This is Information Sheet 213 (INFO 213). It gives guidance to assist providers of marketplace lending products and others providing financial services in connection with these products. This information sheet covers:

- What is marketplace lending?

- Key risks involved in providing marketplace lending products

- Key obligations that may apply to marketplace lending business models and applications for relief

- Advertising of marketplace lending products

- Good practice examples

We have also given guidance to assist investors and borrowers which you can find on our Moneysmart website.

We are aware that different business models may be used to provide marketplace lending products, including:

- managed investment schemes

- the issue of derivatives

- the operation of a financial market, or

- the issue of securities.

The focus of this information sheet is on the obligations that are relevant to products structured as a managed investment scheme, which we have found to be a commonly used business model for marketplace lending in Australia at this time.

The guidance in this information sheet may also be relevant to marketplace lending providers that use other business models.

We welcome further discussion with marketplace lending providers about their proposed business model or the guidance provided in this information sheet. If your business is a start-up you may also request further guidance through ASIC's Innovation Hub.

Our guidance refers to the legislative and policy settings that currently apply. As marketplace lending develops in Australia the legislative and policy settings in this area may be subject to change. We will review the guidance as appropriate in response to any future changes in the law, policy settings or business structures.

What is marketplace lending?

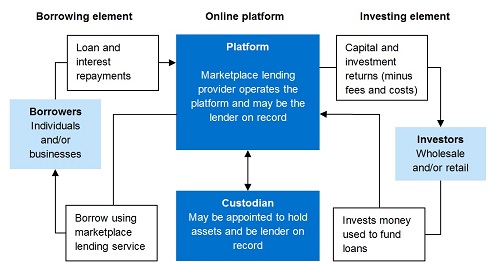

Marketplace lending generally describes an arrangement through which retail or wholesale investors invest money (seeking to earn a return) which is then lent to borrowers (consumers or businesses).

Figure 1: Overview of how marketplace lending is generally structured

Marketplace lending arrangements commonly involve the use of an online platform, such as a website, on which loan requests are made. The loan requests may then be matched against offers to invest. Investors either select the loans they wish to invest in or they are matched with loans that meet specified criteria, such as a prescribed or desired interest rate and loan term. In some arrangements, investors may also be exposed to a loan or a pool of loans. Multiple investors may also fund a single loan.

Although some forms of marketplace lending have often been referred to as 'peer-to-peer lending' or 'P2P', we consider 'marketplace lending' more appropriately describes these lending arrangements, and encourage the use of this term.

Neither marketplace lending nor peer-to-peer lending is a defined legal term. However, providers need to take care that the way they describe their marketplace lending product is not misleading or deceptive. If the product is referred to in a way that is misleading or deceptive we may take action as appropriate.

Key risks involved in providing marketplace lending products

As with other financial products, marketplace lending products have a number of key risks which may impact on investors and borrowers using an online platform. These include:

- fraud and cyber security risk

- risk that conflicts of interest of the marketplace lending provider are not adequately managed which may lead, for example, to reduced credit assessment standards, and

- risk that investors and borrowers do not have sufficient understanding of the marketplace lending product when deciding to participate.

Marketplace lending providers should ensure that investors and borrowers are informed of all relevant risks.

We also refer you to the guidance we give to investors and borrowers on relevant risks on our Moneysmart website.

Key obligations that may apply to marketplace lending business models and applications for relief

Under Australia's financial services and credit laws, providers of marketplace lending products and related services will generally need to hold:

- an Australian financial services (AFS) licence, and

- an Australian credit licence if the loans made through the platform are consumer loans (e.g. loans to individuals for domestic, personal or household purposes).

As with other financial products regulated under the Corporations Act 2001 (Corporations Act), there are requirements to ensure that retail investors have access to sufficient information to make an informed decision about whether or not to invest. There are also requirements that disclosure and promotional material must not include any misleading or deceptive representations – see the guidance under the heading 'Advertising of marketplace lending products'.

