Equity market data for quarter ending December 2016

For an explanation of the measures used in this release, see Information Sheet 177 Quarterly cash equity market data: Methodology and definitions (INFO 177).

Summary

Summary of December quarter data

Tables

Table 1: Market characteristics – average for December quarter

Table 2: Measures of market concentration

Table 3: Measures of market efficiency

Graphs

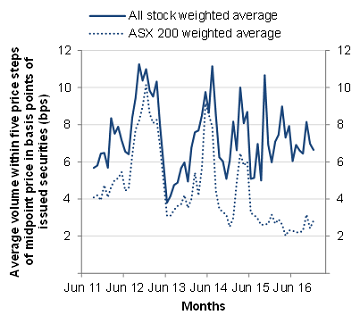

Figure 1: Market share – December quarter 2016

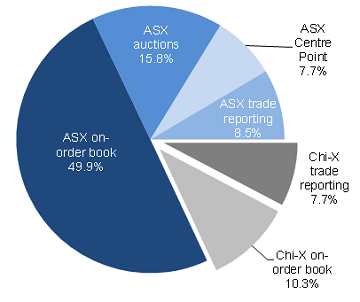

Figure 2: Australia – average daily turnover

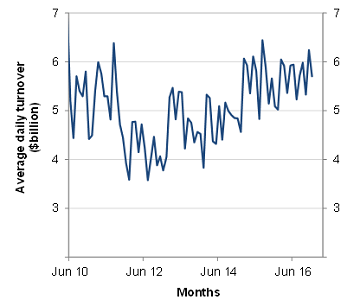

Figure 3: Average trade size by execution venue

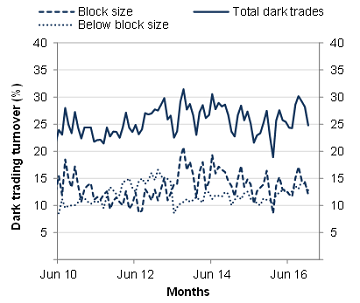

Figure 4: Dark liquidity proportion of total value traded

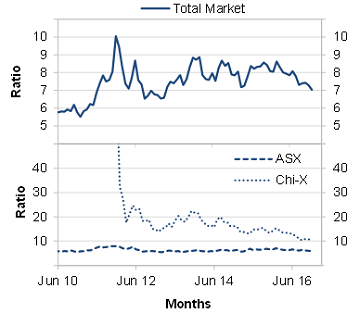

Figure 5: Order-to-trade ratio

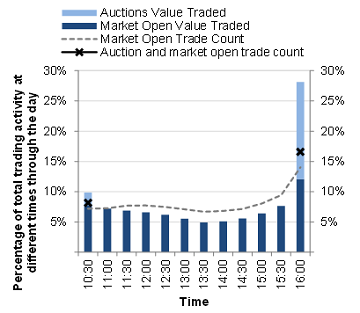

Figure 6: Intraday trading profile – December quarter 2016

Figure 10: Effective bid–ask spreads

Figure 11: Quoted bid–ask spreads

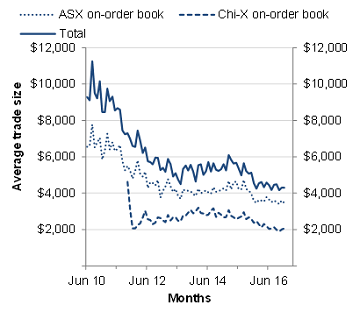

Figure 12: Depth at five price steps as basis points of issued securities

Equity market data from other quarters

Summary of December quarter data

In the December quarter 2016, the ASX accounted for 82% of the total dollar turnover in equity market products. Chi-X accounted for the remaining 18% of total dollar turnover. These figures include all trades executed on order book, as well as trades matched off order book and reported to either market operator. On-order book turnover (excluding ASX auctions) as a proportion of total dollar turnover rose to 68% in the December quarter, from 66.6% in the September quarter. Trade reporting turnover as a proportion of total dollar turnover decreased by 2.1 percentage points (ppts) to 16.2% over the quarter. This was driven by a fall in ASX trade reporting daily turnover from $536 million to $492 million and Chi-X trade reporting daily turnover from $496 million to $443 million.

Overall daily turnover in the equity market averaged $5.8 billion in the December quarter, slightly above $5.6 billion in the September quarter and $5.3 billion in the December quarter 2015, and continues to trend upwards over the past five years.

Turnover in block size dark liquidity declined by 1 percentage point to 13.6% of total value traded over the quarter. However, below block size dark liquidity increased to 13.7% of total value traded in the December quarter, compared to 13.1% in the September quarter.

The overall order-to-trade ratio declined to its lowest level since the March quarter 2013 at 7.2:1. Chi-X’s order-to-trade ratio averaged 10.6:1 and ASX’s ratio averaged 6:1 in the December quarter.

