An unclaimed money return is where an entity provides to ASIC unclaimed money in accordance with the law. All life insurance companies and benefit fund friendly societies (life company/friendly society) must submit an annual unclaimed money return to ASIC by 31 March each year containing the unclaimed money as at 31 December of the previous year (section 216 of the Life Insurance Act 1995 (Life Insurance Act)).

This page contains:

What is unclaimed money for life companies/friendly societies?

Section 216 of the Life Insurance Act identifies unclaimed money as all sums of money that have become legally payable by a life company/friendly society in respect of policies, but where the time limit for commencing proceedings for recovery of these funds has expired. This includes money payable on the maturity of a policy which has not been claimed in seven years after the maturity date and any money that the life company/friendly society considers should be treated as unclaimed money.

However, this does not include unclaimed money held in retirement savings accounts (within the meaning of the Retirement Savings Accounts Act 1997).

How a life company/friendly society lodges a return

Each year by 31 March life companies/friendly societies must lodge a return with ASIC providing the unclaimed money held by them as at 31 December of the previous year.

As a life company/friendly society, you can lodge your return by:

- completing a CSV return form

- lodging the CSV return form, and

- making payment to ASIC of the unclaimed money.

CSV return form

A CSV return form is an Excel spreadsheet and contains:

Header record: Where the life company’s/friendly society’s information is entered (row 1)

Detail record/s: Where the unclaimed money record is entered (rows 2, 3, etc)

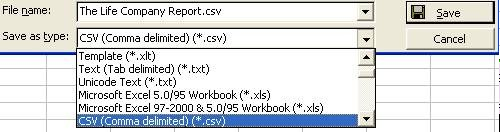

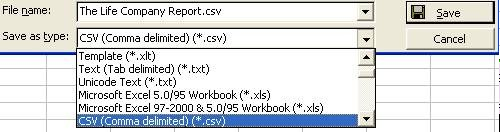

To make an Excel spreadsheet into a CSV return form you will need to save it as a comma delimited file format (.csv). To do this, use ‘save as’ to change the spreadsheet type to .csv.

The CSV return form has a specific format that must be complied with for ASIC’s system to receive and process the return. Our downloadable guide to the CSV return form includes the information to be included and the required format.

Download the Guide to the Life Insurance Act CSV returns form (PDF)

It is advisable to check that your CSV return form has:

- a Header record

- correct totals in the Header record

- the full name and last known address of the owner of the policy and of the life insured by the policy (‘unknown’ addresses may be rejected)

- the amount due for each Detail record

- the policy number

- the date the policy became due (should be more than seven years ago for unclaimed policy money)

- the state where the policy was registered.

The detailed information you provide ensures that accurate and sufficiently complete unclaimed money details can be made available to the public and claimants identified. This information can be searched on our consumer website Moneysmart.

Lodging the CSV return form

Once you have completed your CSV return form you can lodge it by email.

Your email should use this wording:

To: unclaimed.lodging@asic.gov.au

Subject: Life company/Friendly society unclaimed money return for <insert your company>

<Your life company/friendly society name>

<Year of Return>

I refer to our annual unclaimed money return. Please find attached our CSV return form containing details of unclaimed money.

I certify that all entries for unclaimed money from matured policies have been unclaimed for seven years after the maturity date of the policy.

I confirm that we are unable to locate an address for any records listed with an ‘unknown’ address because <if applicable, provide details>.

I certify that the attached CSV return form is true and correct.

<Name of person submitting the email>

<Position of person>

<Contact phone number>

Lodging your CSV return form by email assists ASIC in processing the return as quickly as possible.

As a life company/friendly society, if you have internal privacy or security policies which would prevent you making your return by email with an attached CSV claim form, please send an email to unclaimed.lodging@asic.gov.au outlining:

- details as to why you can’t use the email process; and

- what alternative you propose so that the information can be provided to ASIC electronically, but complying with your security/privacy policy.

We will consider these issues on a case-by-case basis.

Making payment to ASIC of unclaimed money

You will receive email confirmation that your CSV return form has been accepted and details of how you can make payment will be provided.

If the payment of the unclaimed money is not received by ASIC within 5 business days of ASIC’s email your return may be rejected.

Lodging a nil return

If you have no unclaimed money as at 31 December of the previous year, as a life company/friendly society you must still lodge a return by 31 March.

Lodging a nil return

You can lodge a nil return by using this email.

Your email should use this wording:

To: unclaimed.lodging@asic.gov.au

Subject: Life company/Friendly society unclaimed money nil return for <insert your company>

<Your life company/friendly society name>

<Year of Return>

I refer to our annual unclaimed money return. This is to confirm that we have no money to be provided to ASIC as unclaimed money.

<Name of person submitting the email>

<Position of person>

<Contact phone number>

Contact us

Contact the Unclaimed Money Unit:

by phone: 1300 300 630

by email: unclaimed.lodging@asic.gov.au

Postal address:

Unclaimed Money Unit

Australian Securities & Investments Commission

GPO Box 9827

Melbourne VIC 3001

More information