Equity market data for quarter ending December 2022

For an explanation of the measures used in this release, see Information Sheet 177 Quarterly cash equity market data: Methodology and definitions (INFO 177).

Summary

Summary for quarter ending December 2022

Tables

Table 1: Market characteristics – Average for December quarter 2022

Table 2: Measures of market concentration

Table 3: Measures of market efficiency

Graphs

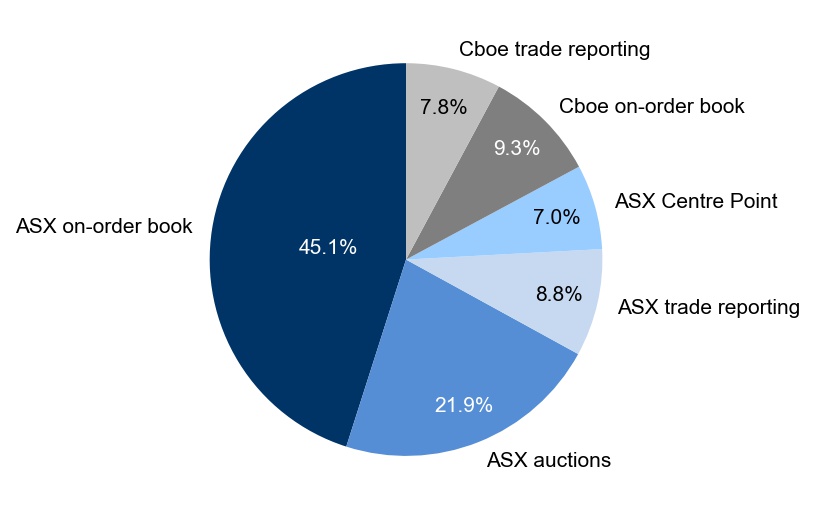

Figure 1: Market share – December quarter 2022

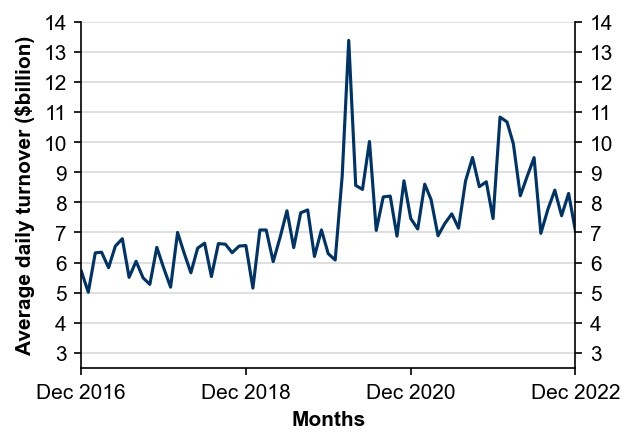

Figure 2: Average daily turnover

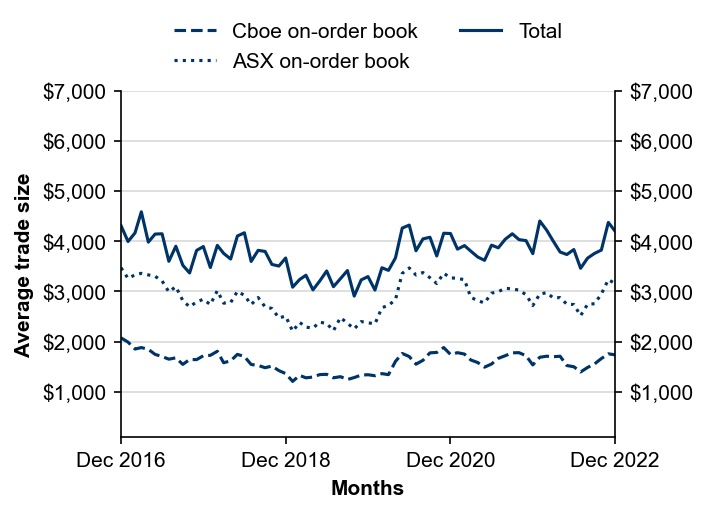

