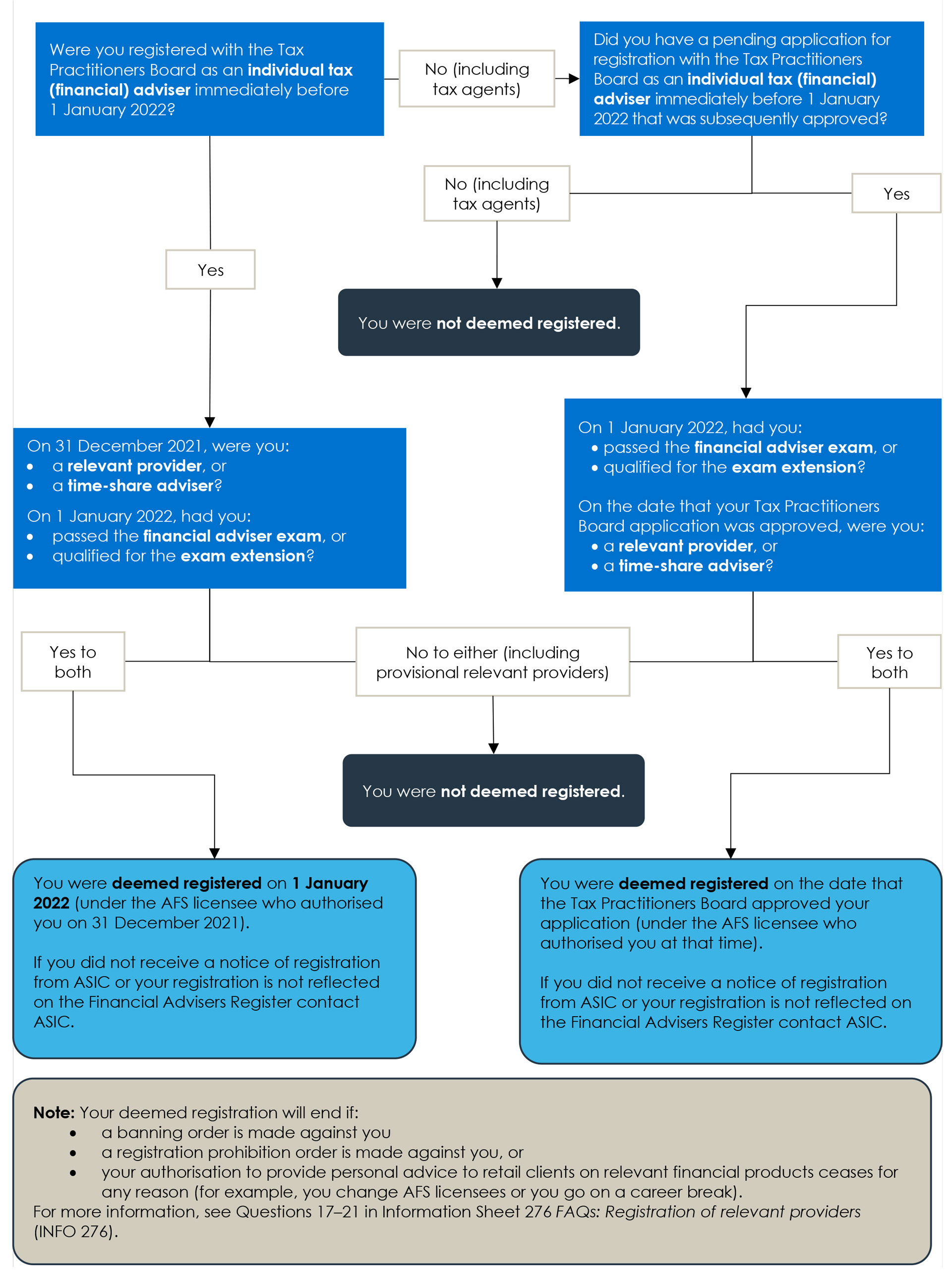

Flowchart: Was I deemed registered with ASIC?

Note: See Table 1 for the process in this flowchart (accessible version). The table includes links to further information.

Table 1: Flowchart – Was I deemed registered with ASIC?

| Step number | Step information |

| Step 1 | Were you registered with the Tax Practitioners Board as an individual tax (financial) adviser immediately before 1 January 2022?

|

| Step 2 | On 31 December 2021, were you:

On 1 January 2022, had you:

For more information, see Information Sheet 260 Timeframe for passing the financial adviser exam (INFO 260).

|

| Step 3 | Did you have a pending application for registration with the Tax Practitioners Board as an individual tax (financial) adviser immediately before 1 January 2022 that was subsequently approved?

|

| Step 4 | You were deemed registered on 1 January 2022 (under the AFS licensee who authorised you on 31 December 2021).

If you did not receive a notice of registration from ASIC or your registration is not reflected on the Financial Advisers Register contact ASIC. Process ends. |

| Step 5 | You were not deemed registered. Process ends. |

| Step 6 | On 1 January 2022, had you:

On the date that your Tax Practitioners Board application was approved, were you:

For more information, see Information Sheet 260 Timeframe for passing the financial adviser exam (INFO 260).

|

| Step 7 | You were not deemed registered. Process ends. |

| Step 8 | You were deemed registered on the date that the Tax Practitioners Board approved your application (under the AFS licensee who authorised you at that time).

If you did not receive a notice of registration from ASIC or your registration is not reflected on the Financial Advisers Register contact ASIC. Process ends. |

| Step 9 | You were not deemed registered. Process ends. |

Note: Your deemed registration will end if:

- a banning order is made against you

- a registration prohibition order is made against you, or

- your authorisation to provide personal advice to retail clients on relevant financial products ceases for any reason (for example, you change AFS licensees or you go on a career break).

For more information, see Questions 17–21 in Information Sheet 276 FAQs: Registration of relevant providers (INFO 276).