Where the loans made through the platform are consumer loans, the marketplace lending provider will need to comply with requirements in the National Consumer Credit Protection Act 2009 (National Credit Act) and the National Credit Code (which is contained in Schedule 1 to the National Credit Act).

For all loans (including loans for a business purpose that are not regulated under the National Credit Act) consumer protection provisions in the Australian Securities and Investments Commission Act 2001 (ASIC Act) apply, including prohibitions on misleading or deceptive representations and use of harassment and coercion in recovering payments.

Operation of a registered scheme

If the marketplace lending product is offered to investors who are retail clients using a managed investment scheme structure, the operator (i.e. the responsible entity) of the scheme will need to register the scheme with ASIC: see section 601ED.

The responsible entity of a registered scheme must be a public company that holds an AFS licence authorising it to operate the scheme (see section 601FA) and any other financial services provided in operating the scheme.

General obligations of an AFS licensee

As an AFS licensee the responsible entity has general obligations under the Corporations Act (see section 912A), including obligations to:

- have adequate arrangements to manage certain conflicts of interest. In particular, remuneration that is received as a result of matching lenders and borrowers should not affect prudent lending standards. As a responsible entity, the marketplace lending provider must act in the best interests of members and give priority to the interests of scheme members, including when there is a conflict

- have available adequate resources, including financial, technological and human resources. Adequacy of IT resources will be an important consideration for the operation of the online platform on a day-to-day basis. There are certain financial requirements that must be met by the responsible entity, including holding net tangible assets of at least $150,000 when a custodian is appointed to hold scheme property (that meet the requirements set out in Regulatory Guide 166 Licensing: Financial requirements (RG 166))

- have adequate risk management systems. Key risks include change in market conditions, cyber security, fraud and loan defaults

- take reasonable steps to ensure representatives that provide financial services covered by its AFS licence comply with financial services laws

- comply with the conditions of the AFS licence and with the financial services laws, and

- submit a written notification about a reportable situation within 30 calendar days after the licensee first knows that there are reasonable grounds to believe a reportable situation has arisen (see Reportable situations).

Specific obligations of a responsible entity

As the responsible entity of a registered scheme, the marketplace lending provider will also have specific obligations under the Corporations Act (see Chapter 5C). These obligations include:

- ensuring that the scheme has a constitution and compliance plan that complies with the relevant content requirements: see sections 601GA, 601GB and 601HA. The provisions of the constitution and compliance plan should be tailored as appropriate to reflect the nature of the scheme operated

- ensuring the withdrawal arrangements comply with the requirements for a liquid or illiquid scheme as applicable: see Part 5C.6. Generally, the scheme will be an illiquid scheme because the assets of the scheme are loans. If the scheme is illiquid and members have a right to withdraw on request, there is a requirement to make a withdrawal offer to the members of a class or to all members

- the duties of the responsible entity under section 601FC, including that:

- the responsible entity act in the best interests of members of the scheme

- the responsible entity exercise the degree of care and diligence that a reasonable person would exercise in the responsible entity's position

- members of the same class are treated equally and members of different classes are treated fairly

- the responsible entity ensure that the scheme's constitution and compliance plan meet the relevant content requirements, and

- the duties of the officers and employees of the responsible entity: see sections 601FD and 601FE. These duties include that the officers of the responsible entity act in the best interests of the members of the scheme and that officers and employees not make use of information acquired to gain an improper advantage or cause detriment to the members.

Classification of the registered scheme

We consider marketplace lending providers acting as responsible entities will generally need a tailored AFS licence authorisation to operate a registered scheme that proposes to undertake marketplace lending activities. The following is an example of such an authorisation granted by ASIC to a marketplace lending provider where the borrowers are consumers:

|

Operate the following registered managed investment scheme (including the holding of any incidental property) in its capacity as responsible entity: |

The AFS licence, ASIC Form 5100 Application for registration of a managed investment scheme, scheme constitution and compliance plan should outline that the scheme's purpose is to facilitate marketplace lending and include a summary description of the scheme's structure.