Figure 3: Average trade size by execution venue

Figure 4: Dark liquidity proportion of total value traded

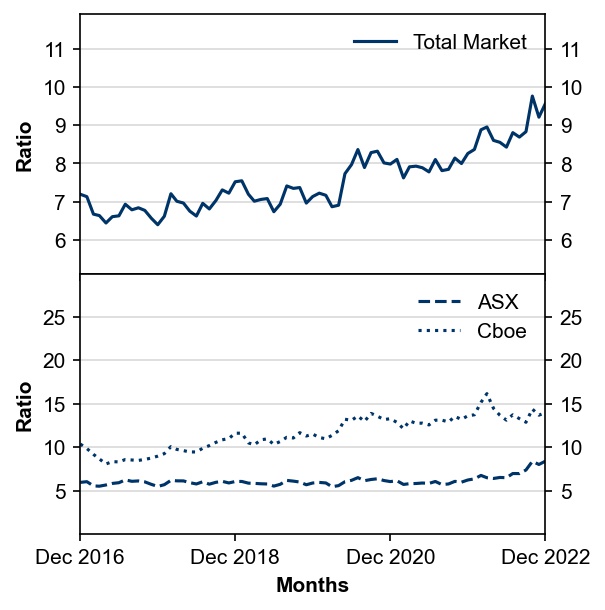

Figure 5: Order-to-trade ratio

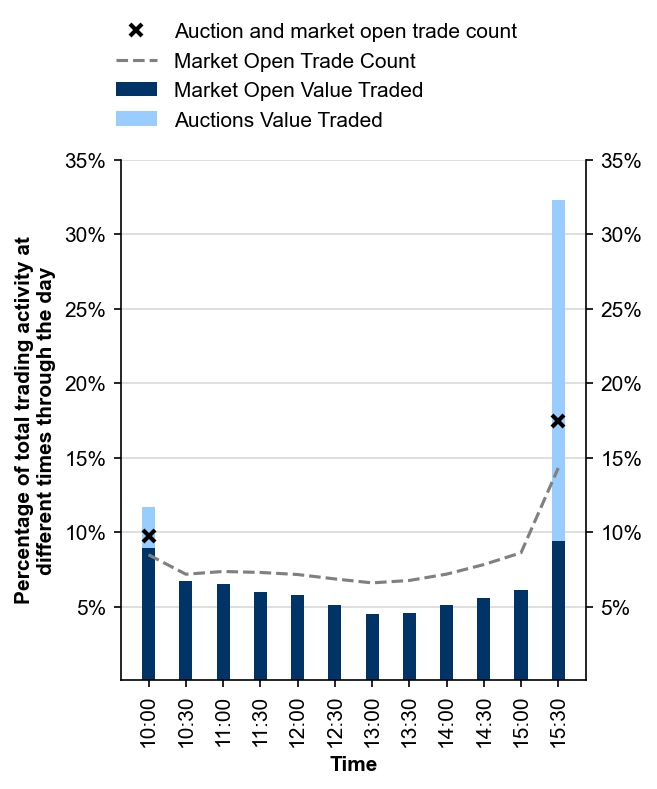

Figure 6: Intraday trading profile – December quarter 2022

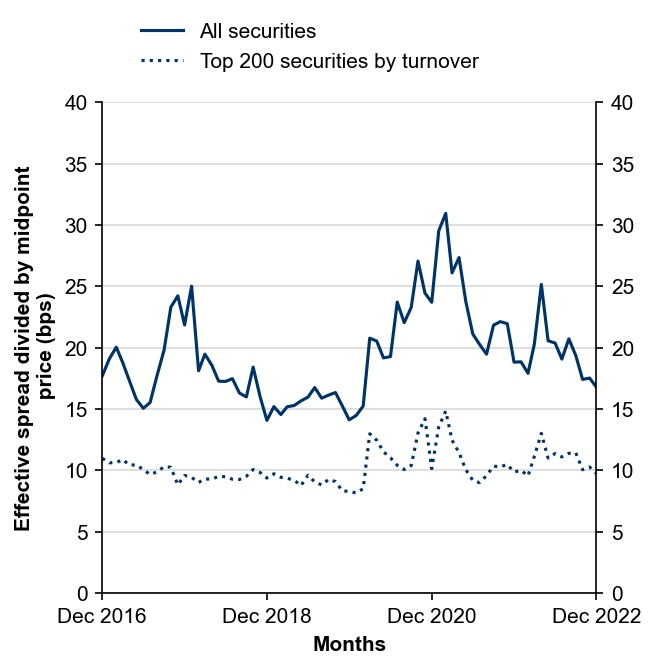

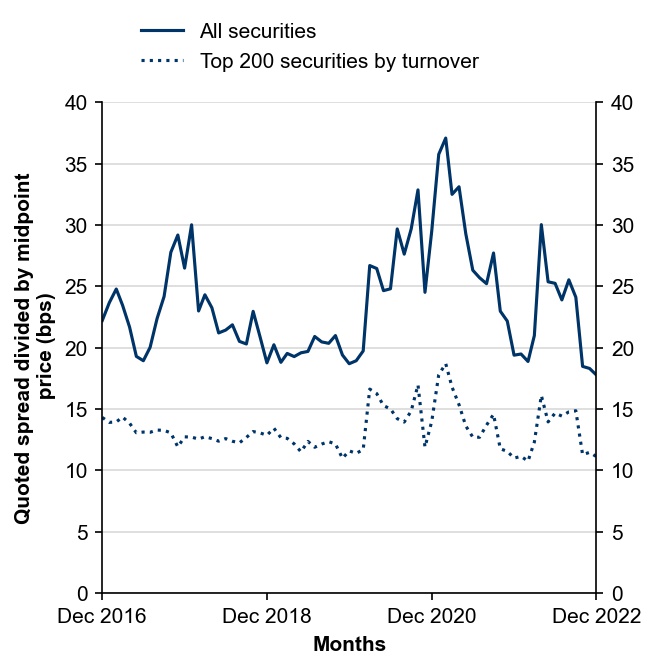

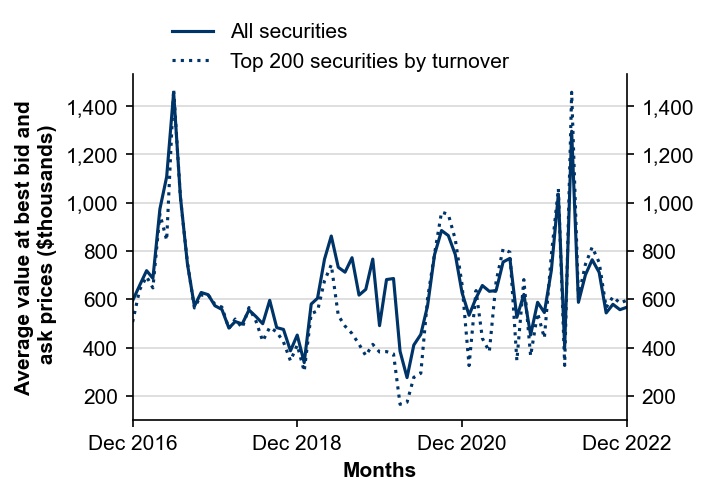

Figure 10: Effective bid-ask spreads

Equity market data from other quarters

Summary for quarter ending December 2022

In the December 2022 quarter, ASX accounted for 82.8% of the total dollar turnover in equity market products. Cboe accounted for the remaining 17.2% of total dollar turnover. This is an increase in ASX’s market share from last quarter where it was 82.3%. These figures include all trades executed on order book, as well as trades matched off order book and reported to either market operator. On order book turnover (excluding ASX auctions) as a proportion of total dollar turnover decreased to 61.4% in the December quarter from 61.5% in the September quarter. Trade reporting turnover as a proportion of total dollar turnover increased to 16.7%, compared to 16.2% in the September quarter.

