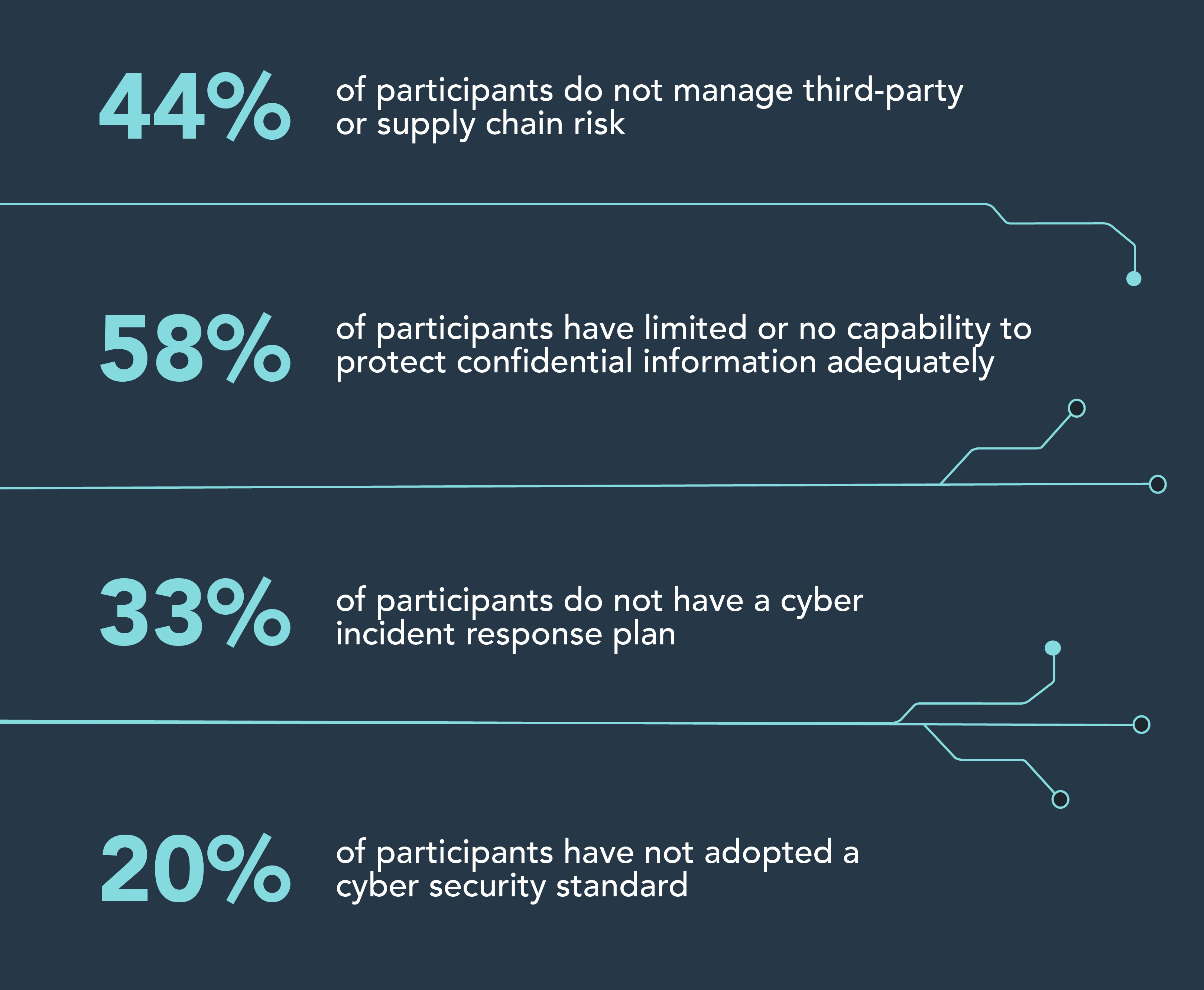

- 44% of participants do not manage third-party or supply chain risk

- 58% of participants have limited or no capability to protect confidential information adequately

- 33% of participants do not have a cyber incident reponse plan

- 20% of participants have not adopted a cyber security standard

MIU - Issue 154 - November 2023

This Market Integrity Update contains the following articles:

- Enforcement priorities for 2024 announced

- New Commissioners commence at ASIC

- Greater vigilance required to combat cyber threats

- Over $17.4 million in compensation paid to retail investors

- Proposed changes to OTC derivative transaction reporting

- ASIC–RBA acknowledge ASX’s CHESS solution design announcement

- ASX’s release of the Portfolio, Program and Project Management Special Report and Audit Report

- Treasury consults on the first tranche of Quality of Advice recommendations

- AFS licence suspensions

Enforcement priorities for 2024 announced

We’ve announced our enforcement priorities for 2024, including a new priority related to technology and operational resilience for market operators and participants.

