ASIC’s priorities for the supervision of market intermediaries in 2022–23

ASIC’s strategic priorities are detailed in ASIC’s Corporate Plan 2022–26.

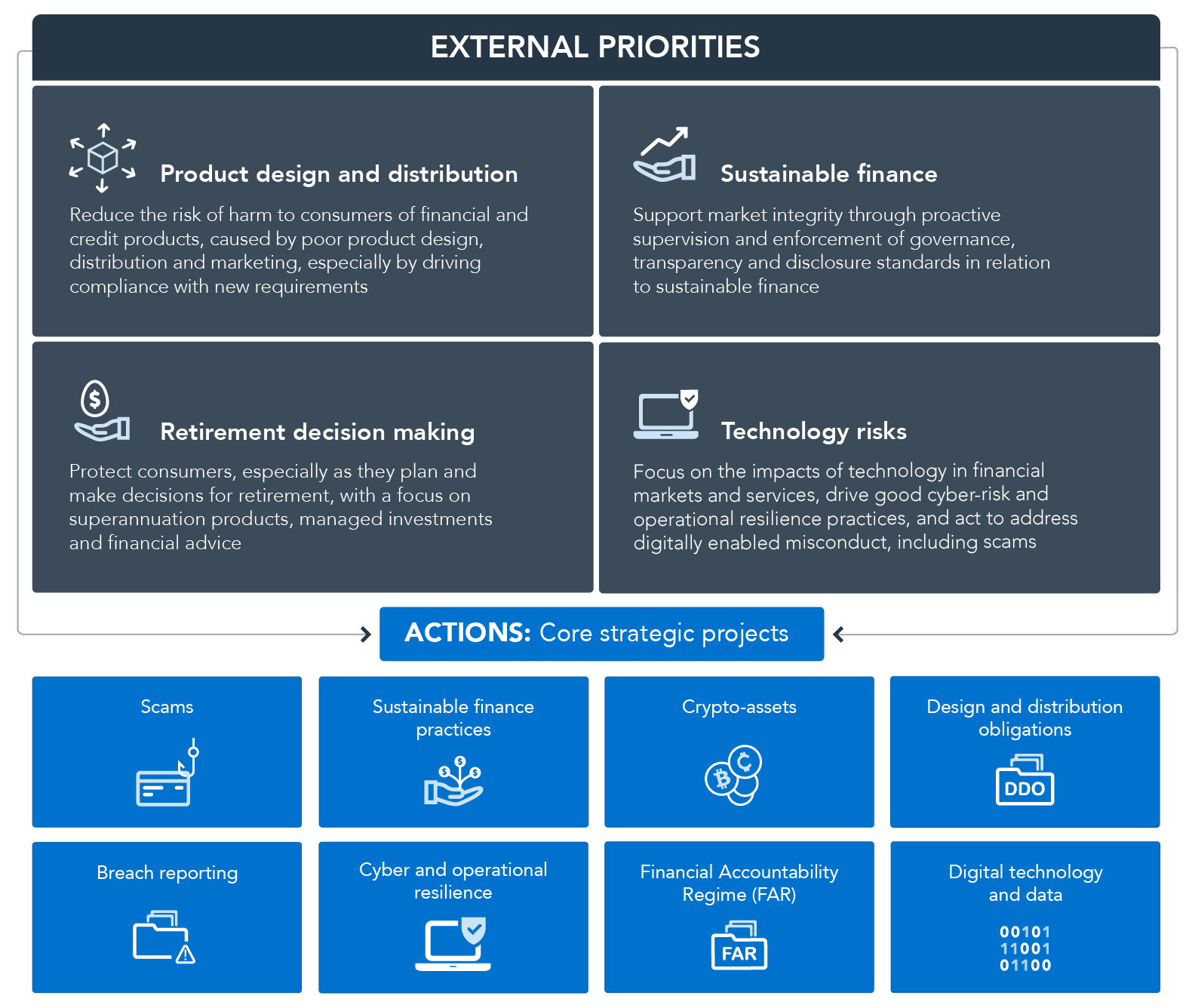

Our external priorities target the most significant threats and harms in our regulatory environment. To deliver on these external strategic priorities, ASIC will focus on eight core strategic projects. (Click image to enlarge)

ASIC's external strategic priorities - text version

External priorities

- Product design and distribution: Reduce the risk of harm to consumers of financial and credit products, caused by poor product design, distribution and marketing, especially by driving compliance with new requirements.