Operation of an unregistered scheme

If a managed investment scheme is only made available to investors that are wholesale clients (as defined in the Corporations Act) it does not need to be registered. The marketplace lending provider will need an AFS licence that covers any financial product advice, dealing, or custodial or depository financial services activities undertaken in relation to the scheme, unless an exemption applies. However, the provider may still need an authorisation for custodial or depository services even where a custodian with an AFS licence that covers custody is appointed to hold the scheme assets (RG 166).

Do any licensing exemptions apply?

To operate a registered or unregistered managed investment scheme and issue interests, the marketplace lending provider will generally need its own AFS licence to provide the financial services.

We are aware that some marketplace lending providers may seek to rely on exemptions from holding an AFS licence under the Corporations Act (in particular the exemptions under section 911A(2)(a) (acting as a representative) and section 911A(2)(b) (relying on an intermediary authorisation)).

We consider that there are limitations on the use of these exemptions. These limitations prevent marketplace lending providers from operating a managed investment scheme and issuing interests in the scheme in reliance on these exemptions.

Australian credit licence and responsible lending

If consumer loans are offered through a marketplace lending platform, the persons involved in entering the loan and operating the platform will need an Australian credit licence (credit licence) and must comply with the requirements set out in the National Credit Act and National Credit Code. Business loans are not regulated under the National Credit Act and National Credit Code.

Credit activities that may occur on a marketplace lending platform for which a credit licence is required, include:

- providing credit and carrying on a business of providing credit

- performing obligations, or exercising the rights, of a credit provider on the credit provider's behalf, and

- providing credit services by suggesting a consumer apply for a particular loan, assisting a consumer to apply for a loan, or acting as an intermediary between the consumer and a credit provider to secure a loan.

Note: The full range of credit activities is set out in the table in section 6 of the National Credit Act. We have provided guidance on what types of conduct constitute credit activities in Regulatory Guide 203 Do I need a credit licence? (RG 203).

Marketplace lending providers need to consider how they have set up their platform, the different entities involved in operating the platform and the activities they engage in, who needs to hold a credit licence and what authorisations those persons will need.

For example, if:

- the marketplace lending provider enters into the loan contracts with borrowers as trustee for the investors, it will be the credit provider and will need a credit licence with an authorisation to 'engage in credit activities as a credit provider'

- the marketplace lending platform is structured as a registered managed investment scheme and uses a custodian to enter the loan contracts as trustee for the investors, the custodian will be the credit provider. In this case, the custodian will need a credit licence with an authorisation to 'engage in credit activities as a credit provider', and the marketplace lending provider may also need a credit licence with an authorisation to 'engage in credit activities other than as a credit provider', and

- the marketplace lending platform facilitates loans that are entered directly between the investors and the borrowers, the investors will be the credit providers and may need to hold a credit licence to engage in those activities. The marketplace lending provider would need a credit licence with an authorisation to 'engage in credit activities other than as a credit provider'

Credit licensees need to comply with responsible lending requirements set out in Chapter 3 of the National Credit Act. These requirements apply before a credit licensee enters a loan with a consumer or assists a consumer to apply for a loan. We have provided guidance on the circumstances in which the responsible lending obligations will apply and what those obligations involve in Regulatory Guide 209 Credit licensing: Responsible lending conduct (RG 209).

In general, the responsible lending obligations involve making inquiries that will enable the credit licensee to:

- understand the particular consumer's financial situation, and their requirements and objectives for the loan

- verify the information about the consumer's financial situation, and

- use that information to assess whether the loan would be unsuitable for the consumer.

If a custodian is the credit provider for loans entered through a marketplace lending platform, and the marketplace lending provider is the person who assists consumers to enter those loans, both the custodian and marketplace lending provider will have their own responsible lending obligations (and liabilities if the obligations are not met). While in practice the marketplace lending provider may perform the inquiries, verifications and assessments for the custodian as its agent, the custodian will still be responsible for fulfilling these obligations.

In addition to the assessment obligations, there are requirements to provide disclosure documents to consumers at various stages of the process of obtaining credit. We have provided information on the broader range of responsible lending disclosure obligations in RG 209 and Information Sheet 146 Responsible lending disclosure obligations - Overview for credit licensees and representatives (INFO 146).

