How to apply for relief

This page provides step-by-step instructions on how to apply for relief. Applications for relief are submitted through the ASIC Regulatory Portal using online forms known as transactions.

This page contains:

- Register your portal account

- Invite trusted representatives to transact in the portal on your behalf

- Submit through the portal on behalf of clients

- About each transaction and how they work in the portal

- About specific transaction types

Also see:

- Refer to Information Sheet 82 Apply for relief (INFO 82) for more information.

- FAQs: Applying for relief - for frequently asked questions about ASIC's Regulatory Portal and invoices in Regulatory Portal.

Note: Fundraising and corporate finance documents are also lodged through the ASIC Regulatory Portal. For more information, see Changes to how you lodge fundraising and corporate finance documents.

Register your portal account

Recently registered? Please wait a minimum of 30 minutes before launching a transaction.

Anyone using the portal to transact with ASIC will need to register an individual account. You can register by selecting the ‘I just want to register’ tile on the registration page. You can then log in and submit any of the new transactions to ASIC.

You can also register your individual account when you are invited to connect to an entity account. In this scenario, a Senior administrator or Administrator of an entity account such as a law firm partnership will send you an invitation key and you will be prompted to register your portal account as part of that process.

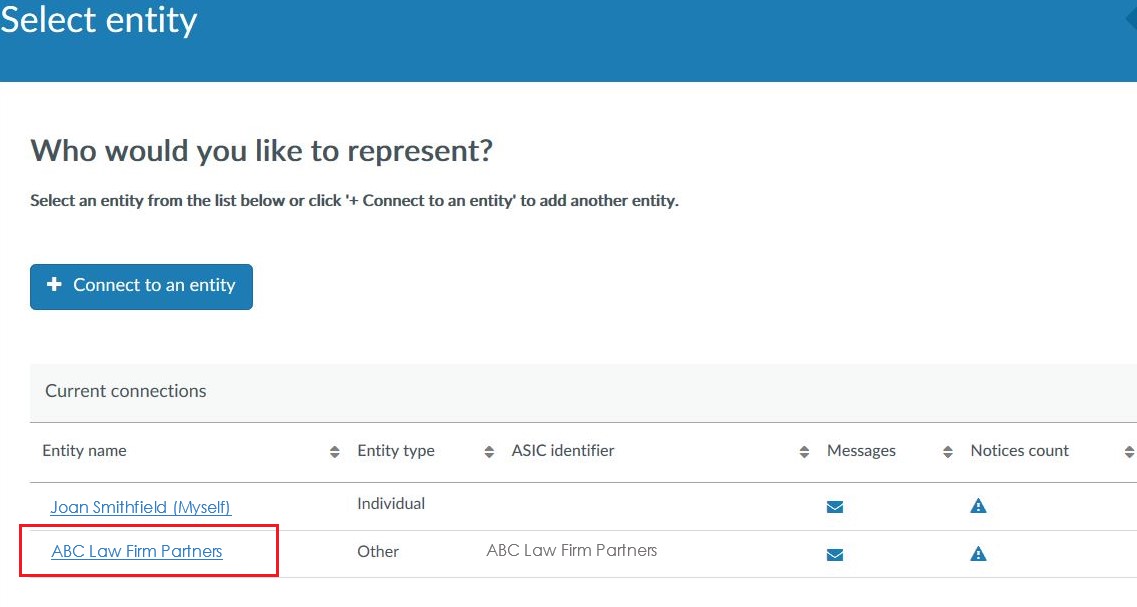

All portal users log in to their individual account before selecting who they would like to represent - including themselves - from their list of ‘current connections’.

See also Can someone act on my behalf in the portal?' in the FAQs.

Invite trusted representatives to transact in the portal on your behalf

You can invite trusted representatives to act on your behalf in the portal.

Invitation process

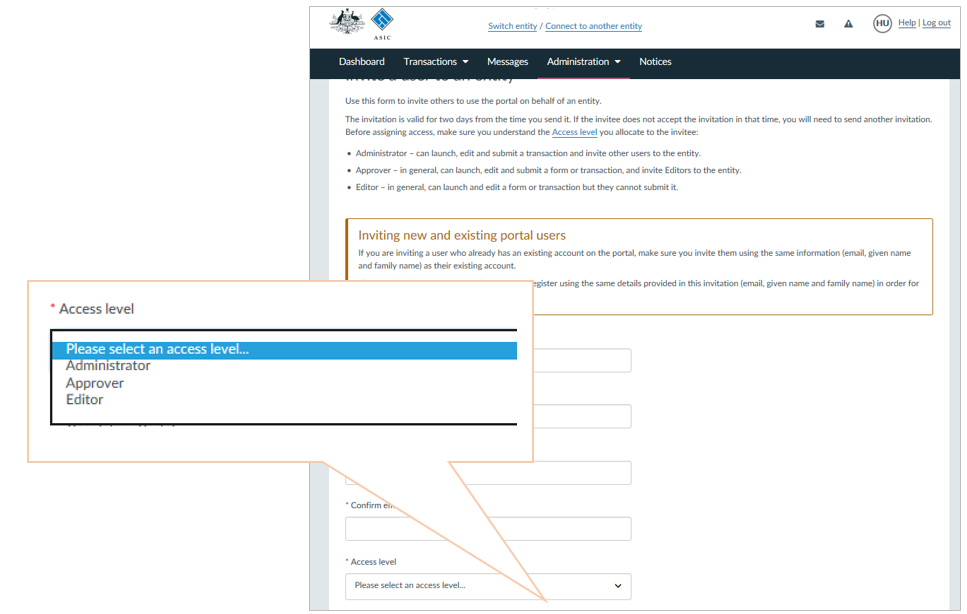

If you would like someone to act on your behalf in the portal, you first need to invite them to connect to your account. Only a user with Senior administrator or Administrator Access level can invite other users to connect.

Setting access levels

When inviting someone to connect you can define their Access level to control what they can and can’t do on your behalf. For example, you can authorise a trusted representative such an associate or agent to launch and edit a transaction, but not submit it

There are four Access levels – Senior administrator, Administrator, Approver and Editor.

Only the Senior administrator or an Administrator of the account can invite other users to connect. If you registered the account, you will be the Senior administrator by default.

The person you invite will receive an email with an invitation key. The invitee will need to register an account of their own if they don’t have one already.

For more information, including on how to invite someone to connect to your account, see the Administration section on the FAQ page.

Submit through the portal on behalf of clients

A law firm partnership can submit transactions to ASIC for its clients. This can be done by law firm employees who submit transactions on behalf of their clients under the centralised law firm account.

Already registered?

Make sure you select to represent your law firm before launching a transaction

-

The screen shot below is an example of the landing page all portal users see when they log in.

-

Your law firm will show in your list of ‘current connections’ once you have been invited to connect to the law firm account.

-

Before you launch a transaction, make sure you select to represent your law firm. Do not select your own name (‘Myself’).

-

This will ensure the invoice is issued to your law firm – not to you as an individual.

Not registered yet?

How to register and connect to a law firm partnership

Step 1 – register

A partner of the firm will need to perform the initial portal account registration.

- Go to the registration page – https://regulatoryportal.asic.gov.au/registration/

- Select ‘I want to act on behalf of a registered company or body’ tile.

- In the 'Entity type' drop-down list select ‘Other’

- In the ‘Category’ drop-down list select ‘Partnership’ and provide the relevant information to register.

- Enter your Australian Business Number (ABN) and ASIC key in relation to ABN.

- Confirm that you are a current partner of the partnership.

- Provide some personal contact details.

- Make final declaration.

Step 2 – first login

The partner should log in and add in billing contact details for the law firm.

- Select your law firm from the ‘Select entity’ page once logged in. Do not select your own name.

- Provide billing contact details.

Step 3 – invite others

Once registered and once the billing and other contact details have been added, the partner can invite others to connect to submit transactions for its clients under the centralised law firm account.

- Select your law firm from the ‘Select entity’ page once logged in. Do not select your own name.

- Click on Administration in the top navigation bar.

- Click on the Users tab.

- Click on Invite new user to entity button.

- Enter the invitee's details – name, email address etc. You will also need to declare that you understand the access you are giving the invitee.

- Click Confirm.

This will send the invitee an email, including an invitation key that they can use to register or connect to the law firm if they have an existing portal account. The invitee can undertake administrative tasks like inviting other users to connect to the law firm account, if they are given ‘Administrator’ access.

How to register and connect to a law firm that is a company

Only a Director or Secretary of the company can perform the initial registration. They can then invite others to connect and act on their behalf. Steps to perform initial registration:

- Go to the registration page – https://regulatoryportal.asic.gov.au/registration/

- Select ‘I want to act on behalf of a registered company or body’ tile.

- In the ‘Entity type' drop-down list select ‘Australian Registered Company’ and provide the relevant information to register. You will need to have the following on hand:

- ASIC Identifier (Australian Company Number (ACN)),

- Corporate Key (for more information, see Corporate Key).

- Provide some personal contact details.

- Make final declaration.

Key points for law firms

- The law firm partnership account will contain a record of all the transactions submitted by portal users acting on behalf of the partnership. Access to transactions in the portal can be restricted.

- While the transactions may be submitted on behalf of a client, the debt for each transaction will be raised against the law firm partnership and will be shown on the invoice statement issued to the partnership.

- Each outstanding transaction will be listed on the one invoice statement as a separate line item, rather than separate invoices for each transaction.

- If the transaction is submitted on behalf a client, the name of the client will appear on the relevant transaction line item.

How else can I submit transactions on behalf of a client?

Separate to submitting as a law firm partnership, there are two other ways you can submit transactions to ASIC for a client and each of them will determine where the invoice statement is issued.

Submitting as client entity (e.g. a company)

- To connect to a client and to submit transactions on its behalf in the portal, you must first be invited by a Senior administrator or an Administrator of the client’s portal account. For companies registered on the portal, directors and sectaries are Senior administrators.

- The client’s portal account will contain the record of the transactions submitted by users who have connected to the account to act on its behalf.

- The debt for each transaction will be raised against the client entity and will be displayed on the invoice statement issued to the client entity.

- Individuals connect to a client entity using their individual portal account. A law firm partnership entity cannot connect to a client entity.

Submitting as an individual

- You can submit transactions to ASIC on behalf of a client from your own portal account.

- In this scenario, you are not connected to the portal account of your client entity, however you can still submit transactions on their behalf.

- You can invite others to draft/submit/review transactions on your behalf in the portal.

- Your portal account will contain a record of all the transactions you have submitted. It will also include a record of any transactions submitted on your behalf.

- The debt for each transaction will be raised against you as the individual and will be displayed on the invoice statement issued to you.

About each transaction and how they work in the portal

The forms in the portal are known as transactions. The transactions in the portal feature a common design and functionality. When you answer a question in a transaction, you may be requested to provide information specific to your response. This conditional logic ensures that appropriate questions are tailored to your responses.

