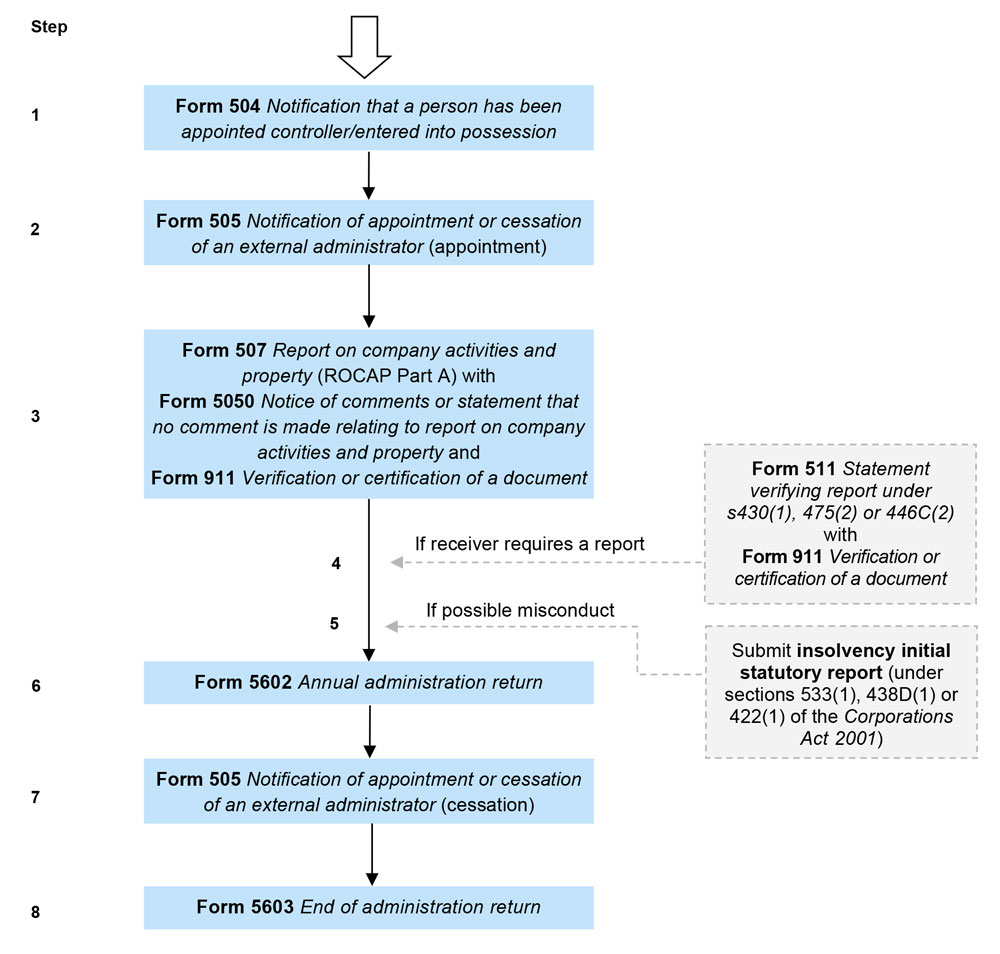

Flowchart 8: Receiver

This flowchart and the explanatory text should be read with Information Sheet 29 External administration, controller appointments and schemes of arrangement: Most commonly lodged forms (INFO 29).

Unless otherwise permitted by the Corporations Act, a person must not act as a receiver unless they are a registered liquidator: section 418(1)(d).

Flowchart 8: Receiver

Explanation of Flowchart 8: Receiver[1]

| Step | Form or notice | Notes |

|

1 |

Form 504 |

Legislation: section 427(1). Form 504 is an ASIC-approved form. Requirement: Lodgement is mandatory. Tick-a-box choice (Details of company in receivership): ‘This notice is being given by the person who obtained an order for the appointment of, or who appointed, the receiver or receiver and manager under s427(1)’. Lodgement: The person appointing or obtaining the order for the appointment of a receiver must lodge within 7 days after appointment. Company status:[2] If this is the first external administrator or controller appointed to the company, the company status will change from REGD to EXAD after processing of the first of either Form 504 or Form 505 (Step 2) and will create a new appointment for the receiver. |

|

2 |

Form 505 |

Legislation: section 427(2). Form 505 is an ASIC-approved form. Requirement: Lodgement is mandatory. Tick-a-box choice (Details of appointment): ‘Receiver of the property described in the schedule of property to this form’. Tick a box choice (Method of appointment): ‘Appointment by instrument’ or ‘Appointment by court order’. Lodgement: The receiver must lodge within 14 days after appointment. Online lodgement is preferred. Company status: If this is the first external administrator or controller appointed to the company, the company status will change from REGD to EXAD after processing of the first of either Form 504 (Step 1) or Form 505 and will create a new appointment for the receiver. |

|

3 |

Form 507 |

Legislation: section 429(2)(c)(i). Form 507 is an ASIC-approved form. Requirement: Lodgement is mandatory. Tick-a-box choice (Reason for report): ‘Appointment of controller – s429(2)(b)’. Lodgement: The receiver must lodge within 1 month after receipt of the report. Online lodgement is preferred. Note 1: Where the only property is scheme property of a registered scheme, different requirements apply: section 429A. Note 2: If an extension is granted, the receiver must lodge a Form 555 Notice of controller extending time to submit report on company activities and property: section 429(4). |

|

with … |

Form 5050 |

Legislation: section 429(2)(c)(i). ASIC has applied the number ‘5050’ to lodgement of the required information for administrative purposes (i.e. there is no actual Form 5050). Requirement: Lodgement is mandatory. Lodgement: The receiver must lodge within 1 month after receipt of the report. Online lodgement is preferred. |