National Credit Code requirements

The National Credit Code provides a consumer protection framework for consumer loans, and includes:

- upfront and ongoing disclosure requirements

- caps on the cost of loans

- requirements when ending and enforcing a loan, including collection activities

- advertising requirements, including requirements about using comparison rates in advertising, and

- requirements for dealing with borrowers whose circumstances have changed and who are now unable to meet their repayment obligations because of hardship.

Note: ASIC has provided guidance on the National Credit Code obligations, including on hardship variations and debt collection practices: see Information Sheet 105 FAQs: Dealing with consumers and credit (INFO 105) and Regulatory Guide 96 Debt Collection Guideline: For collectors and creditors (RG 96)).

These obligations apply to all credit providers who provide consumer loans, including credit providers who are exempt from holding a credit licence.

Marketplace lending using other business structures

While we have outlined the obligations relevant to the operation of a managed investment scheme, we note that other business structures may be used by marketplace lending providers. These structures may attract other obligations under the Corporations Act, for example:

- Where debentures are issued to retail investors, a prospectus may need to be issued (see Chapter 6D of the Corporations Act) and, Chapter 2L of the Corporations Act will apply.

- Where the loans are debentures issued by borrowers, and the platform facilitates offers being made to investors to acquire these debentures, the product provider may be operating a financial market as defined in section 767A of the Corporations Act. This generally includes a facility through which offers to acquire or sell financial products are regularly made. In these circumstances, an Australian market licence or exemption will generally be required (for more information on when an Australian market licence is required, including the meaning of relevant terms such as 'regularly': see Regulatory Guide 172 Financial markets: Domestic and overseas operators (RG 172)).

- Where the marketplace lending provider issues securities (other than debentures) with an economic exposure based on particular lending arrangements, a prospectus may be required: see Chapter 6D of the Corporations Act.

Marketplace lending providers will need to ensure that they understand and comply with the obligations relevant to their particular business structure.

Applications for relief

In particular circumstances a marketplace lending provider may be able to demonstrate that it would be unreasonably burdensome to comply with a requirement under the Corporations Act or National Credit Act and Code. ASIC has discretionary powers to give relief from the requirements of the Corporations Act and National Credit Act and Code.

Guidance on how to make an application for relief, and information that should be included in an application is set out in Regulatory Guide 51 Applications for relief (RG 51) and other relevant regulatory guides such as Regulatory Guide 136 Funds management: Discretionary powers (RG 136).

Some examples of relief that we have granted to marketplace lending providers is set out below:

- relief from the withdrawal requirements (section 601GA(4) and Part 5C.6) to facilitate withdrawal of cash by members while the scheme is illiquid. This relief was granted in circumstances where each member had a separate portfolio that comprised a separate class of interest. For additional information see Report 420 Overview of decisions on relief applications (June to September 2014) (REP 420)

- relief from the requirement to seek registration of a separate managed investment scheme for each loan entered into through the lending platform, and

- relief from the requirement to treat the underlying assets of a provision fund operated in connection with the lending platform as scheme property of the scheme. For additional information see Report 435 Overview of decisions on relief applications (October 2014 to January 2015) (REP 435).

Disclosure obligations

If retail investors will be acquiring an interest in a managed investment scheme, a Product Disclosure Statement (PDS) will need to be prepared by a marketplace lending provider and provided to investors: see Part 7.9 of the Corporations Act. Marketplace lending providers must ensure that the PDS complies with the content requirements of the Corporations Act. Some of the matters that should be covered in the PDS include:

- how the platform operates, including details of the business structure, loans offered and how investors and borrowers are matched to a loan

- how the interest rates are set and by whom

- whether a borrower that an investor may be matched to is a consumer or business, whether the investor or the platform facilitates the selection of the particular borrower and any differences in the risk profile of the borrowers

- if the platform facilitates investors being matched to borrowers, the criteria used to determine how investors are matched to borrowers and any input investors may have in relation to the matching