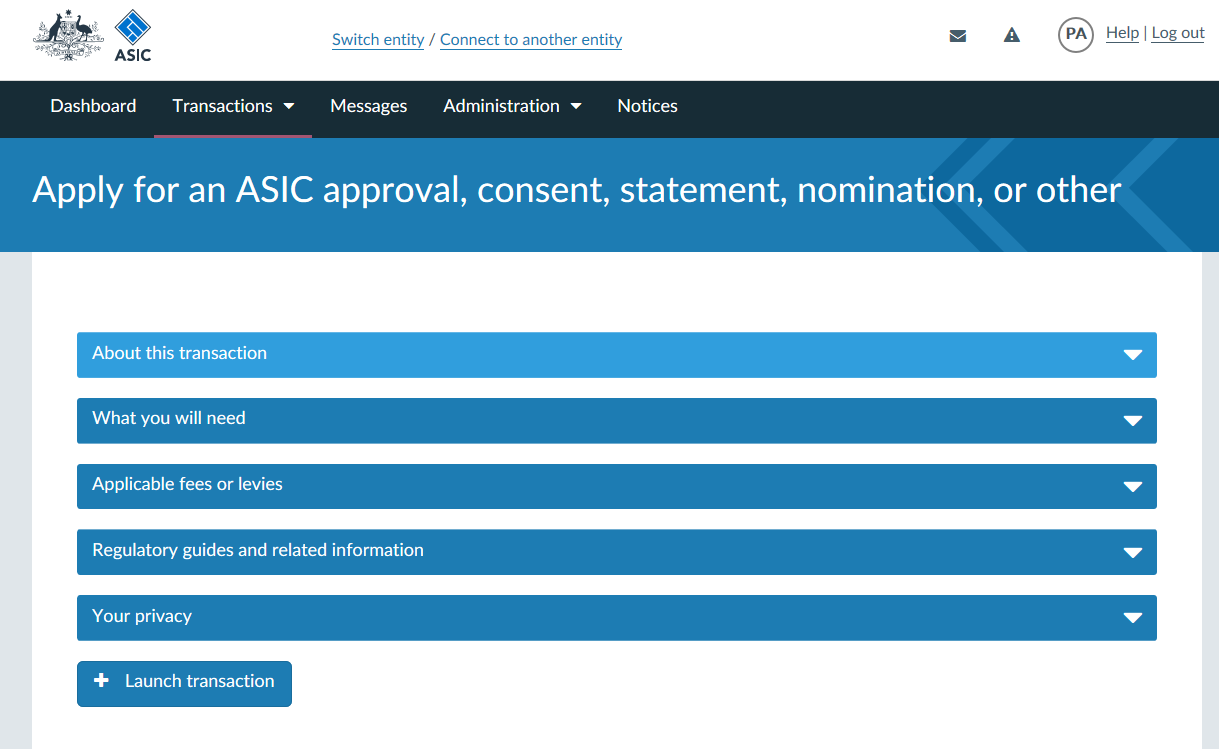

About the transaction

Key information is displayed on a landing page before you begin a transaction – this includes a summary of what you will need on hand to complete it. It also includes:

- Legislative references

- Documents you may need to attach to the transaction

- Applicable fees or levies

- Links to regulatory guides and related information.

- Privacy information.

Restricting access to transactions

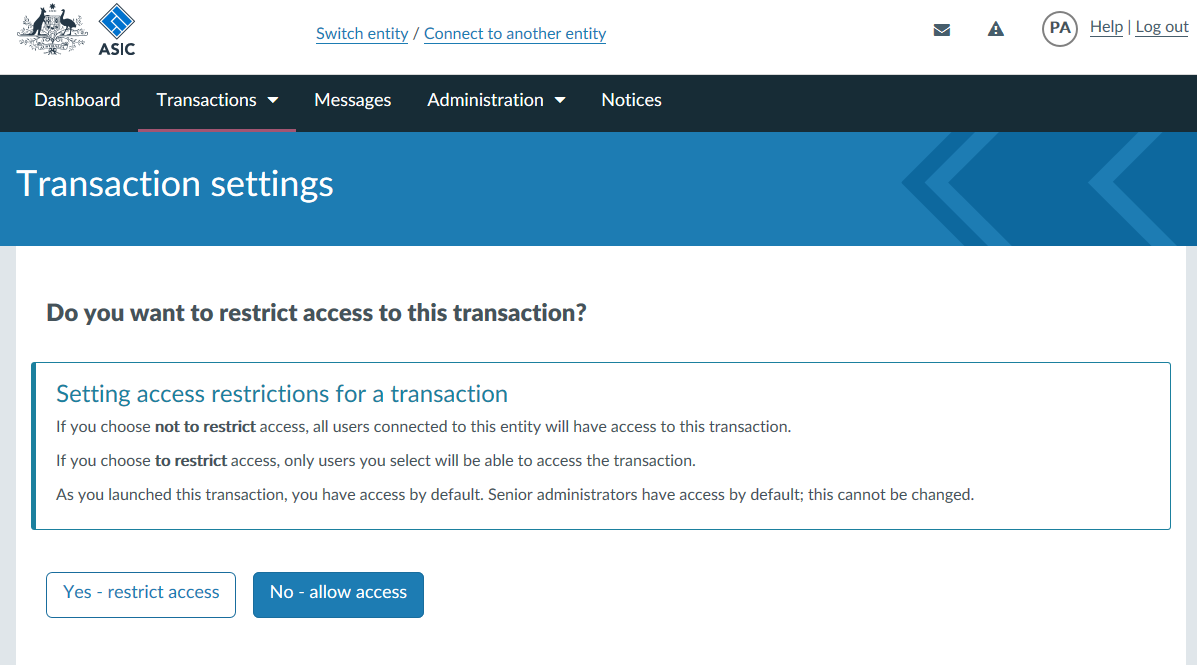

When you launch a transaction in the portal you will first be asked if you want to restrict access to it on the transaction settings page.

To restrict access, click Yes – restrict access. This will take you to a set restrictions page, which allows you to select users who can access the transaction.

If you choose not to restrict access, all users connected to the account will have access to the transaction. If you choose to restrict access, only users you select will be able to access the transaction.

Once you have set these restrictions, you can add or remove users later.

For more information on restricting access to transaction see the Forms and transactions section on the FAQ page. For more information on how to invite someone to connect to your account and user access levels, see the Administration section on the FAQ page.

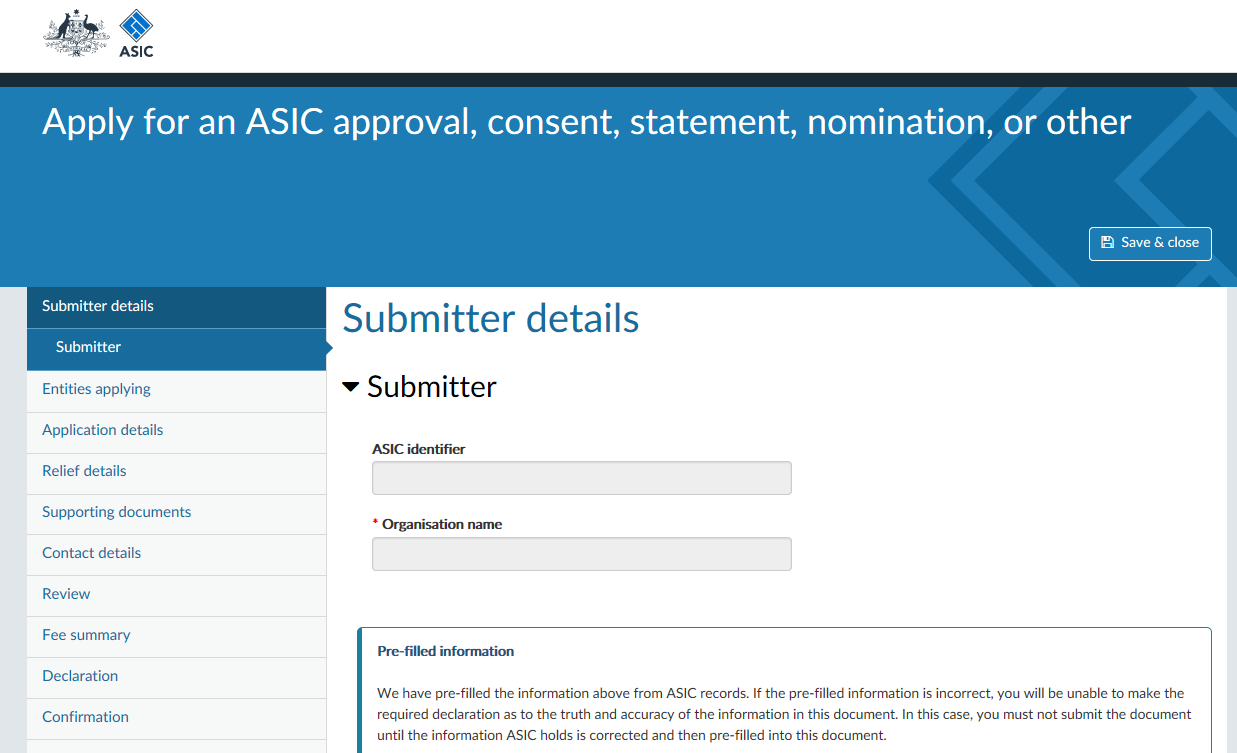

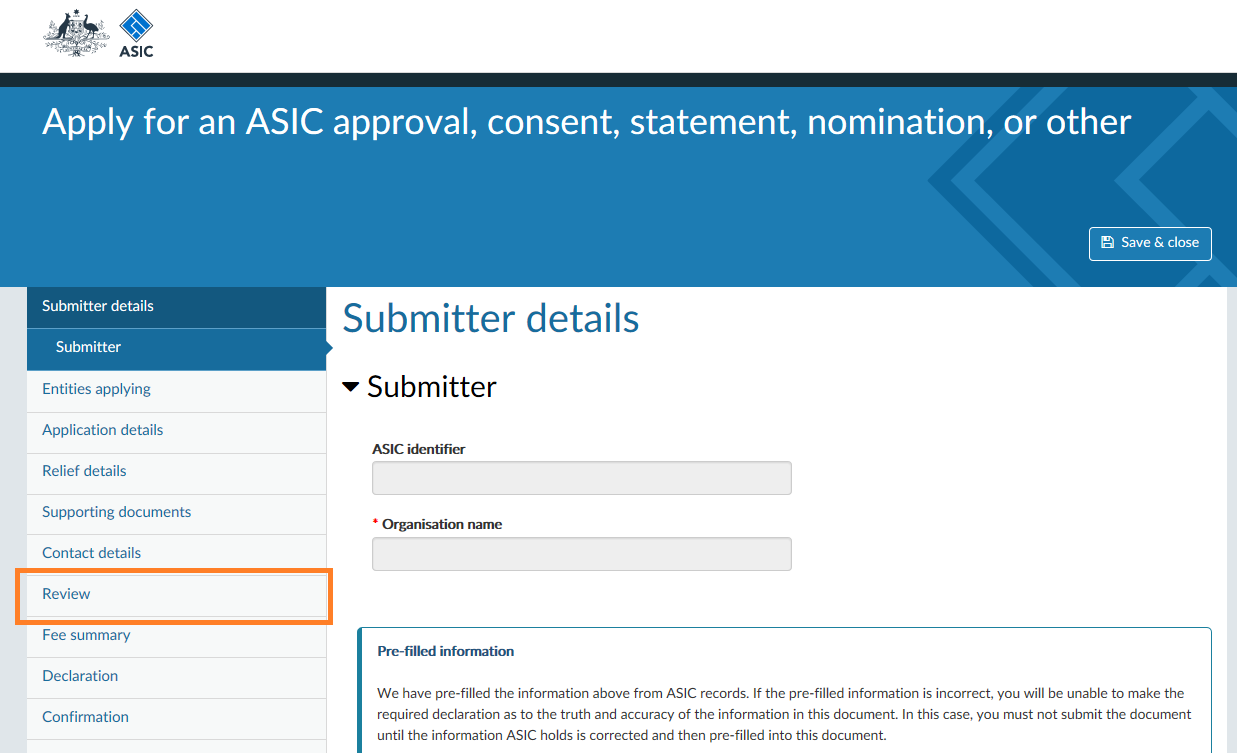

Sections

Transactions in the portal have sections. The total number of sections you need to complete will depend on each transaction and your specific circumstances. You will need to complete the sections of the transaction sequentially. The example shown below is from the Apply for an ASIC approval, consent, statement, nomination, or other transaction.

