Market Integrity Update - Issue 63 - August 2015

Issue 63, August 2015

Review of client money handling

We recently reviewed the client money handling practices of seven equities market participants. As part of this exercise, we required the participants to produce bank statements, policies and procedures, reconciliations and other supporting documents. We then tested these documents against the client money handling requirements in the ASIC market integrity rules, Corporations Act 2001 and Corporations Regulations 2001.

We recently reviewed the client money handling practices of seven equities market participants. As part of this exercise, we required the participants to produce bank statements, policies and procedures, reconciliations and other supporting documents. We then tested these documents against the client money handling requirements in the ASIC market integrity rules, Corporations Act 2001 and Corporations Regulations 2001.

We observed that the participants’ policies and procedures for client money handling were generally tailored to suit the nature, scale and complexity of their financial services business. Overall, they demonstrated compliance with most of the client money handling requirements. However, in some cases:

- the participants did not periodically review their policies and procedures for client money handling

- the participants did not check that the Authorised Deposit-taking Institution was qualified to maintain trust accounts

- Responsible Executives did not sign trust account reconciliations within the required timeframe or, in some instances, include the prescribed statement

- trust accounts were incorrectly designated (see 'Stories from the beat' below).

Among the participants we examined, there were also a number of different approaches to reporting of breaches of the client money handling requirements. We are concerned that this may indicate a lack of understanding about when breaches are reportable.

You do not have to report all breaches or likely breaches. We expect that, when you become aware of any breach (or likely breach), you will:

- consider the circumstances and impact of that breach (or likely breach)

- decide if the breach is significant (and, if so, report it to ASIC), and

- document this process.

ASIC Regulatory Guide 78 Breach reporting by AFS licensees (RG 78) provides further guidance for participants about when a breach is considered 'significant': see RG 78.11–RG 78.14.

Participants and market operators are encouraged to self-report breaches of the ASIC market integrity rules to ASIC, even if they are not significant.

Alleged breaches of the ASIC market integrity rules may be referred by ASIC to the Markets Disciplinary Panel (MDP) for determination, as an alternative to civil proceedings. If the alleged breach or breaches are established, the MDP may consider the conduct of the participant or operator after a breach occurred, among other things, in determining any appropriate pecuniary penalty or other remedy: see Regulatory Guide 216 Markets Disciplinary Panel (RG 216).

RG 216.123 provides that 'The MDP's consideration of whether a breach was self-reported to ASIC is not limited by any breach reporting obligations that may apply to the recipient under the Corporations Act. The MDP may consider it relevant that a recipient self-reported a breach that they were not obliged to report.' This means that whether or not a breach was self-reported may be considered a mitigating or aggravating factor.

We previously discussed the topic of self-reporting to ASIC in this newsletter.

Equity market data – June 2015 quarter

ASIC has published equity market data for the June 2015 quarter.

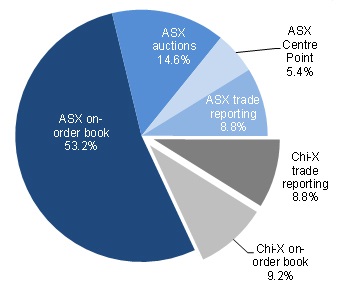

In summary, in the June quarter 2015, the ASX accounted for 82.0% of the total dollar turnover in equity market products. Chi-X accounted for the remaining 18.0% of total dollar turnover. These figures include all trades executed on order book, as well as trades matched off order book and reported to either market operator. On-order book turnover as a proportion of total dollar turnover rose to 62.4% in the June quarter, compared to 60.2% in the March quarter. Conversely, trade reporting turnover as a proportion of total dollar turnover fell by 2.3 percentage points to 17.6% over the quarter.

Market share - June quarter 2015

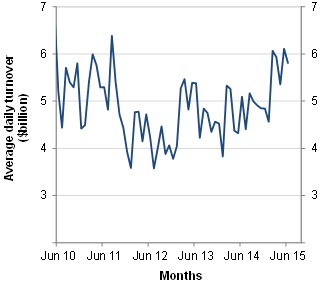

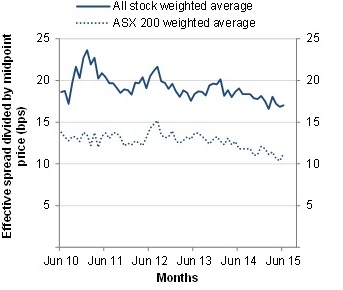

Overall daily turnover in the equity market averaged $5.8 billion in the June quarter, an increase from $5.5 billion in the March quarter and $4.6 billion in the June quarter 2014. The weighted average quoted bid-ask spread for securities in the ASX 200 index fell slightly to 13.3 basis points of the midpoint price in the quarter. The weighted average quoted bid-ask spread for all securities decreased slightly to 20.3 basis points of the midpoint price.