- if the investors select the loan in which they are investing, information about the loans they may select to enable the investors to make an informed decision (this may be a separate part in the PDS from the more general disclosure about the platform)

- any returns to investors, including whether the repayment amounts comprise principal and/or interest and when they are due

- how the creditworthiness of borrowers is assessed, when this is undertaken and by whom

- the risks to investors, including:

- that investors may lose some or all of their money

- that the loan may not be repaid

- that assessment of borrowers' creditworthiness is only an opinion and creditworthiness may change after the loan is made

- from the absence of liquidity of the loans or the investor's interest in the scheme

- from the absence of diversification, and

- that the platform may fail

- any fees and costs, whether payable by investors or taken from amounts paid by borrowers and not paid to investors

- any withdrawal rights available to investors

- that cooling-off rights do not apply to investors (assuming the scheme is illiquid)

- any steps that will be taken on a loan default and the effect of default on investors

- what happens if the platform fails, and

- if there is a source of protection for investor losses (such as a derivative, guarantee or provision fund), how this is funded and when it can be accessed by investors.

Marketplace lending providers may also have ongoing disclosure obligations to retail clients under the Corporations Act. These include:

- ongoing disclosure of material changes and significant events to retail investors (section 1017B) or the continuous disclosure obligations in sections 674–677. Marketplace lending providers should assess whether their ongoing disclosure obligations require them to provide investors with ongoing information about the status of the loans and any source of protection for investor losses to assist investors to understand their investment. Even if it is not required in certain circumstances, you may wish to consider providing this information as a matter of good practice

- provision of periodic statements to retail investors (section 1017D), and

- confirming transactions (section 1017F).

Advertising of marketplace lending products

We recognise that advertising content and delivery have an important role in attracting investors and promoting a marketplace lending product's benefits and features. It is important that 'promoters' ensure that advertising material is clear, accurate and balanced.

A promoter includes the product issuer and credit provider and can be a third party such as a financial adviser, credit service provider, distributor or agent. We note that promoters of financial products, financial advice services, and credit products and services, have a legal obligation to not make false or misleading statements or engage in misleading or deceptive conduct in relation to these products and services. This includes the promotion of marketplace lending products and services.

Regulatory Guide 234 Advertising financial products and services including credit: Good practice guidance (RG 234) contains good practice guidance to help promoters understand their legal obligations. RG 234 is relevant to advertising material that is communicated through any medium and in any form. In the case of marketplace lending products, this can include:

- magazines and newspapers

- radio and television

- the internet (e.g. webpages, banner advertisements, video streaming)

- social media, and

- mobile phone messages.

It is also important that investors are encouraged to seek further information about the product – in particular, by reading the PDS before deciding to invest. Under the Corporations Act, if the product is promoted to retail investors, the content of advertising or other promotional material must indicate that a PDS is available, where it can be found, and that the investor should consider the PDS in making decisions about acquiring the product (section 1018A).

Specific advertising concerns

Promoters of marketplace lending products should, when considering their obligations in relation to advertising, ensure that the content and delivery of advertising and other promotional material fairly represents the product, for example:

- If the advertising implies it is giving an overall summary of the key features of the product, it does not merely focus on the benefits of the product (e.g. that the borrowers are creditworthy, that attractive returns may apply from investing in the product, and the speed and ease of online lending and borrowing) but also addresses the risks.

- Comparisons with other products are clearly explained.

- Comparisons with dissimilar products that falsely imply similarity, and use of terminology that could create a false and misleading impression about the product are avoided.

- Any reference to ratings of borrowers' creditworthiness does not create a false and misleading impression that they are similar to ratings issued by traditional credit rating agencies. For this reason, alphanumeric ratings that are similar to those used by traditional credit rating agencies (e.g. AAA and BBB) should not be used to describe the creditworthiness of borrowers in the context of marketplace lending. To the extent that marketplace lending promoters wish to describe the creditworthiness of borrowers quantitatively, any quantitative description should be accompanied by qualitative information to explain what the quantitative descriptor means.