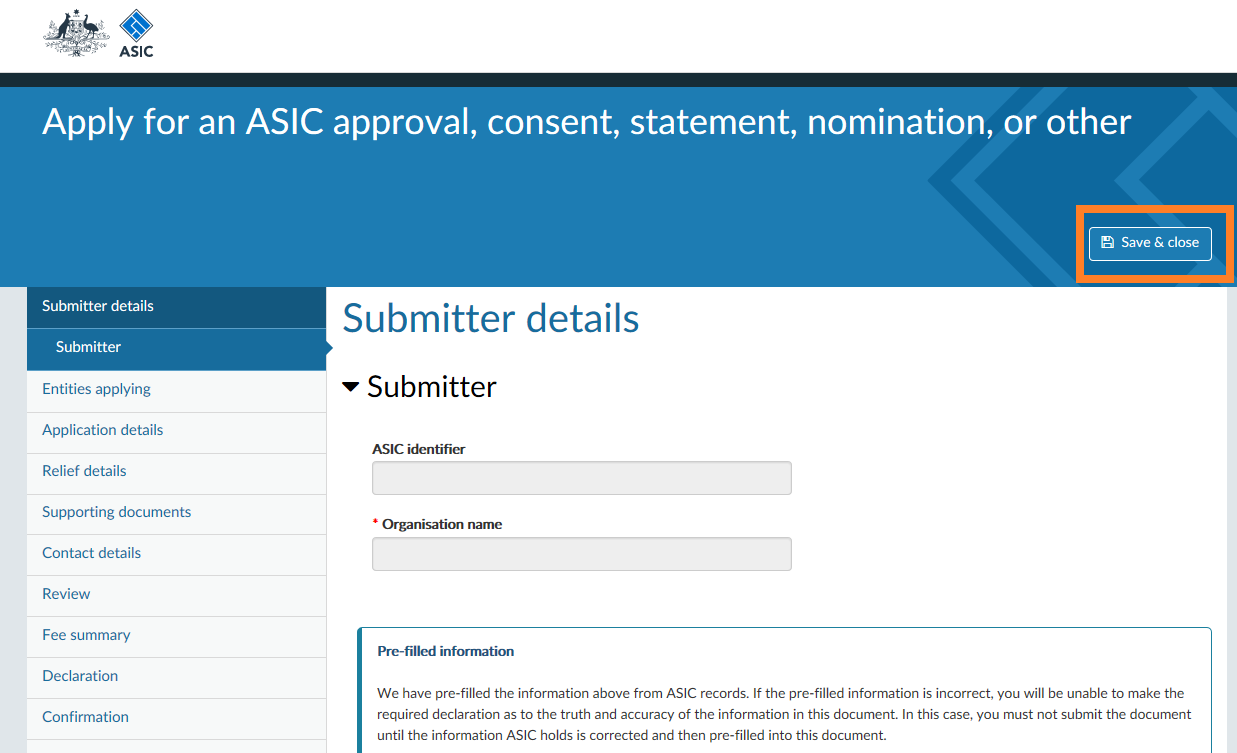

Save a draft, come back later

If you do not have the required information at hand, you can save the transaction as a draft and return later to complete it.

Multiple people can contribute to the draft, provided they have been given access to edit the transaction.

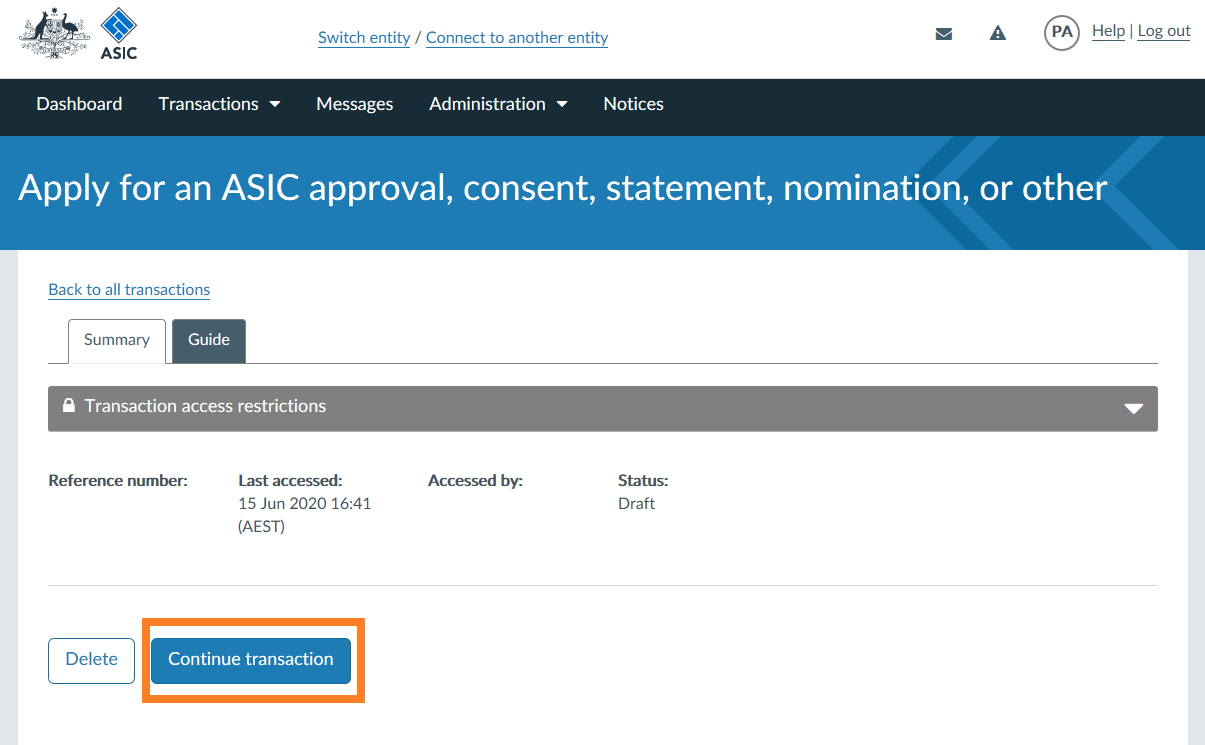

You can access your drafts from the ‘View all transactions’ page in the portal – where you can then click on an individual transaction. This will take you to a detailed view for that transaction. From here you can continue with the transaction by selecting the ‘Continue transaction’ button.

For more information on providing access to a transaction see the Forms and transactions section on the FAQ page. For more information on how to invite someone to connect to your account, see the Administration section on the FAQ page.

Reviewing a transaction

Once you have entered draft information and navigated through the form, a ‘review’ page will appear (also indicated in the left-hand navigation), towards the end of the transaction.

This page will summarise all the information you have entered so far in the transaction for review.

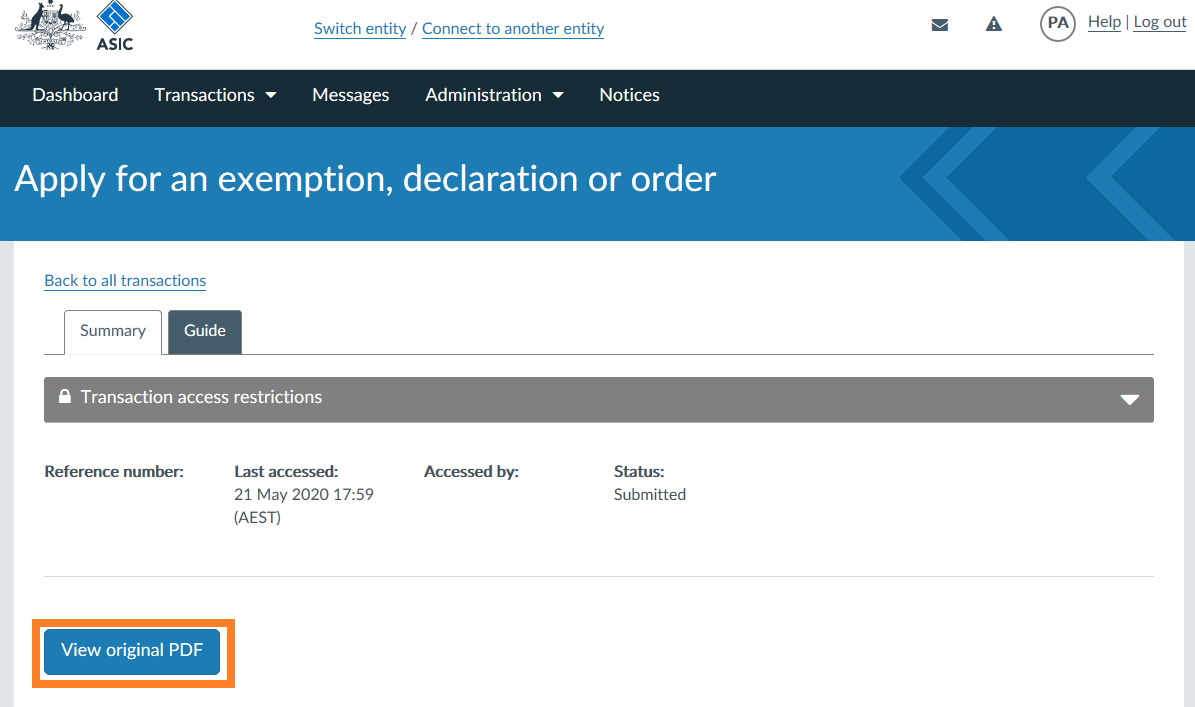

Download a PDF version

Transactions that have been submitted via the portal can also be viewed or downloaded in PDF format at any time. Note that if you choose to print out a transaction from the portal, all possible questions will be printed.

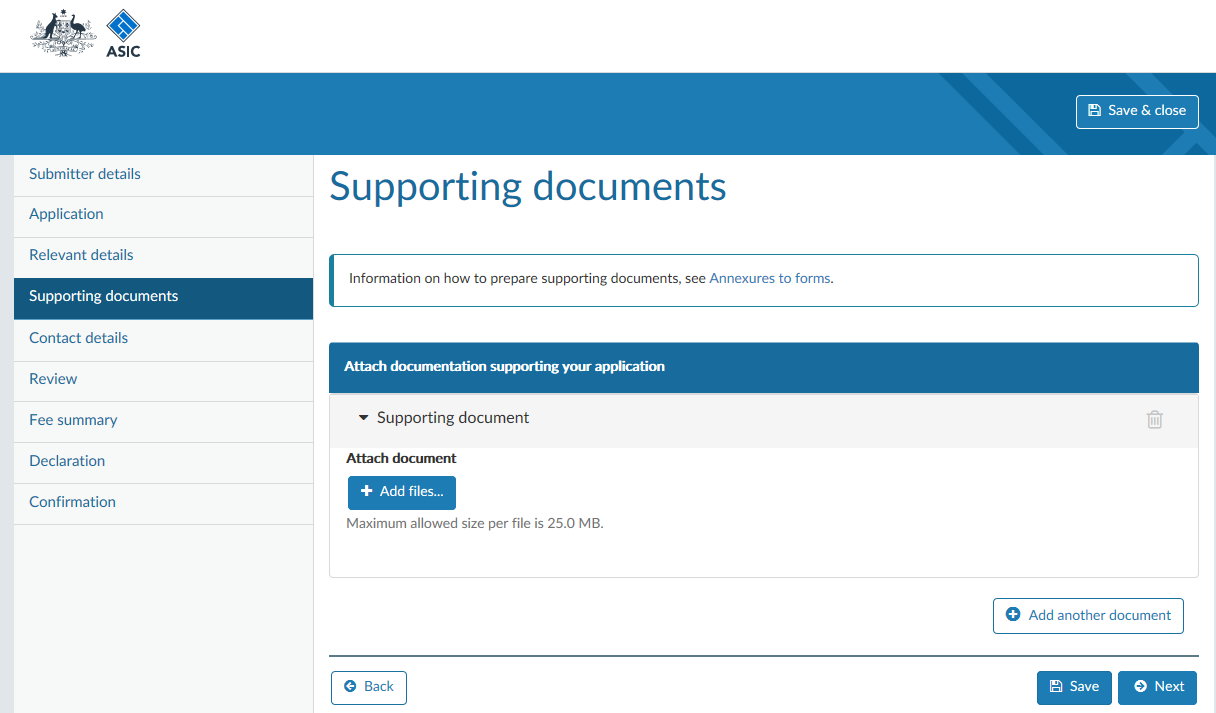

Attaching supporting documentation

You can attach document as required as part of the transaction.