|

and … |

Form 911 |

Legislation: regulations 1.0.16 and 5.2.02. Form 911 is prescribed by the Corporations Regulations. Requirement: Lodgement is mandatory. Lodgement: The receiver must lodge within 1 month after receipt of the report. When lodging online, Form 911 is a certification, not a separate form. Online lodgement is preferred. |

|

4 |

Receiver requires a report Form 511 |

Legislation: section 430(1) and regulation 1.0.03B. Form 511 is an ASIC-approved form. Requirement: Lodgement is mandatory, contingent on the circumstances arising (if the receiver ordered and received a report from others). Tick-a-box choice (Purpose for lodgement of copy of Form 511): ‘Controller, under reg 1.0.03B, (a report prepared under s430(1))’. Attachment: A copy of the report received under section 430(1). Lodgement: The receiver must lodge within 7 days after receipt of the report from the other person. Online lodgement is preferred. |

|

with … |

Form 911 |

Legislation: regulation 1.0.16. Form 911 is prescribed by the Corporations Regulations. Requirement: Lodgement is mandatory, contingent on the circumstances arising (if the receiver has ordered and received a report from others). Lodgement: The receiver must lodge within 7 days after receipt of the report from the other person. When lodging online, Form 911 is a certification, not a separate form. Online lodgement is preferred. |

|

5 |

Section 422 report required for possible misconduct Submit insolvency initial statutory report (under sections 533(1), 438D(1) or 422(1) of the Corporations Act 2001) |

Legislation: section 422. Requirement: Lodgement is mandatory, contingent on the circumstances arising (if it appears to the receiver that a relevant person may have committed an offence in relation to the company, been negligent, or otherwise engaged in misconduct). Tick-a-box choice (Under what provision are you lodging this report): ‘Section 422 (receiver reports)’. Lodgement: The receiver must lodge as soon as practicable after forming an opinion. Online lodgement via the ASIC Regulatory Portal is preferred. Note 1: A freeform written report can be lodged to comply with section 422, but submitting an insolvency initial statutory report is preferred. Note 2: See Regulatory Guide 16 External administrators: Reporting and lodging (RG 16) for more details. |

|

6 |

Form 5602 |

Legislation: section 422A(3). Form 5602 is an ASIC-approved form. Requirement: Lodgement is mandatory. Lodgement: The receiver must lodge within 3 months after the end of the ‘control return year’, which is the period of 12 months beginning on the day of appointment and each subsequent period of 12 months. Online lodgement as structured data is required. Note: See the additional guidance to INFO 29 for information on lodging Form 5602 where a replacement receiver is appointed. |

|

7 |

Form 505 |

Legislation: section 427(4). Form 505 is an ASIC-approved form. Requirement: Lodgement is mandatory. Tick-a-box choice (Ceasing, resignation or removal): ‘Cease’ (or ‘Cessation of receiver’ on paper form). Lodgement: The receiver must lodge within 7 days after cessation. Online lodgement is preferred. Company status: If this is the only external administrator or controller appointed to the company, the company status will change from EXAD to REGD after this form is processed. |

|

8 |

Form 5603 |

Legislation: section 422B(2). Form 5603 is an ASIC-approved form. Requirement: Lodgement is mandatory. Lodgement: The receiver must lodge within 1 month after the control of the property of the corporation ends. The receiver must also give notice to the members, the creditors, the corporation or the external administrator (if appointed) that a return has been lodged, if requested to do so in writing: section 422B(4). Online lodgement as structured data is required. |

More information

For more information on external administration, visit asic.gov.au/insolvency or contact ASIC on 1300 300 630 or online at asic.gov.au/question.

More flowcharts for form lodgements

- Flowchart 1: Liquidator in a members’ voluntary winding up

- Flowchart 2: Liquidator in a creditors’ voluntary winding up

- Flowchart 2A: Liquidator in a creditors’ voluntary winding up (simplified liquidation process)

- Flowchart 3: Liquidator in a court-ordered winding up

- Flowchart 4: Liquidator in a provisional liquidation

- Flowchart 5: Administrator in a voluntary administration

- Flowchart 6: Administrator in a deed of company arrangement (DOCA)

- Flowchart 7: Voluntary administration or DOCA to a creditors’ voluntary winding up

- Flowchart 9: Receiver and manager

- Flowchart 10: Controller (other than a receiver, receiver and manager, or managing controller)

- Flowchart 11: Managing controller (other than a receiver and manager)

- Flowchart 12: Pooling

- Flowchart 13: Scheme of arrangement or reconstruction

- Flowchart 14: Restructuring practitioner of a company

- Flowchart 15: Restructuring practitioner of a restructuring plan for a company

[1] Types of forms: Information is lodged with, and received by, ASIC for recording on the company register as ‘forms’. Forms fall into one of the following categories:

- a prescribed form, which is a form prescribed in Schedule 2 to the Corporations Regulations, or

- an ASIC-approved form, which is a form that is not prescribed, but is one that ASIC may approve under section 350 of the Corporations Act and section 100-6 of Schedule 2, or

- an ASIC administrative form, which is a form that is neither prescribed nor approved, but is one that has been given an administrative form number by ASIC for the purpose of identifying the type of information being lodged (e.g. Form 5011).

[2] Company status: Certain form lodgements cause company status changes. These may not apply if a company is subject to another external administration. The status of a company is recorded on ASIC’s database as:

- REGD – registered

- EXAD – under external administration and/or controller appointed

- SOFF – strike-off action in progress

- DRGD – deregistered