We’re committed to addressing misconduct that damages Australia’s financial markets. As financial markets continue to become increasingly digitised and automated, the technical and operational risks faced by market operators and market participants have also increased.

Technological and operational resilience remains integral to maintaining market integrity. We’ve observed that where failures in implementation of automated systems are not identified in initial testing, they tend to persist, in some cases for many years. The automated and interconnected natures of these systems means that market harm can far exceed harm caused by errors or breaches in manual processes.

Our enduring priorities continue to include insider trading, market manipulation and continuous disclosure. We’ve also retained priorities relating to greenwashing and enforcing design and distribution obligations.

- Read the media release

New Commissioners commence at ASIC

ASIC Chair Joe Longo has welcomed the commencement of new Commissioners Simone Constant and Alan Kirkland, who began their five-year terms on 20 November.

In August the Treasurer announced the appointment of three new Commissioners to ASIC to serve alongside Mr Longo, Deputy Chair Sarah Court and Deputy Chair Karen Chester, noting Ms Chester’s term ends in January 2024.

Ms Kate O’Rourke commenced her term in September 2023.

The initial regulatory focus of Ms Constant will be on markets, superannuation and cyber security, Mr Kirkland on insurance, credit, financial advisers and investment management, and crypto assets, and Ms O’Rourke on banking and payments, audit, insolvency and registers.

- Read the media release

Greater vigilance required to combat cyber threats

We’re calling on organisations to prioritise their cyber security after our report into the cyber capability of corporate Australia identified significant gaps.

The report summarises the results of ASIC’s recent cyber pulse survey. The results of the voluntary self-assessment survey have exposed deficiencies in cyber security risk management of critical cyber capabilities, indicating that organisations are reactive rather than proactive when it comes to managing their cyber security.

Encouragingly, participating organisations indicated well-developed capabilities in identity and access management, governance and risk management, and information asset management, with large organisations consistently self-reporting more mature cyber capabilities.

Understandably, due to competing demands for limited human and financial resources, small organisations lagged behind larger entities in third-party risk management, data security, consequence management, and adoption of industry standards.

Ninety-five per cent of survey participants opted to receive an individual report which provided important insights on how their cyber resilience compared to their peers. This demonstrates a commitment to improving their organisation’s cyber resilience.

Survey result highlights

- Read the media release

Over $17.4 million in compensation paid to retail investors

We’ve overseen more than $17.4 million in combined compensation payments to over 2,000 retail clients affected by breaches of financial services laws by eight retail OTC derivative issuers.

This compensation figure, being paid or agreed to be paid since March 2021, comprises:

- a combined $4.3 million paid or agreed to be paid to over 1,500 retail clients of seven different issuers of contracts for difference (CFDs) since March 2021, due to issuing CFDs that exceeded the leverage ratio limits permitted by the ASIC Corporations (Product Intervention Order – Contracts for Difference) Instrument 2020/986. The seven CFD issuers self-reported the breaches, proposed remediation programs, and cooperated with us through the review and remediation of affected clients. The seven CFD issuers were:

- Capital Com Australia Pty Ltd

- CMC Markets Asia Pacific Pty Ltd

- Eightcap Pty Ltd

- IG Australia (IG Markets Limited and IG Australia Pty Ltd)

- Pepperstone Group Limited

- Saxo Capital Markets (Australia) Limited

- StoneX Financial Pty Ltd trading as City Index

- approximately $13.1 million to 523 derivatives clients of Oztures Trading Pty Ltd trading as Binance Australia Derivatives (Binance) between May and September 2023, due to its incorrect classification of retail clients as wholesale clients which resulted in various other breaches of financial services laws. Binance’s Australian financial services licence was cancelled on 6 April 2023 following its request to voluntary cancel its licence.

- Read the media release for details of the breaches, the compensation payments made, and the underlying compensation methodologies we reviewed

Proposed changes to OTC derivative transaction reporting

We’ve released a follow-on consultation proposing minor and technical changes to the ASIC Derivative Transaction Rules (Reporting) 2024 (the 2024 Rules).

Commencing 21 October 2024, the 2024 Rules repeal and replace the current ASIC Derivative Transaction Rules (Reporting) 2022 to align with international reporting standards, consolidate transitional provisions and exemptions within the rules and ensure that the reporting requirements are fit for purpose.

Consultation Paper 361a ASIC Derivative Transaction Rules (Reporting) 2024: Follow-on consultation on changes to data elements and other minor amendments (CP 361a) follows the data elements proposals outlined in Consultation Paper 361 Proposed changes to simplify the ASIC Derivative Transaction Rules (Reporting): Second consultation (CP 361).

CP 361a proposes changes to the 2024 Rules to:

- include seven additional data elements

- provide clarifications and administrative updates to the data elements

- make consequential changes to Chapter 2: Reporting Requirements

- make other administrative updates including re-referencing the location of definitions in the Corporations Act 2001 which have been moved by the Treasury Laws Amendment (2023 Law Improvement Package No. 1) Act 2023

(together, the proposed data element changes).