Messaging ASIC about transactions

You can correspond with ASIC about transactions via the portal’s Message feature. This will keep a history of the correspondence regarding a specific transaction. You can attach files as part of this feature. The Messages, notifications and Official notices section on the portal FAQ page has more detail on how to use this feature.

About specific transaction types

Find instructions for specific transactions within the Regulatory portal.

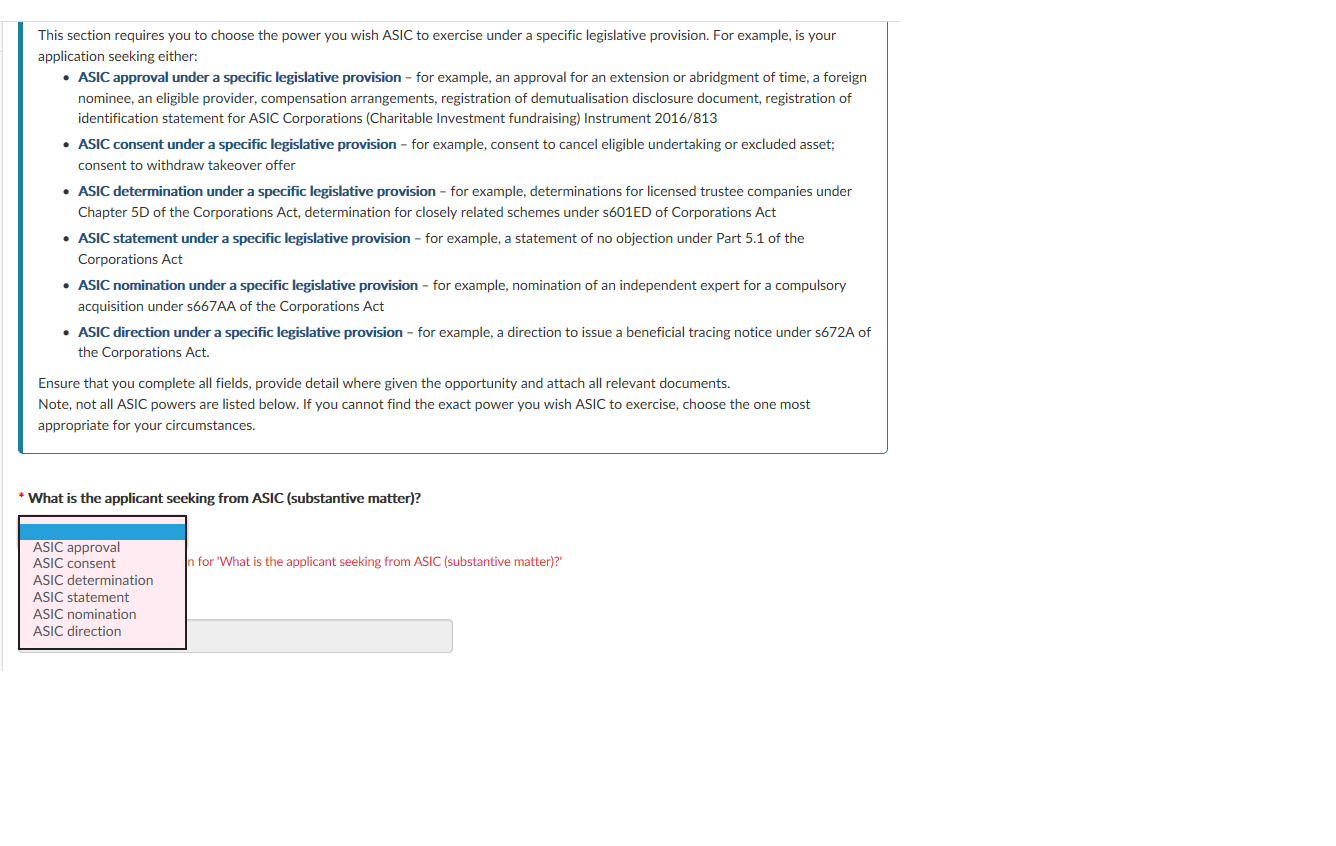

Apply for an ASIC approval, consent, statement, nomination, or other

This transaction is for an entity or person to apply for ASIC approval, consent, determination, direction, statement or nomination under a specific legislative provision. In the transaction we will ask you to:

- provide details of all entities applying

- provide details of any managed investment scheme(s) or Australian or foreign passport fund(s) related to the application

- identify any third parties whose interests would be adversely affected by the granting of the ASIC approval, consent, determination, direction, statement or nomination

- indicate the market sensitivity of the application

- indicate the urgency of the application

- provide details of why you are applying for ASIC to exercise the specific power, and

- if required, attach supporting documents for the application.

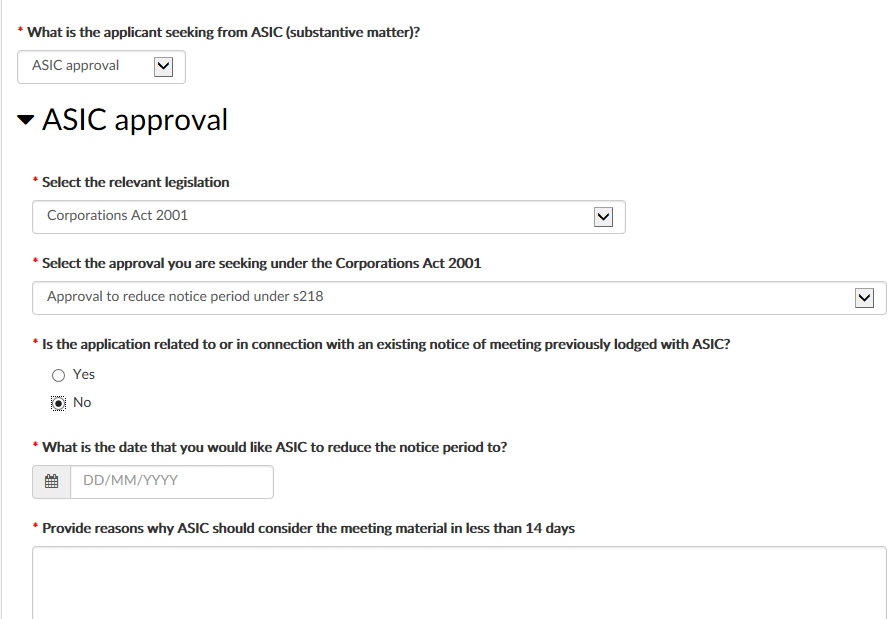

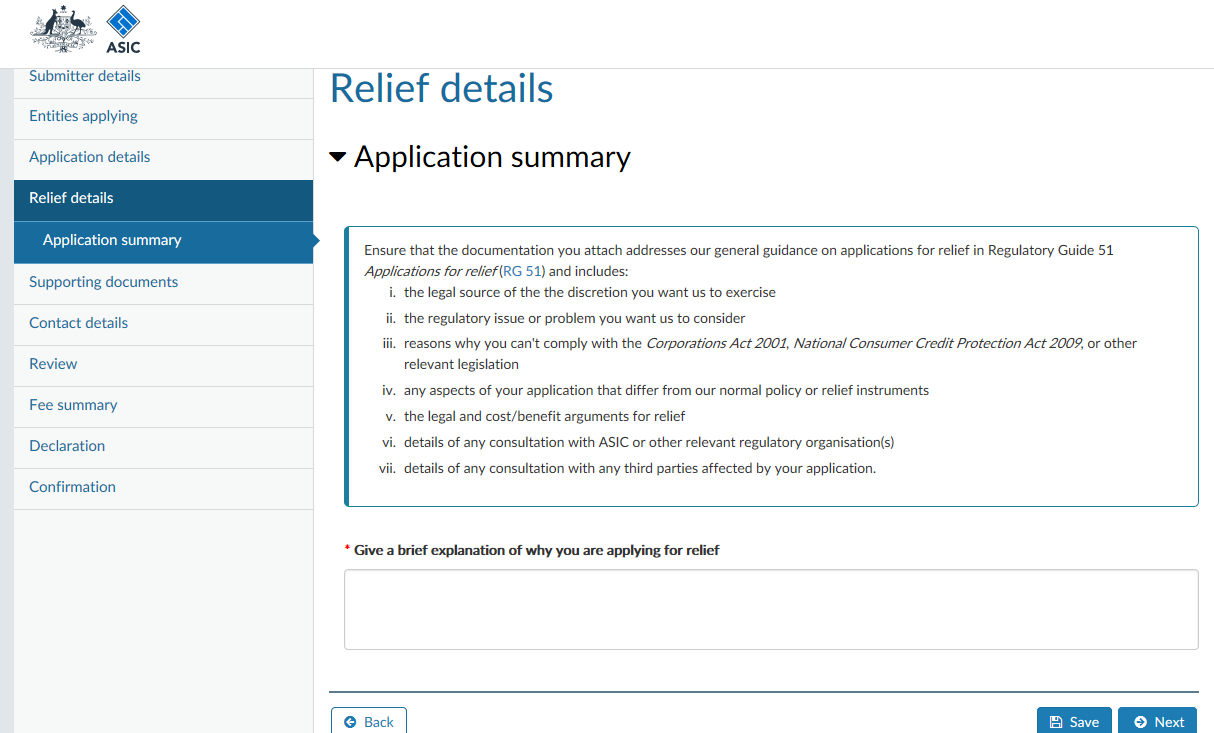

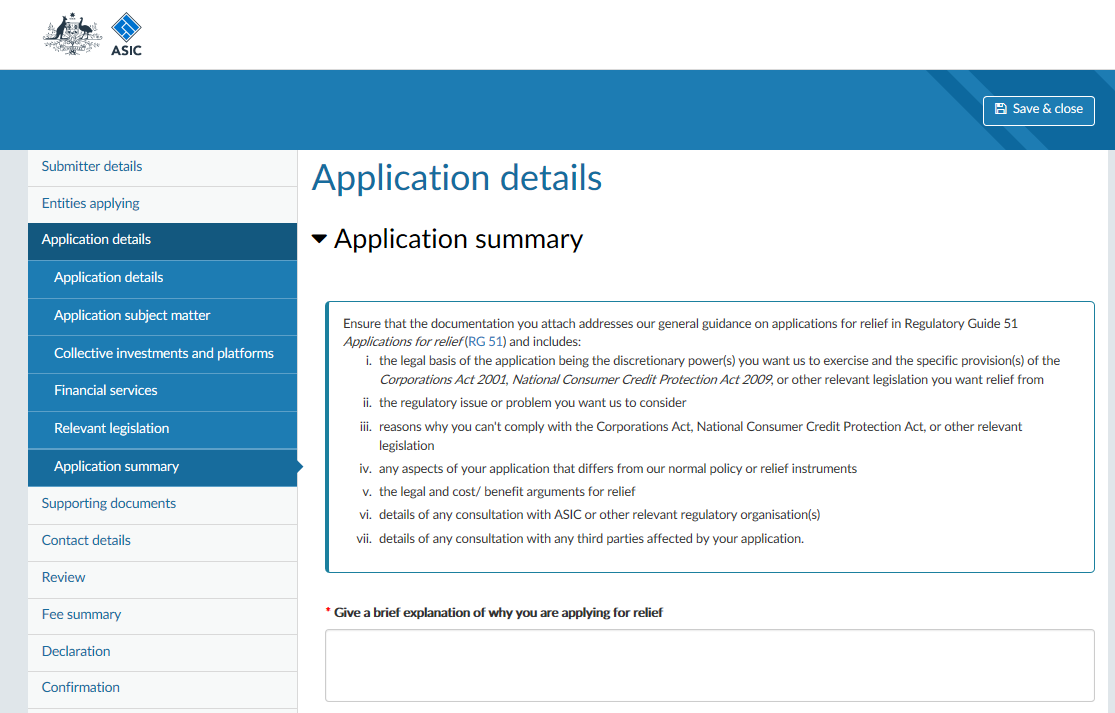

Shown below are some of the questions and some of the functionality you can expect from this transaction in the portal. This overview does not show every aspect of the transaction.