Australia - Average daily turnover

Below block size dark liquidity represented 12.0% of total value traded in the June quarter, up 0.4 percentage points from the previous quarter, roughly equal to its share of the market a year prior (12.2%). Turnover in block size dark liquidity was 14.1% of total value traded, down 0.9 percentage points from the previous quarter.

Intraday volatility remained steady at a slightly elevated level, while the weighted average interday volatility for the S&P/ASX 200 index eased slightly in the quarter to around 1.6% after peaking at 1.9% in December 2014. The overall order-to-trade ratio increased to 8.1:1 in the quarter as the ASX reported a higher ratio that was partly offset by a lower ratio on Chi-X.

Read Equity market data for quarter ending June 2015

Fifth anniversary of ASIC market supervision

On 1 August 2010, responsibility for the supervision of real-time trading on Australia's domestic licensed equities and futures markets was transferred to ASIC from the ASX. This month marks the fifth anniversary of this milestone.

These days, ASIC supervises 125 participants, trading across seven equities and futures markets, on which more than 960,000 trades are made per day (compared with 520,000 in 2010).

You can read (and watch) more about this milestone and ASIC's achievements over this time on the ASIC website.

Read 5th anniversary of ASIC market supervision

Watch 'five years of market supervision'

OTC reporting obligations

The final phase of the implementation of the OTC derivatives transactions reporting requirements will commence on 12 October 2015. From this date, reporting entities with an OTC derivatives book size below $5 billion gross notional outstanding as at 30 June 2014 may be required to commence reporting all their OTC derivatives transactions under the ASIC Derivative Transaction Rules (Reporting) 2013.

All firms that are Reporting Entities should ensure that they have made necessary preparations to commence reporting applicable OTC derivative transactions and positions, including those that are transacted with clients (e.g. CFDs, Margin FX) or used for hedging purposes.

More information about derivative transaction reporting is available on the ASIC website.

Cyber security – 'Companies like yours'

ASIC has previously published a number of alerts in this newsletter about cyber security and related issues, such as identity theft. We recently came across a short video produced by Deloitte which illustrates the level of sophistication and planning cyber-attacks may involve, and just how devastating they can be.

ASIC has previously published a number of alerts in this newsletter about cyber security and related issues, such as identity theft. We recently came across a short video produced by Deloitte which illustrates the level of sophistication and planning cyber-attacks may involve, and just how devastating they can be.

'Companies like yours' is a high quality account of a fictional cyber-attack. It drives home the importance of cyber resilience to market intermediaries. This topic was considered in ASIC Report 429: Cyber resilience: Health check (REP 429).

We would like to thank Deloitte for allowing us to share a link to this video with you.

Watch the video 'Companies like yours'

Read:

Cyber resilience: Health check

MECS – Tip of the month

Crossing system reporting

The Market Entity Compliance System (MECS) has now been rolled out to all market entities. To assist users to meet their regulatory obligations, MECS contains 30 forms that can be submitted online.

For participants, the following forms relating to crossing systems are available:

- provision of crossing system initial report (M83)

- crossing system outage notification (M84)

- provision of publically available crossing system information (M85)

- provision of non-public crossing system information (M86)

- provision of crossing system monthly report (M87)

Each form includes instructions for completing and lodging the form. Submitting forms through MECS enables market entities to manage and retain a record of manage their interactions with ASIC.

Enforcement report released

ASIC has released a report outlining enforcement outcomes achieved by the regulator between 1 January 2015 to 30 June 2015.

ASIC has released a report outlining enforcement outcomes achieved by the regulator between 1 January 2015 to 30 June 2015.

During the six month period, ASIC achieved 323 enforcement outcomes to protect financial consumers and enhance the fairness and efficiency of Australia’s financial markets.

