How authorised deposit-taking institutions lodge unclaimed money returns

An unclaimed money return is where an entity provides to ASIC unclaimed money in accordance with the law. All authorised deposit-taking institutions (ADIs) must submit an annual unclaimed money return to ASIC by 31 March each year containing the unclaimed money as at 31 December of the previous year (section 69 of the Banking Act 1959 (Banking Act)).

ADIs include banks, building societies and credit unions. For a complete list of ADIs go to the APRA website.

Find your lost money

Use Moneysmart's Unclaimed money search

This page contains:

- What is unclaimed money for ADIs?

- How an ADI lodges a return

- Lodging a nil return

- Contact us

- More information

What is unclaimed money for ADIs?

Section 69 of the Banking Act identifies unclaimed money as all principal, interest, dividends, bonuses, profits and sums of money legally payable by the ADI, but where the time limit for commencing proceedings for recovery of these funds has expired. This includes dormant accounts where there has been no deposit or withdrawal by the owner of the account for seven years.

However, this does not include:

- unclaimed money held in retirement savings accounts (within the meaning of the Retirement Savings Accounts Act 1997)

- money in an account that is denominated in a currency other than Australian currency

- money in a children’s account

- farm management deposits (within the meaning of the Income Tax Assessment Act 1997)

- term deposits

- money held in an account with the ADI in respect of which the holder of the account, or an agent of the holder, has notified the ADI, between the end of the year and the day the statement is delivered to the Treasurer, that the holder wishes to treat the account as active.

Amounts of unclaimed money less than $500 cannot be sent to ASIC by an ADI (see the Banking (Unclaimed Money) Regulation 2016).

For more information on the requirements and exemptions see section 69 of the Banking Act and related regulations.

How an ADI lodges a return

Each year by 31 March ADIs must lodge a return with ASIC providing the unclaimed money held by the ADI as at 31 December of the previous year.

As an ADI, you can lodge your return by:

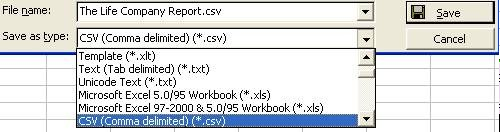

- completing a CSV return form

- lodging the CSV return form by email, and

- making payment to ASIC of the unclaimed money.

Lodging a nil return

If you have no unclaimed money as at 31 December of the previous year, as an ADI you must still lodge a return by 31 March. You can lodge a nil return by email.

Lodging nil return

Your email should use this wording:

To: unclaimed.lodging@asic.gov.au

Subject: ADI unclaimed money nil return for <insert your company>

<Your ADI name>

<Year of Return>

I refer to our annual unclaimed money return. This is to confirm that we have no money to be provided to ASIC as unclaimed money.

<Name of person submitting the email>

<Position of person>

<Contact phone number>

Contact us

Contact the Unclaimed Money Unit:

By phone: 1300 300 630

By email: unclaimed.lodging@asic.gov.au

Postal address:

Unclaimed Money Unit

Australian Securities and Investments Commission

GPO Box 9827

Melbourne VIC 3001