Choose the power you wish ASIC to exercise from a pick list.

The options will vary after you select what the applicant is seeking from ASIC (substantive matter). The example below is when ‘approval’ is selected.

There is a free text field where you will add a brief explanation of why you are applying for relief.

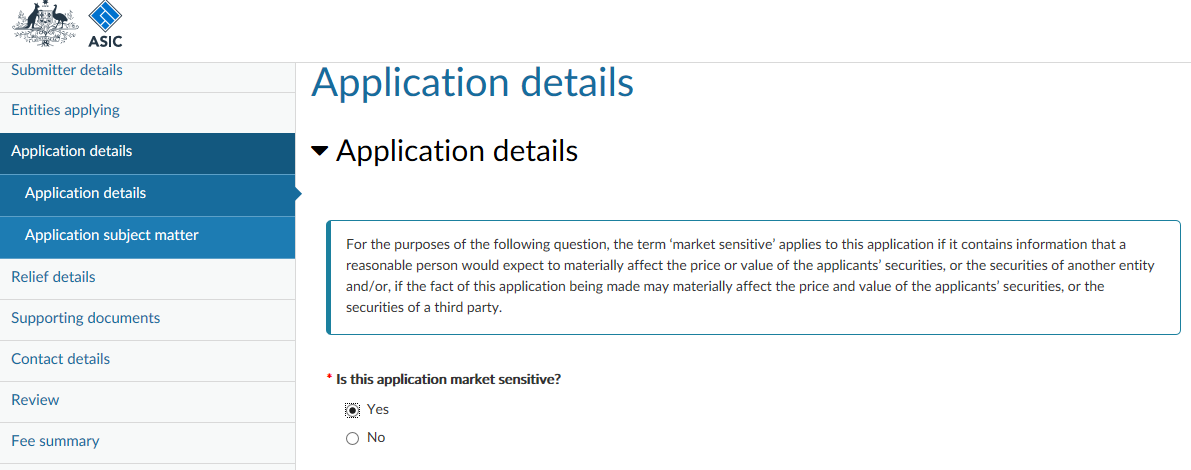

Apply for a waiver from ASIC market integrity rules

This transaction is for a market participant or market licensee to apply for a waiver from ASIC market integrity rules. We recommend that applicants discuss the nature of the waiver they are seeking with their relevant ASIC Intermediary Supervisor, before they complete the application. In the transaction we will ask you to:

- provide details of all entities applying for a waiver

- provide details of any third parties whose interests would be adversely affected by the granting of a waiver

- indicate the market sensitivity of the application

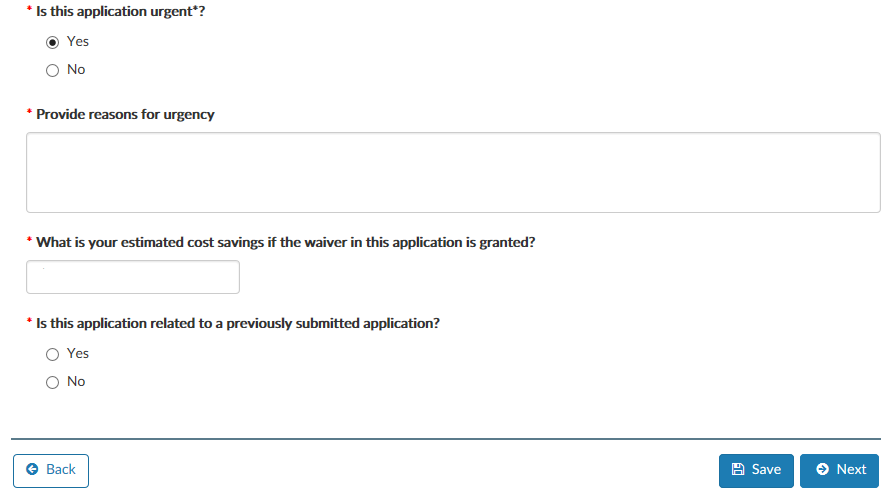

- indicate the urgency of the application, including start date of the waiver and duration

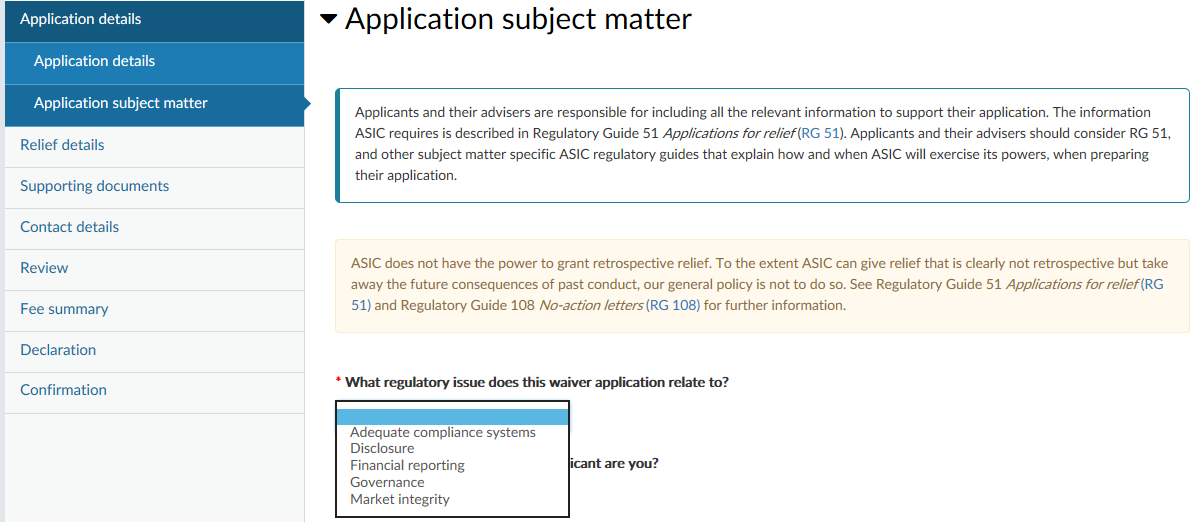

- indicate the regulatory issue the waiver application relates to

- indicate the specific market integrity rule for which the waiver is sought – you can select multiple market integrity rules

- provide details of why you are applying for a waiver, and

- attach, if required, any supporting documents for the application.

Shown below are some of the questions and some of the functionality you can expect from this transaction in the portal. This overview does not show every aspect of the transaction.

Early in the transaction, there are questions relating to market sensitivity, urgency, and estimated savings if the waiver is granted.

You can then choose the related regulatory issue from a pick list.

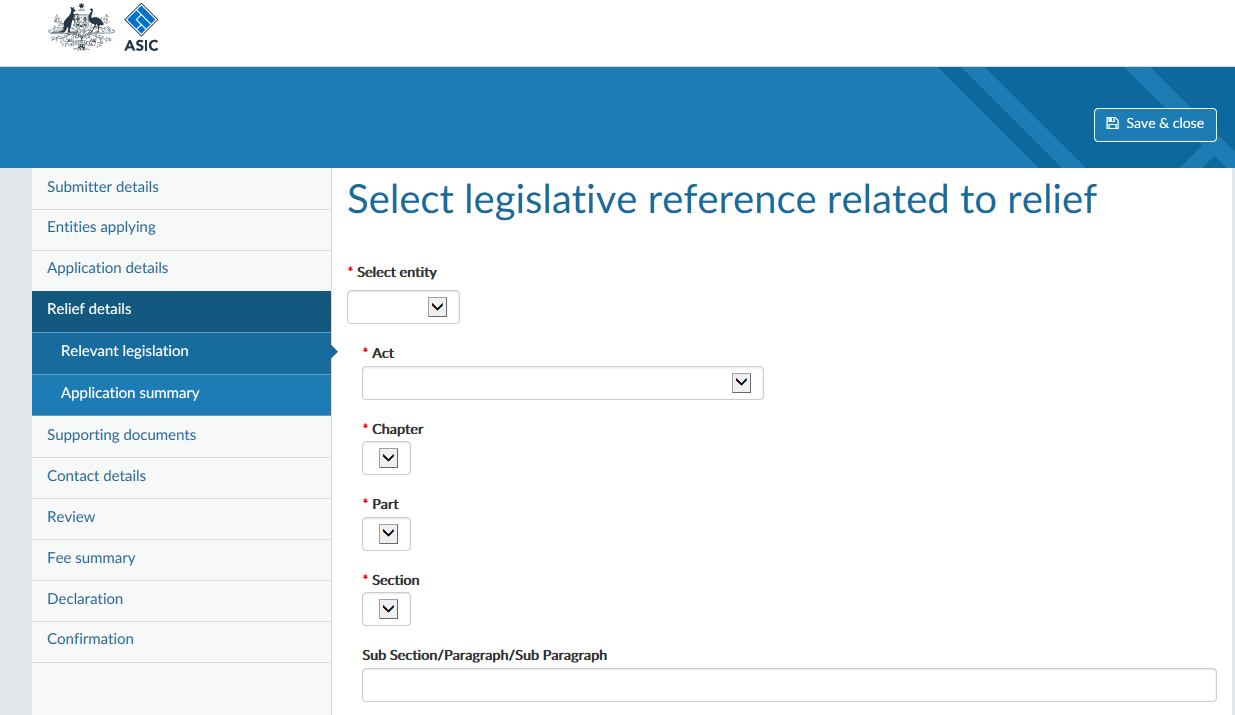

You can select legislative references related to the waiver application from pick lists. The options are automatically updated depending on the selections you make. You can add multiple references to legislation in your application.

