Financial firms required to submit an IDR report to ASIC every six months include all Australian financial services (AFS) licensees that provide financial services to retail clients, and all Australian credit licensees.

In addition to the above licensees, the IDR data reporting handbook also sets out some other types of firms that are in scope for IDR data reporting (e.g. certain unlicensed entities and certain superannuation trustees). However, the vast majority of in-scope financial firms will be AFS licensees and/or credit licensees.

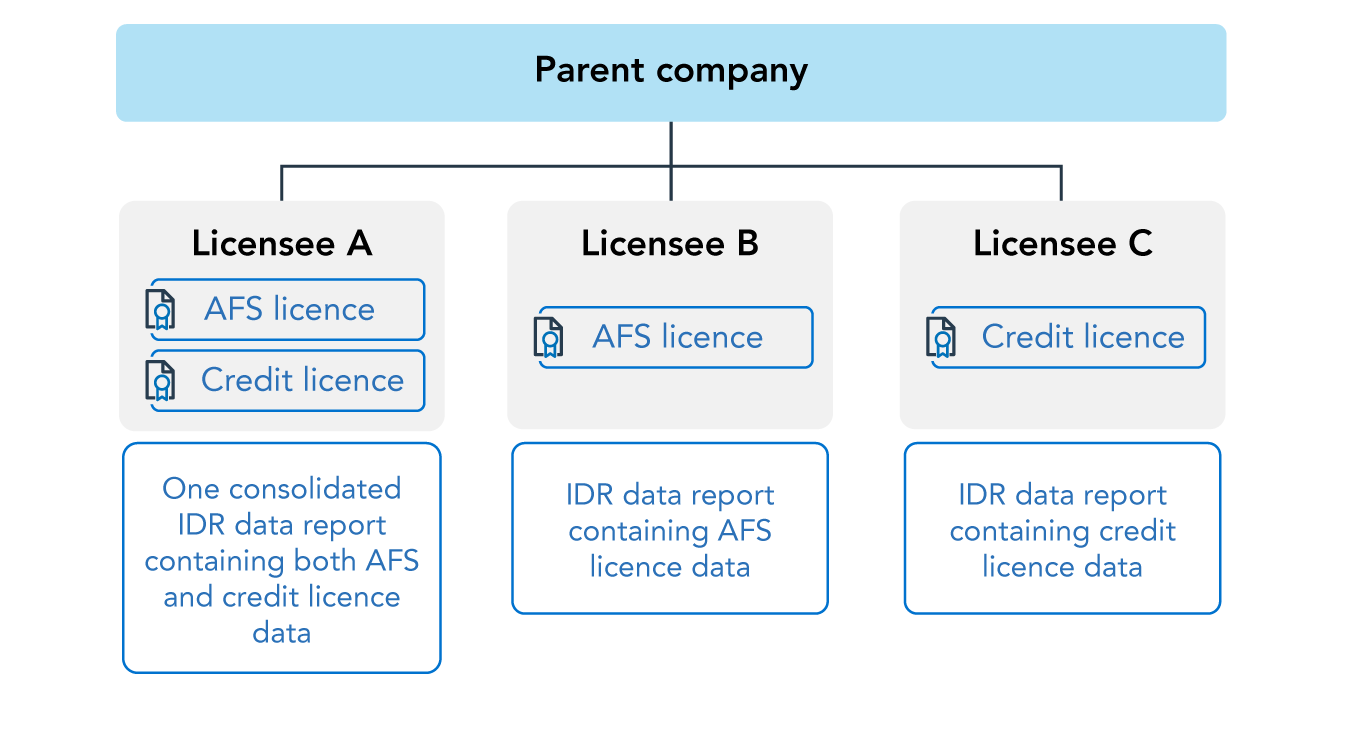

The only exception to this is if the financial firm holds both an AFS licence and a credit licence (with the same licence number). In this instance, they must submit a consolidated report for both licences to ASIC each reporting period. This is the only scenario where a firm will submit a consolidated IDR report (see FAQ 7).