- While marketplace lending offers borrowers an alternative to borrowing money from other sources, such as a bank, it would not be appropriate for any comparison to be made between marketplace lending products offered to investors with products offered to consumers of banking products, such as saving accounts and term deposits. Words such as 'savings', 'saver' or other terms used in relation to banking products should be avoided in advertising or disclosure for marketplace lending products.

- In comparing interest rates or returns that investors may earn by investing in marketplace lending, it is important the comparisons do not create an impression that the product's returns are comparable to term deposits or other banking products.

- Investors should understand upfront the role they have in selecting the particular borrower that they are matched to, particularly, in circumstances where the platform facilitates the selection of the borrower (which may be consumer or a business). In addition to the disclosure in the PDS, it is important for the advertising and interface with investors to provide clear and meaningful disclosure to highlight to investors that their investment may be exposed to a consumer and/or a business loan, and that the selection of the particular borrower will be facilitated by the platform and not the investor.

Registration of security

Marketplace lending providers may facilitate secured loans. In such cases, providers would be expected to take all reasonable steps to register and protect any security interests, including registration on the Personal Property Securities Register or, if appropriate, the Torrens Title Register. Failing to correctly register the security may be inconsistent with the marketplace lending provider's duties as a responsible entity. We consider that marketing loans as secured loans when they are not, or marketing the loans as secured when the security has been incorrectly registered or it has negligible value, would be misleading.

Good practice examples

Marketplace lending products are a relatively new product in Australia. As such, it is important and in the interests of marketplace lending providers to ensure that investors understand marketplace lending products and the relevant risks. As a matter of good practice marketplace lending providers may wish to consider one or more of the following strategies to assist investors in understanding marketplace lending products and relevant risks:

- refer investors to the marketplace lending information available on our Moneysmart website

- provide investors with an appropriately designed risk warning statement. Testing of the risk warning statement may help to ensure its effectiveness

- provide investors with an optional 'knowledge test for investors' to assess their understanding of the product before they invest

- provide the following information on the website:

- information about the policies and procedures for managing the selection of borrowers and ongoing monitoring of loans policies (without disclosing commercially-sensitive information), and

- aggregated information about the loan book such as interest rates, loan amounts, term of the loans and whether loans are secured or unsecured.

We also encourage marketplace lending providers to read the information in Report 429 Cyber resilience: Health check (REP 429) on managing online fraud and other cyber risks.

These good practice examples are not intended to be exhaustive. We encourage the marketplace lending industry to establish and implement standards and good practices for the industry as marketplace lending continues to develop. This will help build and maintain confidence in marketplace lending generally.

Where can you find more information?

Visit here for more information about the National Credit Act

Call ASIC on 1300 300 630 or ask a question online

Read our regulatory guides:

- RG 51 Applications for relief

- RG 78 Breach reporting by AFS licensees

- RG 96 Debt collection guideline: For collectors and creditors

- RG 136 Funds management: Discretionary powers

- RG 166 Licensing: Financial requirements

- RG 172 Financial markets: Domestic and overseas operators

- RG 203 Do I need a credit licence?

- RG 209 Credit licensing: Responsible lending conduct

- RG 234 Advertising financial products and services (including credit): Good practice guidance

Read our information sheets:

- INFO 105 FAQs: Dealing with consumers and credit

- INFO 146 Responsible lending disclosure obligations: Overview for credit licensees and representatives

Read our reports:

- REP 420 Overview of decisions on relief applications (June to September 2014)

- REP 429 Cyber resilience: Health check

- REP 435 Overview of decisions on relief applications (October 2014 to January 2015)

Important notice

Please note that this information sheet is a summary giving you basic information about a particular topic. It does not cover the whole of the relevant law regarding that topic, and it is not a substitute for professional advice. We encourage you to seek your own professional advice to find out how the applicable laws apply to you, as it is your responsibility to determine your obligations.

You should also note that because this information sheet avoids legal language wherever possible, it might include some generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases, your particular circumstances must be taken into account when determining how the law applies to you.

Information sheets provide concise guidance on a specific process or compliance issue or an overview of detailed guidance.

This information sheet was reissued in November 2020.