Financial System Inquiry in December 2014 a draft FFS model was developed, calibrated to reflect the cost of regulating the different industry sectors that we regulate.

Industry consultation in 2015 included stakeholder feedback supporting the principle that a fee should be paid for ASIC's demand driven services, such as processing applications lodged. To address feedback, the Government postponed the implementation of the FFS model to allow time to refine the model. On 22 November 2017, Treasury released a further consultation paper on the revised FFS model, to apply from 1 July 2018 under the industry funding model, to recover the regulatory costs of undertaking certain activities directly attributable to a single, identifiable entity. Treasury have received approximately 14 responses from industry which are now being considered.

Examples of activities to which the new or amended FFS will apply to registered liquidators include applications to remove/vary conditions on their registration, or lift/shorten a period of suspension, or renew their registration, or cancel/suspend their registration or extend the time to deal with a formal proof of debt. A new fee will be introduced for lodging an application for ASIC's authorisation of the applicant as an 'eligible applicant' to publicly examine a person about a corporation's examinable affairs.

The FFS consultation paper is available on the Treasury website. Schedule A of the consultation paper sets out the current and proposed FFS. Schedule B sets out existing fees that Government proposes to remove. Submissions closed on 15 December 2017. The Government expects to introduce the proposed amendments to Corporations (Fees) Act 2001 and Corporations (Fees) Regulations 2001 ('the regulations'), to give effect to the FFS model, in the first half of 2018; with the changes to commence on 1 July 2018.

Note: The fees attached to ASIC forms relating to updating an ASIC registry database (compared with regulatory fees where the benefit of the activity primarily accrues to the individual entity) will not be recovered under the FFS model. The fees for lodging these forms will continue to be set separately. Therefore, following passage of these reforms, some of the fees in the regulations will be determined on a cost recovery basis (the regulatory fees) and other fees (registry fees) will not be on a cost recovery basis.

Release of regulatory guides

![]() On 1 March 2017, ASIC published Regulatory Guide 258 Registered liquidators: Registration, disciplinary actions and insurance requirements (RG 258) to reflect reforms enacted by the Insolvency Law Reform Act 2016 (ILRA).

On 1 March 2017, ASIC published Regulatory Guide 258 Registered liquidators: Registration, disciplinary actions and insurance requirements (RG 258) to reflect reforms enacted by the Insolvency Law Reform Act 2016 (ILRA).

ASIC is updating other regulatory guides to reflect ILRA including:

- RG 16 External administrators: Reporting and lodging

- RG 81 Destruction of records

- RG 82 External administration: Deeds of company arrangement involving a creditors' trust

- RG 109 Assetless Administration Fund: Funding criteria and guidelines

- RG 174 Relief for externally administered companies and registered schemes being wound up

- RG 217 Duty to prevent insolvent trading; Guide for directors, and

- RG 242 ASIC's power to wind up abandoned companies.

Most of the changes are relatively minor to reflect that the ILRA re-located a number of existing requirements of the law from Chapter 5 to Schedule 2 of the Act or to the Insolvency Practice Rules. ASIC will also update RG 82 to reflect judicial commentary on an aspect of ASIC's guidance in the decision in the matter of Bevillesta Pty Limited (in Voluntary Administration) [2011] NSWSC 417.

RG 217 requires review following enactment of the 'safe harbour ' reforms, which are unrelated to the ILRA.

Updated RG 82, 109, 174 and 242 are expected to be published shortly. The remaining RGs are expected to be published in the first half of 2018.

ASIC releases report on corporate insolvencies

![]() ASIC published its annual overview of corporate insolvency statistics based on statutory reports lodged by external administrators for the 2016–17 financial year.

ASIC published its annual overview of corporate insolvency statistics based on statutory reports lodged by external administrators for the 2016–17 financial year.

Report 558 Insolvency statistics: External administrators’ reports (July 2016 to June 2017) (REP 558) is ASIC's ninth report and provides information on the nature of corporate insolvencies, supplementing the monthly statistics that ASIC publishes on its website.

Updated 'Excel' guide for completing a form 5603

![]() After monitoring feedback from RLs and staff we updated our user guide (Excel users) to address frequently asked questions or common user mistakes.

After monitoring feedback from RLs and staff we updated our user guide (Excel users) to address frequently asked questions or common user mistakes.

Common mistakes

- Trying to populate the table with your details. Your RL number from the appointment tab populates the form with your details. An error message appears if you try to type your first name, surname, address and county manually in the form. This part of the table is only for non-RLs who lodge via the agent's portal.

- Not populating all five cells on a line. For each line of the receipts and payments tabs (both detail and summary) make sure you populate all cells on a line.

Common questions

Questions asked about gross assets realised:

- do we include GST received? Answer: No

- do we net off realisation costs? Answer: No

- do we include trading receipts? Answer: No

Question: Do we reduce creditor claims in the creditor table to reflect dividends paid?

Answer: No

Question: Is a Form 5603 required at the end of a voluntary administration given another external administration type follows afterwards (ie a creditors voluntary liquidation or DOCA)?

Answer: We expect you to lodge a Form 5603 at the end of the voluntary administration as it is a separate external administration type

Question: Do I need to show fee approval obtained for voluntary administration fees in my Form 5603 for a CVL when the fees were approved and paid during the VA?

Answer: No, only show VA fees if you pay them during the CVL

Question: Why do I provide the information required in the 'Transaction Category' field?

Answer: You need to complete, 'Transaction Category' from the dropdown box. This field will not show on the PDF created and lodged with ASIC. It is for ASIC's internal purposes only (it allows us to categorise the receipts and payments in our database).

New lodgement periods introduced – update your precedents and avoid late fees

![]() Insolvency Practice Rules (Corporations) 2016 (IPRs) amendments just before 1 September 2017 introduced new lodgement timeframes impacting four ASIC forms. They are:

Insolvency Practice Rules (Corporations) 2016 (IPRs) amendments just before 1 September 2017 introduced new lodgement timeframes impacting four ASIC forms. They are:

Form 5601: Statutory report by a liquidator to creditors

Lodgement period: The report must be lodged with ASIC at the same time as you provide it to creditors. 'Same time' means lodging on the same day (not first thing the next morning).

Form 530: Copy of administrator's report, statement and notice of s439A meeting

Lodgement period: Within two business days of sending the notice to creditors

Form 531: Copy of declaration of relevant relationships and/or declaration of indemnities

Lodgement period:

- Within five business days of the meeting if lodging under s75-265 of the IPRs.

- Within five business days of the RL's appointment as a reviewing liquidator if lodging under s90-18(2)(b) of the IPRs.

- If no specific period prescribed, lodge the declaration as soon as practicable after making it.

Form 5022: Outcome of proposal to creditors or contributories without a meeting

Lodgement period: Within five business days of knowing the outcome.

We updated our systems on 15 November 2017 to implement these changes. If you lodge the forms late, you will now incur a late fee.

To avoid late fees, please review your procedures and checklists to ensure you lodge the forms within the prescribed timeframe.