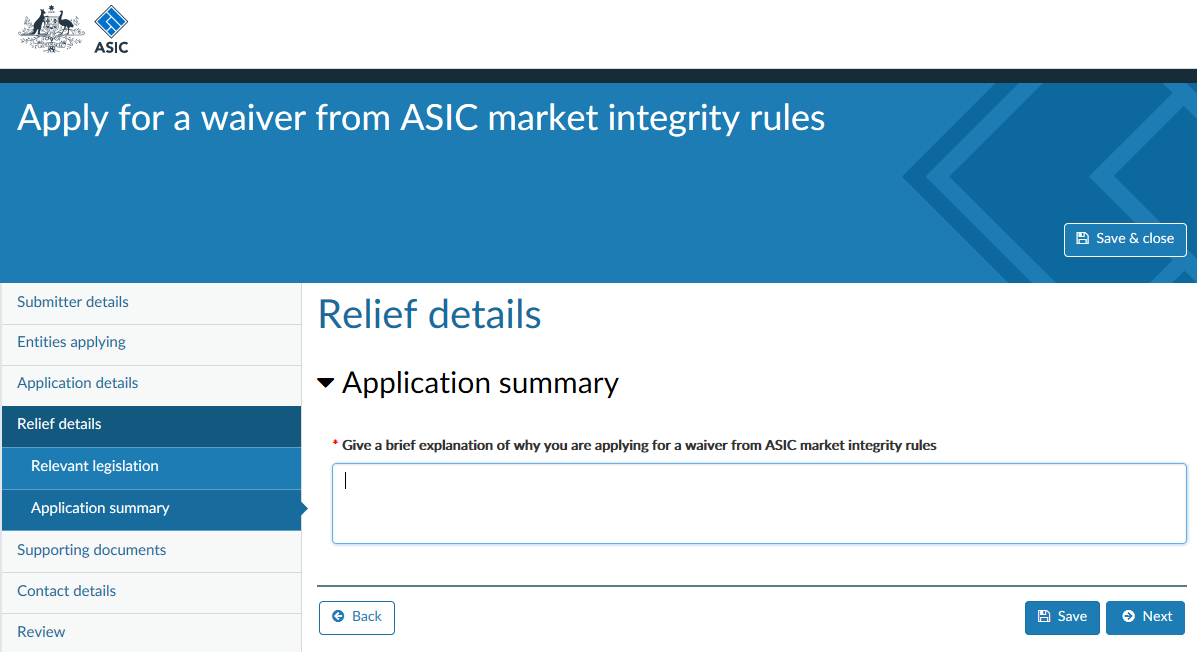

There is a free text field where you will add a brief explanation of why you are applying for a waiver from ASIC market integrity rules.

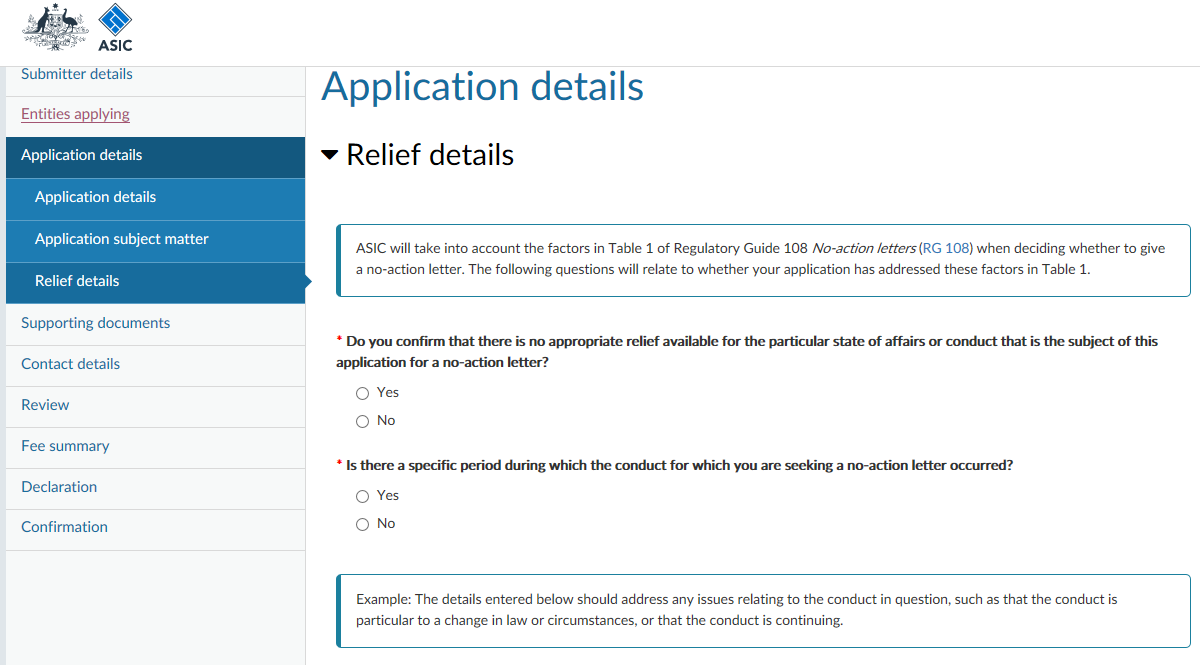

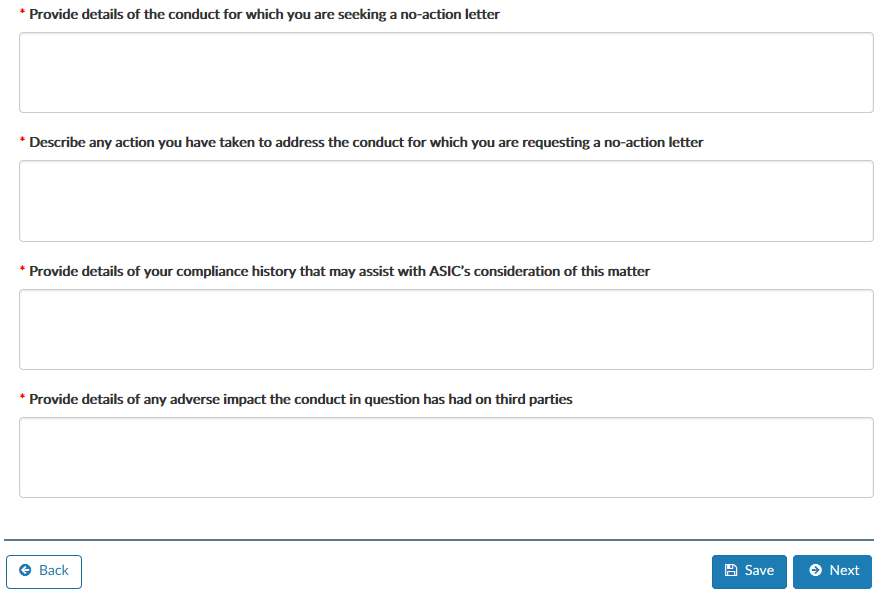

Apply for a no-action letter

This transaction is for an entity or person to apply for a no-action letter from ASIC. A no-action letter states that we do not intend to take regulatory action over a particular state of affairs or particular conduct. In the transaction we will ask you to:

- provide details of all entities (including a natural person) applying for a no-action letter

- provide details of any third parties whose interests would be adversely affected by the granting of a no-action letter

- indicate the market sensitivity of the application

- indicate the urgency of the application

- indicate the regulatory subject area of your application (substantive matter) – you can add multiple subject areas

- indicate the regulatory issue(s) the application relates to.

Shown below are some of the questions and some of the functionality you can expect from this transaction in the portal. This overview does not show every aspect of the transaction.

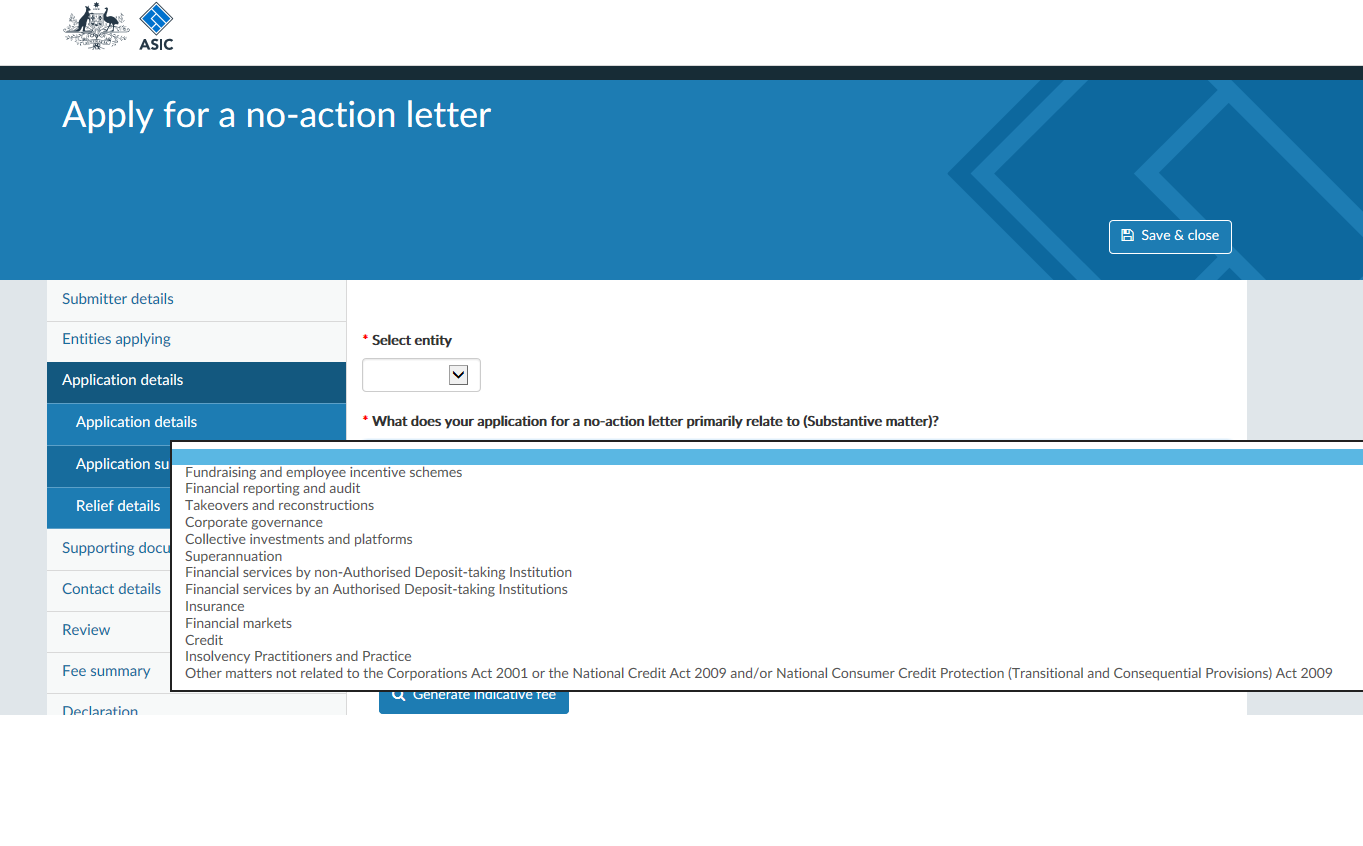

You will be asked to select what the application primarily relates to from a pick list.