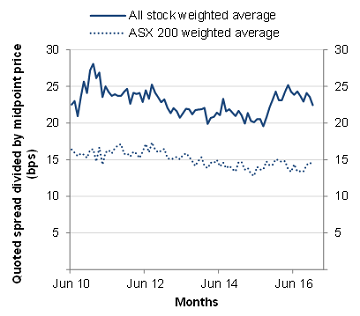

The weighted average quoted bid-ask spread for securities in the S&P/ASX 200 index rose by 1 basis point (bps) to 14.4 bps of the midpoint price over the quarter, but remains within normal ranges. For all securities, the quoted bid-ask spread declined marginally by 0.2 bps to 23.4 bps of the midpoint price.

Table 1: Market characteristics - average for December quarter

| Statistics |

ASX on-order book

|

ASX auctions

|

ASX Centre Point

|

ASX trade reporting

|

Chi-X on-order book

|

Chi-X trade reporting

|

Total

|

|---|---|---|---|---|---|---|---|

| Number of trades per day (market share) |

822,924(60.8%)

|

34,141 (2.5%)

|

136,990(10.1%)

|

11,669(0.9%)

|

299,628 (22.2%)

|

47,213(3.5%)

|

1,352,597(100.0%)

|

| Value traded, $ million/day (market share) |

2,873.3(49.9%)

|

909.5

(15.8%)

|

445.0

(7.7%)

|

492.1(8.5%)

|

595.5(10.3%)

|

443.4

(7.7%)

|

5,758.8(100.0%)

|

| Order-to-trade ratio |

6.1

|

na

|

na

|

na

|

10.6

|

na

|

7.2

|

| Average trade size, $/trade |

3,486

|

26,652

|

3,245

|

42,186

|

1,986

|

9,430

|

4,255

|

Table 2: Measures of market concentration

|

Statistics |

December |

October |

November |

December |

|---|---|---|---|---|

|

Total market Herfindahl index |

0.49 |

0.42 |

0.44 |

0.45 |

|

Public venues Herfindahl index |

0.71 |

0.63 |

0.64 |

0.64 |

Table 3: Measures of market efficiency

| Statistics |

December

2015 |

October

2016 |

November

2016 |

December

2016 |

|---|---|---|---|---|

|

Quoted bid-ask spread, bps |

24.3

15.1 |

24.1

14.3 |

23.6

14.6 |

22.5

14.3 |

| Effective bid-ask spread, bps - All stocks - S&P/ASX 200 stocks |

20.3

12.5 |

19.0

10.4 |

18.9

10.9 |

18.2

11.0 |

| Depth at best 5 price steps - all stocks, bps - All stocks - S&P/ASX 200 stocks |

6.0

3.2 |

8.2

3.2 |

7.0

2.4 |

6.6

2.8 |

Figure 1: Market share - December quarter 2016

Figure 2: Australia - Average daily turnover

Figure 3: Average trade size by execution venue

Figure 4: Dark liquidity proportion of total value traded

Figure 5: Order-to-trade ratio

Figure 6: Intraday trading profile - December quarter 2016

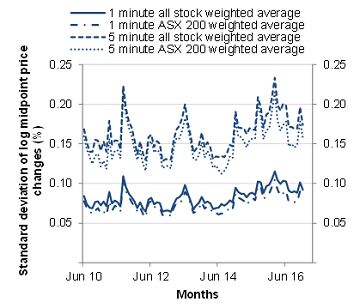

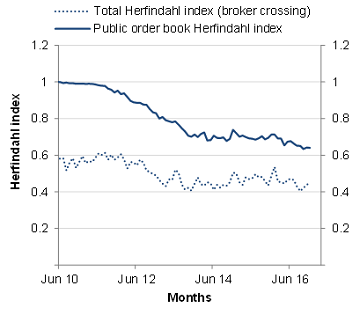

Figure 7: Intraday volatility

Figure 8: Interday volatility

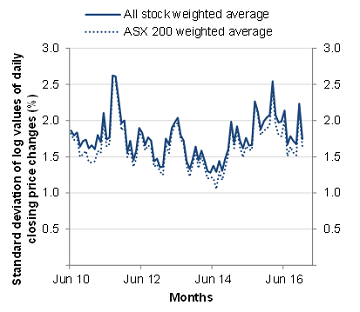

Figure 9: Herfindahl index

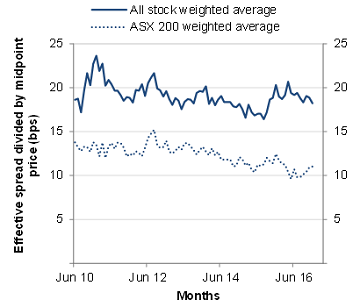

Figure 10: Effective bid-ask spreads

Figure 11: Quoted bid-ask spreads

Figure 12: Depth at five price steps as basis points of issued securities