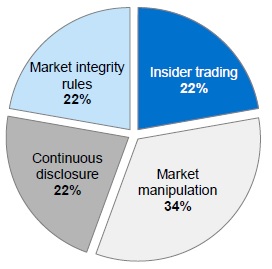

In market integrity, this included four criminal outcomes, one banning and three infringement notices, totalling $213,000. The figure below shows the proportion of enforcement activity in each category of market integrity misconduct over the relevant period.

Market integrity outcomes by misconduct type

Read Report 444 ASIC enforcement outcomes: January to June 2015

Former director sentenced for insider trading

Peter Charles Pritchard Farris, a former director of Northern Star Resources (Northern Star), has been sentenced to two years and nine months imprisonment (fully suspended) for insider trading. In addition, a pecuniary penalty of $65,000 has been imposed on Mr Ferris. Mr Farris also consented to forfeiting the amount of the loss which he avoided by insider trading.

Peter Charles Pritchard Farris, a former director of Northern Star Resources (Northern Star), has been sentenced to two years and nine months imprisonment (fully suspended) for insider trading. In addition, a pecuniary penalty of $65,000 has been imposed on Mr Ferris. Mr Farris also consented to forfeiting the amount of the loss which he avoided by insider trading.

Mr Farris traded prior to an announcement by Northern Star on 30 November 2012 that revealed its major shareholder at the time, InvestMet Limited, as well as Northern Star’s Managing Director, Chairman and a non-executive director had conducted a sell down of their Northern Star shares. The transaction involved the sale of 37 million Northern Star shares at a discounted price of $1.35 per share. Mr Farris was a director of Northern Star and InvestMet at the time of the announcement. As a result of the trades, Mr Farris avoided a loss of $123,975.

In October 2014, Mr Farris pleaded guilty to two counts of insider trading relating to sale of 750,000 Northern Star shares between 28 and 29 November 2012, but disputed the facts of the matter (see 14-186MR).

Following a hearing in May 2015 to determine Mr Farris’ level of knowledge at the time of the trades, the Court found Mr Farris traded when he knew that the information he possessed was inside information.

Since 2009, 38 persons have been prosecuted for insider trading as a result of ASIC investigations, with a success rate of 82% (28 convictions) in the 34 cases in which liability has been determined (4 persons are currently awaiting trial).

Stories from the beat

The majority of the market integrity outcomes ASIC achieves are not publicised in the media, but this does not diminish their importance. Every day, ASIC officers work to ensure our markets are fair and efficient. These are their stories.

An ASIC analyst reviewed bank account statements provided by Participant A as part our review of client money handling. The analyst observed that Participant A's client trust account was not designated as such, but instead named 'Settlement clearing account'.

An ASIC analyst reviewed bank account statements provided by Participant A as part our review of client money handling. The analyst observed that Participant A's client trust account was not designated as such, but instead named 'Settlement clearing account'.

Appropriate designation is an important safeguard to protect the interests of investors. It is also a legislative requirement! An inaccurate designation may result in the funds not being identified as client money and dealt with as required by law. This risks the funds not being protected in the event of the licensee becoming insolvent or ceasing to be licensed. We consider that the name of the client trust account should contain the words ‘client trust account’ or wording to that effect.

The analyst wrote to Participant A requesting the trust account be renamed using an appropriate designation. This change was promptly made.

'New look' newsletter

From this month, the Market Supervision Update has been re-launched as the Market Integrity Update (MIU). The name change better reflects the range of topics addressed in this newsletter, which is relevant to all market intermediaries, including market participants and operators, investment banks, listed companies and investment managers (among others). The relaunch is accompanied by additional reader-friendly features, such as infographics and hyperlinks.

From this month, the Market Supervision Update has been re-launched as the Market Integrity Update (MIU). The name change better reflects the range of topics addressed in this newsletter, which is relevant to all market intermediaries, including market participants and operators, investment banks, listed companies and investment managers (among others). The relaunch is accompanied by additional reader-friendly features, such as infographics and hyperlinks.

We are keen to hear your thoughts about the MIU. Do you like the new format? Are there other features you would like included? We are also happy to receive suggestions for content or general questions about obligations which affect market intermediaries.

You can send your comments and suggestions to feedback@asic.gov.au

Anyone with an interest in Australian financial markets is encouraged to subscribe to the MIU.