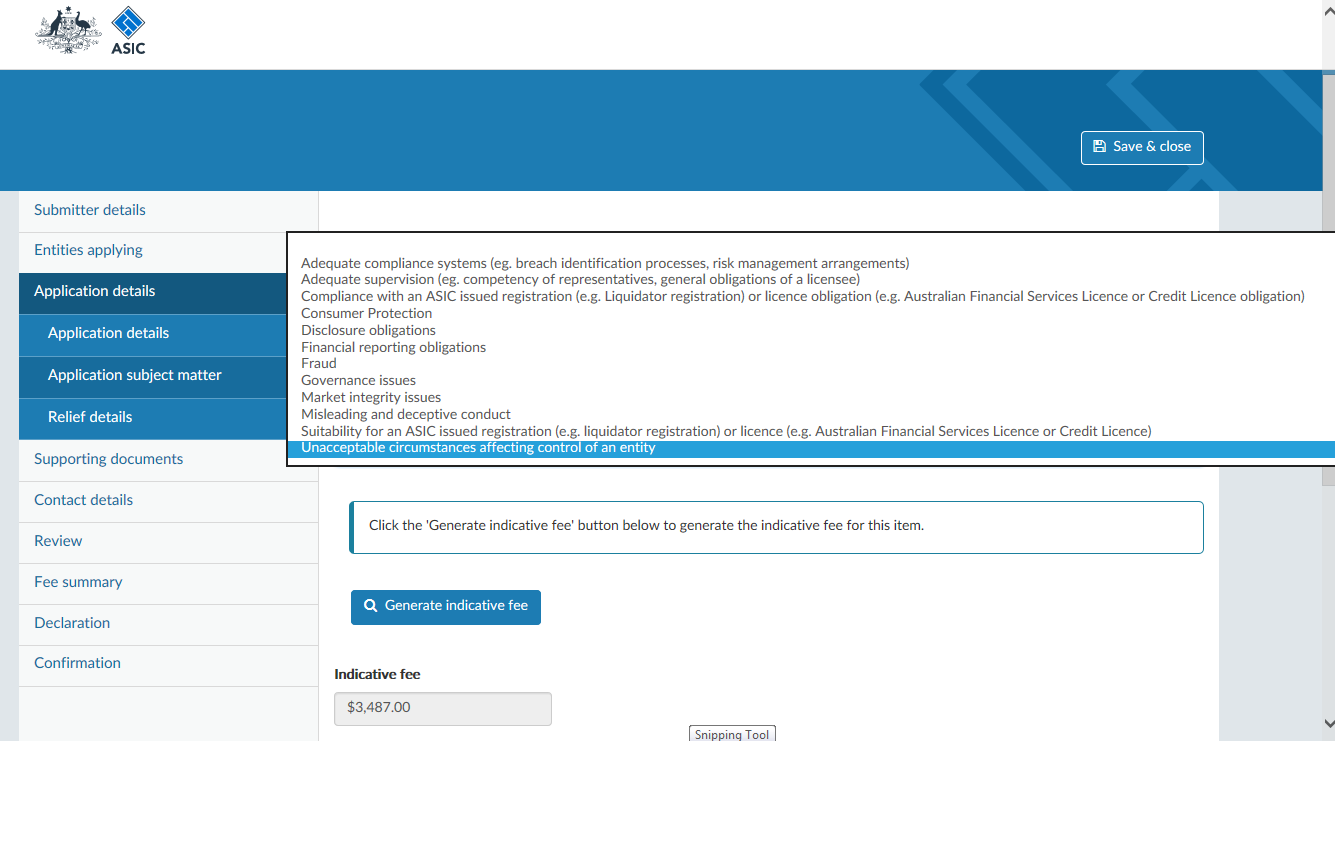

Similarly, you will also select the regulatory issue the application relates from a pick list.

There are questions that relate to whether your application has addressed the factors in Table 1 of Regulatory Guide 108 No-action letters (RG 108).

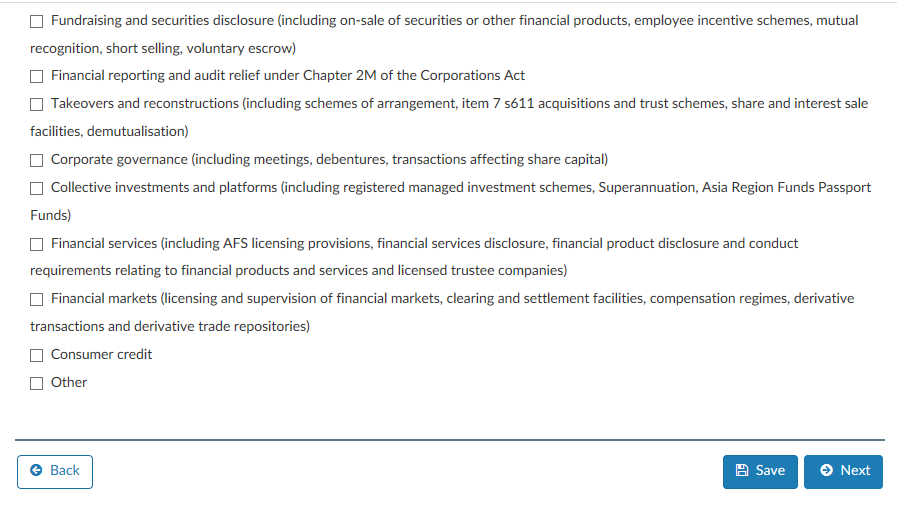

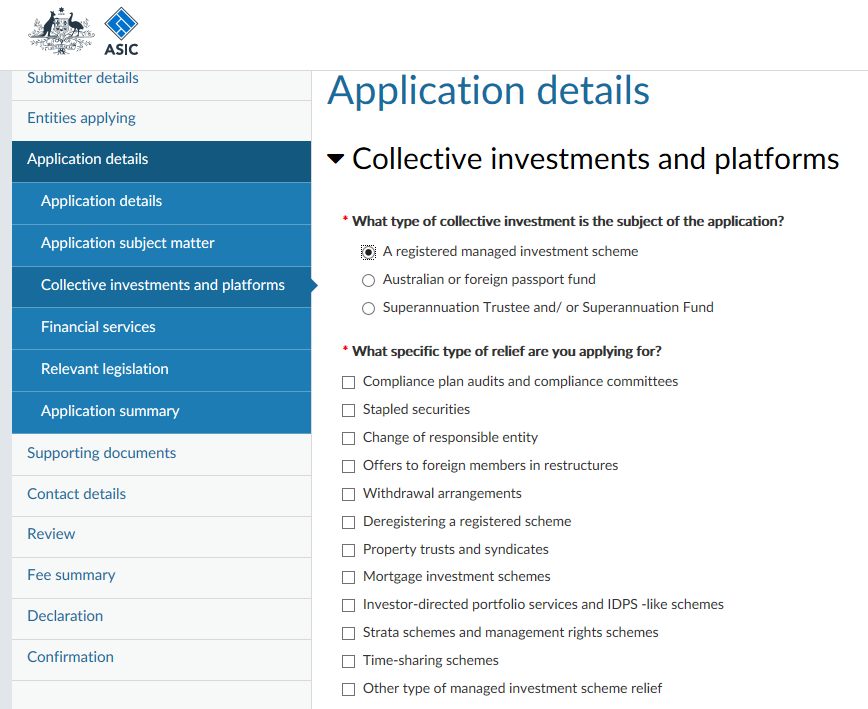

Apply for an exemption, declaration or order

This transaction is for an entity or person to apply for an exemption, declaration or order under a specific legislative provision. In this transaction we will ask you to:

- provide details of all entities applying

- provide details of any managed investment scheme(s) or Australian or foreign passport fund(s) related to the application

- identify any third parties whose interests would be adversely affected by the granting of an exemption, declaration or order

- indicate the market sensitivity of the application

- indicate the urgency of the application

- provide details of why you are applying for ASIC to exercise the specific power, and

- attach, if required, any supporting documents for the application.

Shown below are some of the questions and some of the functionality you can expect from this transaction in the portal. This overview does not show every aspect of the transaction.

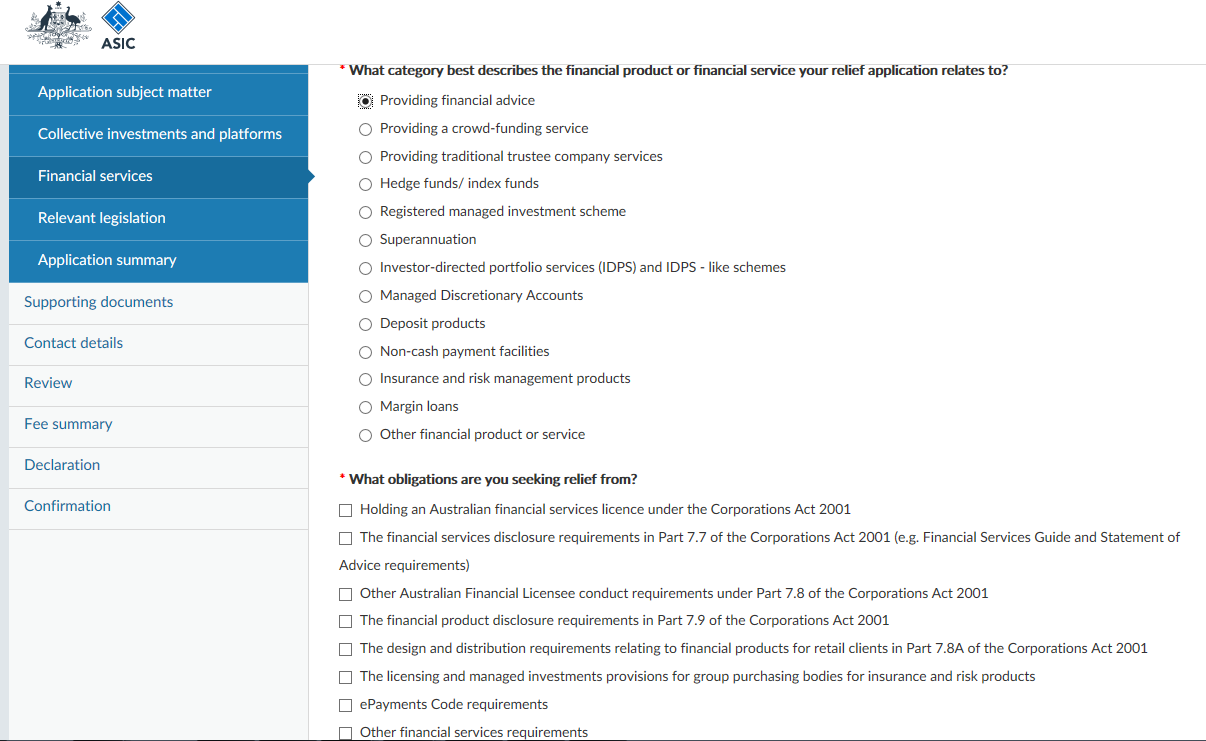

Using check boxes, you can select all subject matter(s) that relate to your application for relief.

You will select the type of collective investment that is the subject of the application. Options will then appear related to the specific relief sought depending on your selection.

Choose from a list of options the category that best describes the financial product or financial service your relief application relates to.

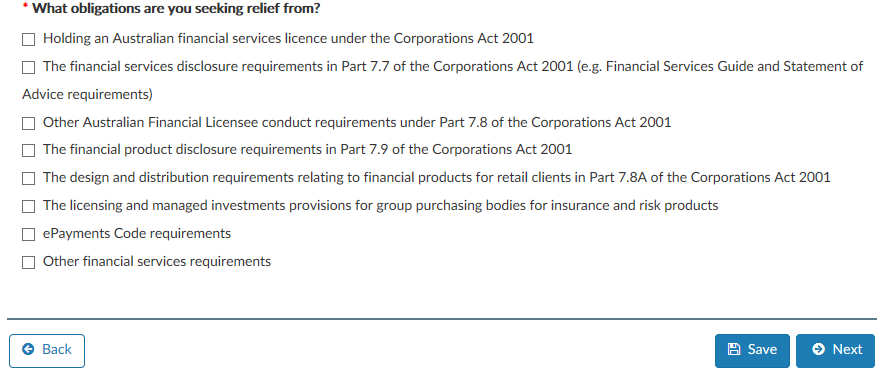

What obligations are you seeking relief from?

