This is Information Sheet 251 (INFO 251). It is for trustees of unregistered managed investment schemes (unregistered schemes) that issue, vary or dispose of interests in unregistered schemes that are financial products.

Important

This information sheet is under revision following the appeal decision in ASIC v BPS Financial Pty Ltd [2025] FCAFC 74. ASIC will be updating the information sheet in early 2026.

It outlines:

- the Australian financial services (AFS) licensing requirements that apply to a trustee of an unregistered scheme that issues, varies or disposes of interests in unregistered schemes that are financial products

- limits in the scope of the following two exemptions from the AFS licensing requirements:

This information sheet does not cover AFS licensing requirements for other financial services provided by trustees.

Note

The decision in ASIC v BPS Financial Pty Ltd [2024] FCA 457 is relevant to this information sheet. The decision confirmed that, to rely on the intermediary authorisation exemption under section 911A(2)(b), the product provider must be a separate person from the person making the offers.

The decision also addressed the question of whether BPS Financial Pty Ltd was entitled to rely on the authorised representative exemption under section 911A(2)(a). ASIC has appealed part of the judgment in this matter in relation to the operation of the authorised representative exemption under section 911A(2)(a): see Editor’s Note 2 in Media Release (MR 24-090) ASIC wins first court outcome regarding a non-cash payment facility involving crypto assets (3 May 2024). In our appeal, ASIC has not challenged the court’s findings in relation to the intermediary authorisation exemption.

AFS licensing requirements

A trustee that issues, varies or disposes of interests in an unregistered scheme must generally hold an AFS licence authorising it to deal in a financial product by issuing, varying or disposing of interests in a managed investment scheme.

In certain circumstances, a trustee may rely on exemptions from the requirement to hold an AFS licence. Exemptions from the requirement to hold an AFS licence include:

- the exemption in section 911A(2)(a) of the Corporations Act 2001 (Corporations Act) as it applies to authorised representatives (authorised representative exemption)

- the exemption in section 911A(2)(b) of the Corporations Act (intermediary authorisation exemption).

A trustee of an unregistered scheme who relies on the intermediary authorisation exemption cannot also be an authorised representative in relation to making offers to arrange to issue, vary or dispose of a financial product under an arrangement for that unregistered scheme.

Authorised representative exemption

Scope of the exemption

The authorised representative exemption is a limited exemption from the requirement to hold an AFS licence. If a person provides a financial service in Australia as an authorised representative of another person (a principal), the person must be authorised under section 916A of the Corporations Act to provide the financial service by a principal that has an AFS licence covering that particular financial service.

In order to determine whether a person can rely on the authorised representative exemption, the test is whether the person is acting as a principal or as a representative of a principal. The exemption applies only if the person is acting as a representative of a principal.

For more information on whether a person is acting as a principal or a representative, see Regulatory Guide 36 Licensing: Financial product advice and dealing (RG 36).

When to rely on the exemption

As an authorised representative of an AFS licensee, the trustee of an unregistered scheme can only rely on the authorised representative exemption if it provides a financial service on behalf of the AFS licensee.

However, the trustee cannot rely on this exemption to avoid the requirement to hold an AFS licence to issue, vary or dispose of an interest in an unregistered scheme for which it is the trustee. The action of issuing, varying or disposing of an interest in a scheme as a trustee is, by its nature, the action of a principal.

Intermediary authorisation exemption

Scope of the exemption

The intermediary authorisation exemption from the requirement to hold an AFS licence to issue, vary or dispose of a financial product including interests in an unregistered scheme may also only be relied on in limited circumstances. This exemption applies where:

- a product provider has an intermediary authorisation arrangement in place with an AFS licensee

- the AFS licensee or its authorised representative (if that person is not the product provider (e.g. not a trustee of an unregistered scheme)) makes an offer to arrange to issue, vary or dispose of the financial product

- the product provider issues, varies or disposes of the financial product if the offer is accepted

- the offer under which the issue, variation or disposal is made, is covered by the licence of the AFS licensee.