- Sustainable finance: Support market integrity through proactive supervision and enforcement of governance, transparency and disclosure standards in relation to sustainable finance.

- Retirement decision making: Protect consumers, especially as they plan and make decisions for retirement, with a focus on superannuation products, managed investments and financial advice.

- Technology risks: Focus on the impacts of technology in financial markets and services, drive good cyber-risk and operational resilience practices, and act to address digitally enabled misconduct, including scams.

Core strategic projects

- Scams

- Sustainable finance practices

- Crypto-assets

- Design and distribution obligations

- Breach reporting

- Cyber and operational resilience

- Financial Accountability Regime (FAR)

- Digital technology and data

Supporting ASIC’s priorities and core strategic projects, our most significant planned activities for supervision of market intermediaries in 2022–23 is focused on:

- Cyber, technology and operational resilience

- Fair and orderly markets

- Product design and governance

- Governance, accountability, sustainability and risk management

- Implementation of law reform

Cyber, technology and operational resilience

Cyber and operational resilience among market intermediaries minimises the risk of disruption from cyber attacks and operational failures and promotes confidence in markets.

- We are implementing a cross-industry self-assessment to benchmark market intermediaries’ cyber resilience and develop sectoral insights.

- We will conduct risk-based reviews of cyber and operational resilience among market intermediaries, including reviews of supervisory controls for remote working arrangements, and compliance with new market integrity rules on technological and operational resilience that apply from March 2023.

- We will monitor market participants’ and market operators’ implementation of the recommendations set out in Report 708 ASIC’s expectations for industry in responding to a market outage.

- We will engage with market intermediaries on their preparedness for and implementation of exchange trading platform upgrades.

- We are closely supervising ASX’s Clearing House Electronic Subregister System (CHESS) replacement project so that it will continue to provide reliable clearing and settlement services for the Australian cash equity market. For market intermediaries, we will oversee their preparation for the new CHESS system, focusing on testing arrangements to limit downstream issues and any implications for clients.

Fair and orderly markets

The efficient operation of fair and orderly financial markets is the cornerstone of our economy – and is essential to ongoing trust and confidence in our financial system.

- We are undertaking real-time and post-trade surveillance of trading on Australia’s domestic licensed markets to identify insider trading, market manipulation, disorderly trading, and misinformed markets. We are applying new tools to increase our detection of complex and novel market abuse matters.

- We are reviewing market participants’ arrangements to prevent and detect misconduct as part of their important role as gatekeepers. This includes consideration of the adequacy of order filters and controls, related governance around order and trade surveillance alerts (including their assessment and escalation) and compliance with suspicious activity reporting obligations.

- We will review market intermediaries’ trade surveillance systems with a view to releasing guidance on better practices.

- We are conducting surveillance of carbon and energy derivative markets and are implementing a new memorandum of understanding with the Australian Energy Regulator to address concerns about misconduct in gas and electricity markets.

- We are further enhancing our fixed income, currency and commodity (FICC) market surveillance system and data analytics. We are using our new bond surveillance capabilities, with a focus on green bonds, syndicated issues and secondary trading in government, semi-government and corporate bonds.

- We are undertaking a thematic review of artificial intelligence/machine learning (AI/ML) practices and associated risks and controls among market intermediaries and buy-side firms, including the implementation of AI/ML guidance issued by the International Organization of Securities Commissions (IOSCO).

- We will consider whether the automated order processing market integrity rules should be extended to futures market participants, and whether the rules should be updated to reflect developments since they were made.

- We are conducting proactive surveillance of debt capital markets issuance to test against our expectations for conduct and controls in Report 668 Allocations in debt capital market transactions. We continue to monitor and test allocation practices for selected equity raising transactions.

- We will align the over-the-counter (OTC) derivatives trade reporting requirements in Australia with international requirements, including the Unique Transaction Identifier, the Unique Product Identifier and Critical Data Elements.

- We are enhancing how we identify, quantify and disrupt scams through a data-informed approach. We are working with other regulators and law enforcement agencies, both domestic and overseas, to disrupt scams and coordinate enforcement strategies. We are improving our communications and consumer education, including through social media, to help consumers be more aware of scams and how to identify them.

