ASIC today released a new regulatory guide, Regulatory Guide 126: Compensation and insurance arrangements for AFS licensees (RG 126).

RG 126 outlines ASIC’s policy for administering the new compensation and professional indemnity (PI) insurance requirements for Australian financial services (AFS) licensees who provide financial services to retail clients. These requirements are set out in the Corporations Act.

The compensation and PI insurance requirements aim to reduce the risk a licensee might not have sufficient financial resources to compensate retail clients for losses they suffer as a result of a licensee breaching the law.

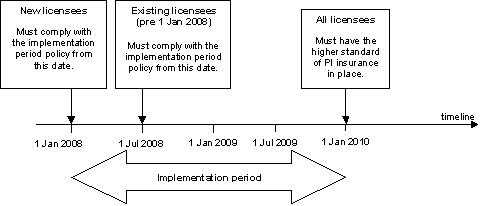

Requiring licensees to have PI insurance cover will improve the current level of consumer protection, but will be limited by what insurance is currently available in the insurance market. ASIC has adopted a two-stage approach to administering the new rules to take this into account.

Over time, ASIC aims to raise the standard of available PI to make sure it delivers effectively.

ASIC will initially require licensees to have PI insurance based on what is commercially available in the market now, but has also set minimum standards to deliver some practical results for consumers. It will be enough for licensees to meet these minimum standards for two years after the requirements commence.

At the end of the two-year implementation period, ASIC expects licensees to have a higher standard of PI insurance. It will work with industry to encourage the development of products or solutions that achieve this higher standard during the implementation period.

A staged approach of this kind is the best way to work towards a high standard of PI insurance cover in the industry and in the meantime provide consumers with a minimum standard of insurance protection.

Background

RG 126 follows Consultation Paper 87: Compensation and insurance arrangements for AFS licensees released on 23 July 2007. ASIC also undertook further consultation with insurer representatives and industry to develop a clear picture of what PI insurance is currently available. We took this information into account in formulating the regulatory guide.

Accompanying the regulatory guide are:

- an outline of key issues raised in the submissions, together with ASIC’s response to these issues; and

- a Regulation Impact Statement, discussing the costs and benefits of the various alternative options ASIC considered for administering the requirements.

What do licensees need to do and by when?

During the implementation period, licensees will need to have PI insurance that complies with the minimum standards set out in Section D of RG 126. These standards deal with who can provide the insurance, the amount of cover needed, the scope of the cover, and what items the insurance policy must cover.

Following the implementation period, licensees must have PI insurance in place that complies with the standard set out in Section C of RG 126. Additional policy features required at this stage are cover for fraud and dishonesty by the licensee, some cover for advice about products not on an approved product list and run-off cover.

Figure 1: Timeline for licensees to comply

Licensees seeking approval of alternative arrangements will need to lodge an application addressing the issues set out in our guidance. We will generally ask for an expert’s report to be submitted with the application. New licensees can apply for approval as part of the licence application process.

What this will mean for consumers

The requirement for licensees to have PI insurance cover will improve the standard of compensation arrangements currently in place in the industry. The extent to which it does so depends on what is currently available in the insurance market. We aim to encourage the development of PI insurance products that will deliver a high standard of protection, but we recognise this will take time. In the meantime, we want licensees to have the highest standard of PI insurance cover that is reasonably commercially available in the current marketplace.

It is important to recognise the limitations of PI insurance as a consumer protection mechanism.

PI insurance is not designed to protect consumers directly and is not a guarantee that compensation will be paid. It is designed to protect the insured (i.e. the licensee) against the risk of financial losses arising from poor quality services (e.g. poor advice or execution of services) and other misconduct by a financial services provider (e.g. fraud by its representatives).

PI insurance is not intended to cover product failure or general investment losses, claims for loss solely as a result of the failure (e.g. insolvency) of a product issuer or a return on a financial product that has not met expectations. Nor is it intended to underwrite the products of a product issuer.

Currently available insurance is unlikely to provide a source of funds where a licensee has become insolvent before the claim was brought. Ideally insurance policies would continue to cover the licensee after it has become insolvent or otherwise ceased business, but we understand this insurance cover is generally not available in the current market to the average licensee. We also recognise that insurers may exclude some areas of cover in currently available policies for risk management reasons.

ASIC will encourage the development of products that provide insurance cover in these areas by setting a higher standard that we will require licensees to meet after the implementation period.

End of release

Download:

- Regulatory Guide 126: Compensation and insurance arrangements for AFS licensees

- Report 112 Report on submissions to CP 87 Compensation and insurance arrangements for AFS licensees

- Regulatory impact statement