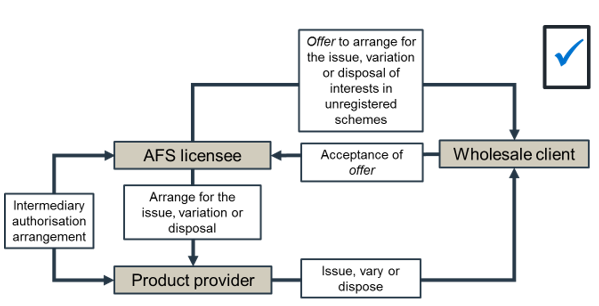

Example where an AFS licensee makes an offer

Figure 1 illustrates the case where the trustee of an unregistered scheme, as a product provider, can rely on the intermediary authorisation exemption to issue, vary or dispose of interests in an unregistered scheme for which it is the trustee. In this case, it is the AFS licensee that makes the offer to arrange for the issue, variation or disposal of interests in the unregistered scheme. The trustee issues, varies or disposes of the interest as the product provider.

Figure 1: AFS licensee offers to arrange for the issue, variation or disposal of the financial product

Note: See the paragraph above for a description of this figure (accessible version).

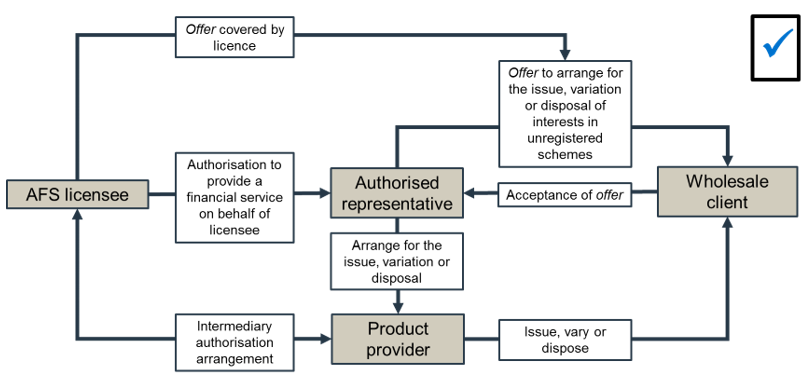

Example where an authorised representative makes an offer

Figure 2 illustrates the case where the trustee of an unregistered scheme, as a product provider, can rely on the intermediary authorisation exemption. In this case, an authorised representative of the AFS licensee (that is not the trustee) makes the offer to arrange for the issue, variation or disposal of interests in the unregistered scheme. These offers are made on behalf of the AFS licensee.

Figure 2: Authorised representative offers to arrange for the issue, variation or disposal of the financial product

Note: See the paragraph above for a description of this figure (accessible version).

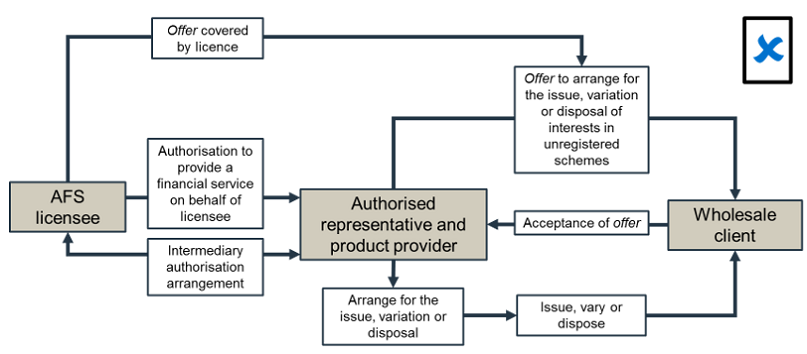

Example where an offer cannot be made

Figure 3 illustrates the case where the trustee of an unregistered scheme cannot rely on the intermediary authorisation exemption to make offers.

Where the intermediary authorisation exemption is relied on by the trustee, as a product provider without its own licence, to issue, vary or dispose of interests in an unregistered scheme, the trustee cannot also make the offer to arrange for the issue, variation or disposal of those interests. This means that, under the intermediary authorisation exemption, the trustee as a product provider cannot also be the authorised representative.

Figure 3: An unlicensed product provider cannot offer to arrange to issue, vary or dispose of the financial product

Note: See the paragraph above for a description of this figure (accessible version).

Where can I get more information?

- AFS Licensing Kit

- RG 1 Applying for and varying an AFS licence

- RG 36 Licensing: Financial product advice and dealing

You can also contact us.

Important notice

Please note that this information sheet is a summary giving you basic information about a particular topic. It does not cover the whole of the relevant law regarding that topic, and it is not a substitute for professional advice. We encourage you to seek your own professional advice to find out how the applicable laws apply to you, as it is your responsibility to determine your obligations.

You should also note that because this information sheet avoids legal language wherever possible, it might include some generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases, your particular circumstances must be taken into account when determining how the law applies to you.