Product design and governance

The design and distribution obligations came into effect on 5 October 2021. These obligations require financial product issuers to design products that meet the needs of consumers and are targeted to the right consumers.

- We are conducting risk-based surveillance of market intermediaries’ financial product design and distribution practices, including:

- design and approval of new products

- issuers’ reviews of target market determinations (TMD) and distribution arrangements

- notifications of significant dealings inconsistent with TMDs

- supervision of authorised representatives

- marketing governance (including social media)

- assessment of client outcomes by distribution channels.

- We are reviewing market intermediaries’ use of digital engagement practices in trading apps and their potential influence on consumer behaviour and outcomes, including algorithmic and copy trading, leader boards, gamification, inducements and other behavioural levers.

- We are undertaking surveillance of crypto-asset offerings by market intermediaries that fall in our remit (e.g. derivatives, managed funds and debentures) for potential misleading or deceptive conduct that may result in consumer harm. We will also raise public awareness of the risks of crypto-assets and decentralised finance (DeFi).

- We are implementing and monitoring the regulatory model for exchange traded products with underlying crypto-asset exposures.

- We will take enforcement action to address poor product design and distribution practices that result in consumer harm, including misleading, predatory or hawking tactics.

Governance, accountability, sustainability and risk management

We support market integrity through proactive supervision and enforcement of governance, transparency and disclosure standards.

- We will continue to undertake frontline supervision and proactive engagement with market participants, investment banks and securities dealers to drive better practices and early identification of issues. We conduct proactive and reactive surveillance of market intermediaries, securities dealers and corporate authorised representatives.

- We will increase our engagement with new and growing market intermediaries and undertake thematic reviews of identified risks (e.g. client money handling, new product approval processes and marketing governance).

- We are actively monitoring the progress and effective completion of market intermediaries’ remediation plans and independent expert reviews (e.g. court enforceable undertakings, licence conditions and court orders).

- We are monitoring the financial strength of market intermediaries, including through testing compliance with capital requirements using enhanced risk indicators and risk-based surveillance. We are also reviewing arrangements for handling client money and safeguarding client assets.

- We will monitor sustainability-related disclosure and governance practices of listed companies, managed funds and green bonds and take enforcement action against misconduct, including misleading marketing and greenwashing.

- We will publish reports on better and poorer practices observed in our reviews of wholesale market intermediaries’ management of conflicts of interest and fixed income market practices. We will continue to engage with industry bodies to promote development of good industry standards.

- We will contribute to IOSCO’s work on sustainable finance, hidden leverage, collateralised loan obligations and leveraged loans, OTC trade reporting, operational resilience and retail market conduct.

- We will continue our reviews of whistleblower programs, corporate finance transactions and the LIBOR transition.

Implementation of law reform

We will support market intermediaries’ implementation of recent and upcoming law reform. We will continue to provide guidance to industry about how we plan to administer and enforce the law – especially for new obligations.

- We are aware the new reportable situations regime has been challenging to implement. We continue to closely monitor the operation of the new regime to support industry with the practical implementation of the new obligations. We will work with AFS licensees to implement solutions to improve the consistency and quality of reporting practices.

- We have updated our market integrity rule guidance following recent rule amendments, including to the technological and operational resilience rules and capital rules.

- Subject to the passage of legislation, we will work with APRA to facilitate a smooth implementation of the Financial Accountability Regime, including implementing a coordinated, risk-based approach to registration activities under the regime.

- We are supporting the Government’s development of Foreign Financial Service Provider regulation and transitional arrangements.

- We will support the development of a regulatory framework for crypto-assets and work with domestic and international peers to monitor risks, develop coordinated responses to issues and develop international policy regarding crypto-assets and DeFi.

- We will promote the development of international standards and better practices through our participation in IOSCO working groups and liaison with other local and international regulatory agencies.

- We will seek your feedback on ways we can improve regulatory efficiency and reduce red tape. We will continue to provide relief, where appropriate, to participants in capital markets and the financial services industry to facilitate business, promote innovation and support the Australian economy.

Conclusion

We encourage you to use this letter as a reference tool for your compliance, supervisory and risk management programs, and to prepare for your interactions with ASIC. To stay informed of regulatory developments and issues affecting market intermediaries, we recommend subscribing to our monthly newsletter and participating in our quarterly Market Liaison Meetings.