The data elements consulted on in CP 361 were based on the international standards and systems for harmonised OTC derivative transaction reporting at that time. The proposed data element changes have been informed by further developments internationally and our ongoing engagement with internal and external stakeholders. Our follow-on consultation process aims to ensure timely inclusion of the proposed data element changes within industry’s current 2024 Rules changes programs to implement international reporting standards.

We welcome your feedback on CP 361a by 15 December 2023. Email otcd@asic.gov.au if you wish to make a submission.

ASIC–RBA acknowledge ASX’s CHESS solution design announcement

ASIC and the Reserve Bank of Australia (RBA) (the regulators) acknowledged ASX’s announcement of a solution design to replace CHESS.

The product-based solution and vendor announced by ASX is a foundational step in getting the CHESS replacement program back on track.

This follows advice provided by the ASX Cash Equities Clearing and Settlement Advisory Group (Advisory Group), a small group of recognised industry leaders established to advise ASX Clear and ASX Settlement on strategic clearing and settlement issues led by independent chair Alan Cameron AO.

The Advisory Group considered that a product-based solution, presented by ASX, and assessed by it, is an appropriate option to support a safe and timely replacement of CHESS. In addition, the Advisory Group responded with recommendations to ASX to provide clear statements on the industry impact, including the benefits to the market of the selected solution and ASX’s commitment to building a system that is interoperable. The Advisory Group also noted the importance of the competition in clearing and settlement legislation and supporting ASIC rules to provide regulatory backing for interoperability.

ASX will also need to ensure existing CHESS continues to be maintained to meet ongoing resilience, reliability, integrity, and security requirements. This will be a continued focus for the regulators.

The replacement of CHESS is a complex and technical program of work. It is critically important that robust and transparent governance arrangements are put in place by ASX to manage the risks associated with such an implementation.

- Read the media release

ASX’s release of the Portfolio, Program and Project Management Special Report and Audit Report

We acknowledge ASX’s release of a Special Report, along with an external Audit Report, on its Portfolio, Program and Project Management Frameworks (PPPM Reports). The PPPM Reports are relevant to ASX’s delivery, implementation, and governance of the recently announced CHESS replacement solution design.

ASX has now published all three of the special reports and accompanying audit reports it was required to provide to ASIC under notice. We’ll now consider all of the reports to determine if further regulatory action is required.

ASIC and the Reserve Bank of Australia (RBA) (the Regulators) are closely monitoring the delivery of the CHESS replacement by ASX Clear and ASX Settlement to ensure the facilities adhere to the Regulators’ expectations and comply with their clearing and settlement facility licence obligations.

- Read the media release

Treasury consults on the first tranche of Quality of Advice recommendations

Treasury is consulting on draft legislation for the first tranche of the Delivering Better Financial Outcomes reforms package.

The 2019 Hayne Royal Commission recommended a review of the regulatory framework be undertaken with a view to improving the quality of financial advice. The Quality of Advice Review considered how regulatory settings could better enable the provision of high-quality, accessible and affordable financial advice to retail clients. The review’s final report was provided to the Government on 16 December 2022 and made 22 specific recommendations.

The recommendations being addressed by the first tranche of reforms are:

- Recommendation 7: clarifying the legal basis for superannuation trustees reimbursing a member’s financial advice fees from their superannuation account

- Recommendation 8: streamlining ongoing fee renewal and consent requirements and removing the need to provide a fee disclosure statement

- Recommendation 10: providing flexibility around Financial Services Guide requirements

- Recommendations 13.1 to 13.5 and 13.7 to 13.9: simplifying the provisions governing conflicted remuneration.

The consultation closes on 6 December 2023.

AFS licence suspensions

We’ve suspended the Australian financial services (AFS) licences of First City Corporate Advisory Services Pty Limited (First City) and JB Markets Pty Ltd (JB Markets).

First City

First City’s AFS licence was suspended for failing to lodge its annual financial statements and audit reports.

The suspension, in place until 27 March 2024, provides First City with an opportunity to meet its outstanding compliance obligations.

If First City has not complied with its outstanding obligations by the end of the suspension period, ASIC will consider cancelling its AFS licence. The suspension took effect on 3 October 2023.

- Read the media release

JB Markets

JB Market’s AFS licence was suspended until 30 April 2024 for failing to:

- comply with the financial requirements of its AFS licence

- have adequate resources to provide the financial services covered by the licence and to carry out supervisory arrangements.

The licence suspension means that JB Markets (and its representatives) cannot provide financial services unless it is for the purpose of terminating existing arrangements with clients.

The licence suspension includes a provision that requires JB Markets to continue as a member of the Australian Financial Complaints Authority, with arrangements for compensating retail clients to continue, including the holding of professional indemnity insurance cover.

JB Markets may apply to the Administrative Appeals Tribunal for a review of our decision. The suspension took effect on 8 November 2023.

- Read the media release