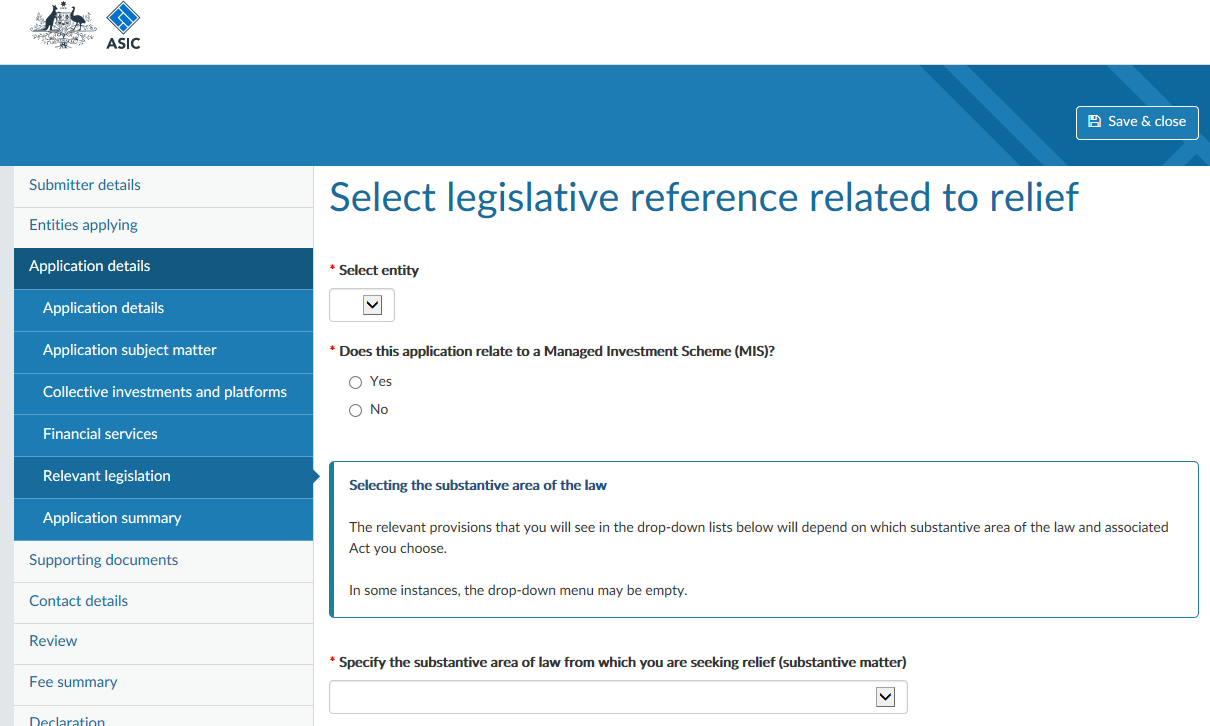

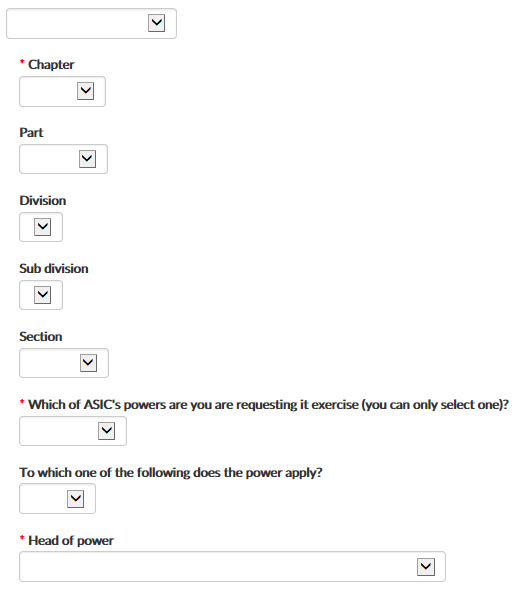

From a pick list, you will select the substantive area of law, relevant legislation and head of power in relation to your application. You can add multiple.

Different options will appear based on which substantive area of the law and relevant legislation you select.

There is a free text field where you will add a brief explanation of why you are applying for relief.

Extension of time for a company to hold its annual general meeting (AGM)

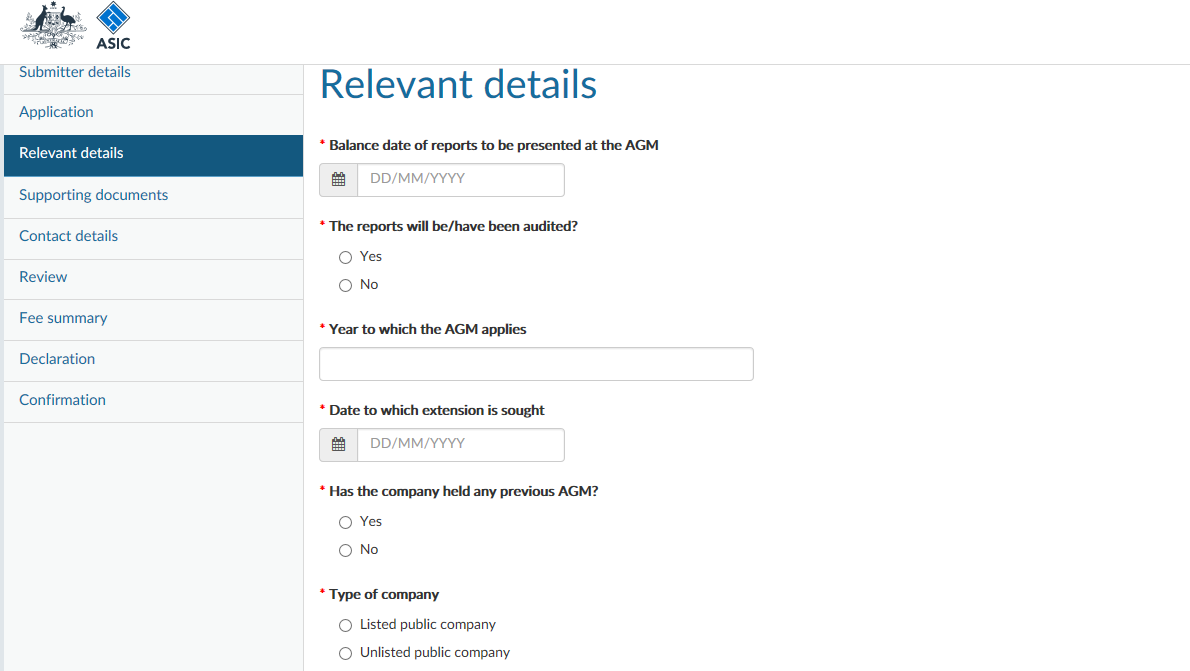

Only the company director can submit this application to ASIC. In the transaction we will ask you to specify whether the application relates to:

- an extension of time to hold the AGM in a calendar year other than the one required by section 250N, or

- an extension of time to extend the period within which the company may hold its AGM to a date later in the calendar year in which the AGM would otherwise have been due.

We will also ask you to:

- specify whether the company is a listed or unlisted public company

- the name of ultimate holding company (if any)

- to specify the balance date of reports to be presented at the AGM

- whether the reports will be/have been audited and the name of auditor

- to specify the year to which the AGM applies

- to specify the date to which extension is sought

- if the company held any previous AGM – if not, then date of registration

- provide reasons why an extension of time is required.

Shown below are some of the questions and some of the functionality you can expect from this transaction in the portal. This overview does not show every aspect of the transaction.

You will be prompted to provide details including the balance date of reports to be presented at the AGM, year to which the AGM applies, date to which extension is sought, and type of company.

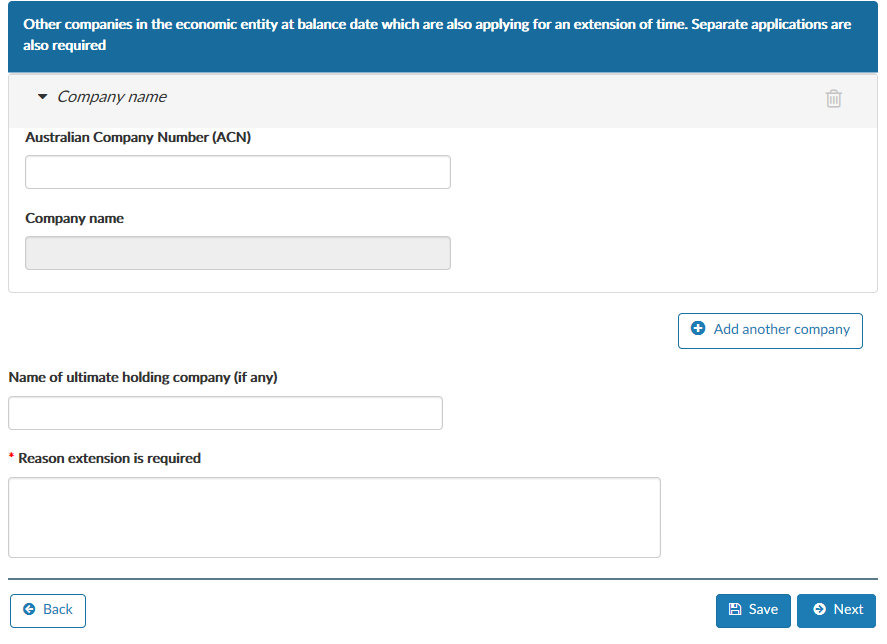

There is also a section where you will provide details of other companies in the economic entity at balance date which are also applying for an extension of time. A reason for the extension is required.

The transaction allows you to easily attach supporting documents.

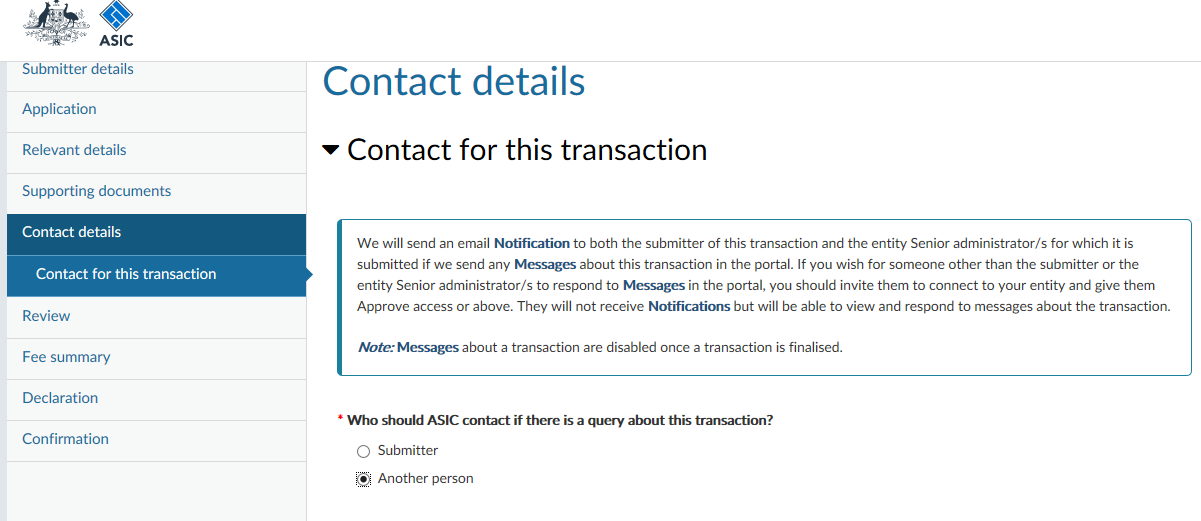

Provide a contact for the application – ether you as the submitter or someone else.