Estimated costs and levies

ASIC’s Cost Recovery Implementation Statement (CRIS) sets out estimated costs and industry funding levies for the financial year for each subsector. The CRIS is a requirement under the Australian Government Charging Framework, specifically the Australian Government Cost Recovery Guidelines. For each subsector, the estimated levies are based on:

- six months (July to December of the financial year) of actual costs and estimated costs for the rest of the financial year, and

- estimates of the population and business activity metrics for each subsector.

The estimated levies are a guide only. Levy notices for entities will reflect actual levies. Actual levies are based on:

- our actual cost of regulating each subsector in the financial year, so that that each industry subsector is only charged for the actual costs of regulating that subsector, and

- the actual business activity metrics submitted by regulated entities on the ASIC Regulatory Portal between July and September of the subsequent financial year.

This means that actual levies are calculated after the end of the financial year. ASIC makes legislative instruments each year, setting out our regulatory costs for the previous financial year, how they were allocated, and the metrics we use to calculate the levies.

In the past, we included commentary in the CRIS on material variances between our estimated and actual costs for the previous financial year. We now release information about variances when we publish the summary our actual costs and levies in December of the subsequent financial year. For more information, see Regulatory costs and levies.

We then issue levy notices under the industry funding model between January and March of the subsequent financial year. For more detail – including availability of payment plans and waivers of levies in exceptional circumstances – see Industry funding levy notices.

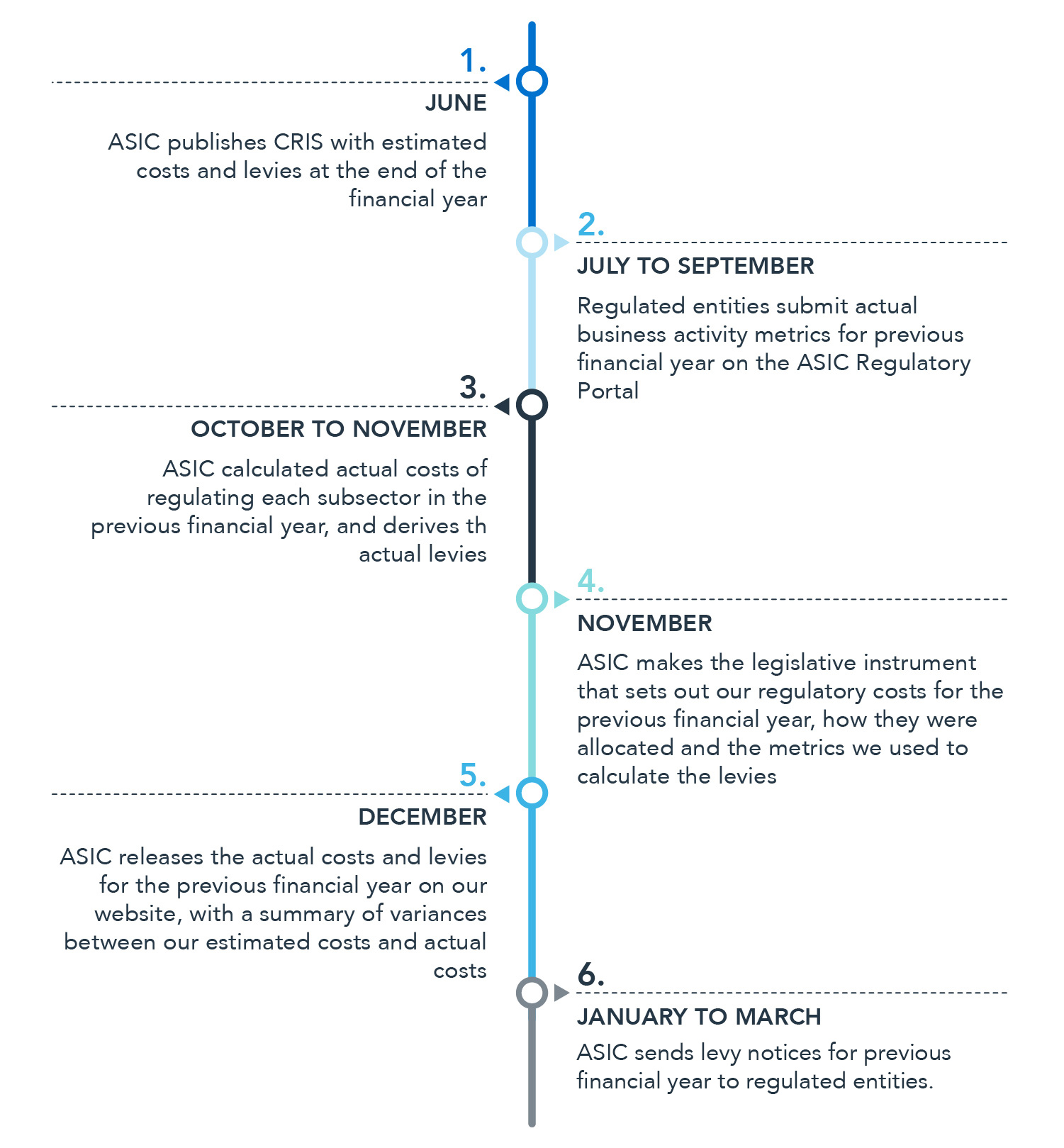

Figure 1 sets out the timeline of the industry funding model process.

Figure 1: Industry funding model process

Text version of Industry funding model process

Step 1: In June, ASIC publishes CRIS with estimated costs and levies at the end of the financial year.

Step 2: Between July and September, regulated entities submit actual business activity metrics for previous financial year on the ASIC Regulatory Portal.

Step 3: Between October and November, ASIC calculates actual costs of regulating each subsector in the previous financial year, and derives the actual levies.

Step 4: In November, ASIC makes the legislative instrument that sets out our regulatory costs for the previous financial year, how they were allocated and the metrics we used to calculate the levies.

Step 5: In December, ASIC makes the legislative instrument that sets out our regulatory costs for the previous financial year, how they were allocated and the metrics we used to calculate the levies.

Step 6: Between January and March, ASIC sends levy notices for the previous financial year to regulated entities.

Previous CRISs

- Cost Recovery Implementation Statement 2023–24

- Cost Recovery Implementation Statement 2022–23

- Cost Recovery Implementation Statement 2021–22

- Cost Recovery Implementation Statement 2020–21

- Cost Recovery Implementation Statement 2019–20

- Cost Recovery Implementation Statement 2018–19

- Cost Recovery Implementation Statement - levies- 2017–18