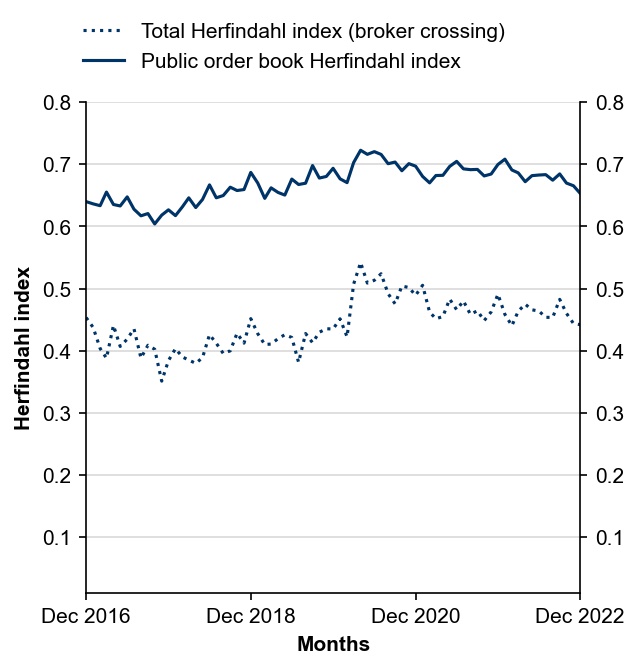

ASX’s market share, measured by the Herfindahl-Hirschman Index (HHI) measure of market concentration of public order book volumes, decreased to 0.66 in the December quarter from 0.68 in the September quarter (maximum 1.00).

Daily Turnover in the Australian equity market decreased by $75 million from the September quarter to an average of $7.6 billion for the December quarter.

The overall order-to-trade ratio increased from 8.8:1 in the September quarter to 9.5:1 in the December quarter.

Depth of the orderbook across the best bid and ask in the December 2022 quarter reached an average of $597,000 across the largest 200 securities and $568,000 across all securities, compared to $712,000 and $673,000 last quarter, respectively. Quoted spreads in the December quarter have decreased for the largest 200 securities, currently at an average of 11.29 bps from 14.68 bps last quarter. Across all securities, quoted spreads have decreased, at 18.18 bps from 24.51 bps last quarter. Effective spreads have decreased across the largest 200 securities, at 10.02 bps from 11.30 bps last quarter, and decreased across all equity products, at 17.24 bps in the December quarter from 19.71 bps previously.

Table 1: Market characteristics – Average for December quarter 2022

| Statistics | ASX on book | ASX Auctions | ASX Centre Point | ASX trade reporting | Cboe on book | Cboe trade reporting | Total |

|---|---|---|---|---|---|---|---|

| Number of trades per day | 1,108,042 | 58,945 | 179,533 | 35,321 | 414,551 | 55,030 | 1,851,423 |

| (market share) | 59.8% | 3.2% | 9.7% | 1.9% | 22.4% | 3.0% | 100.0% |

| Value traded ($ million/day) | 3,443.5 | 1,675.5 | 533.9 | 675.3 | 712.3 | 598.4 | 7,639.0 |

| (market share) | 45.1% | 21.9% | 7.0% | 8.8% | 9.3% | 7.8% | 100.0% |

| Order-to-trade ratio | 8.3 | na | 7.3 | na | 14.0 | na | 9.5 |

| Average trade size ($/trade) | 3,113.9 | 28,471.9 | 2,980.7 | 19,023.0 | 1,720.0 | 10,987.6 | 4,133.0 |

Table 2: Measures of market concentration

| Statistics | Dec 2021 | Oct 2022 | Nov 2022 | Dec 2022 |

|---|---|---|---|---|

| Total market | 0.49 | 0.46 | 0.44 | 0.44 |

| Public venues | 0.70 | 0.67 | 0.67 | 0.65 |

Table 3: Measures of market efficiency

| Market Efficiency Statistics | Dec 2021 | Oct 2022 | Nov 2022 | Dec 2022 |

|---|---|---|---|---|

| Quoted bid-ask spread (bps) | ||||

| Top 200 securities by turnover | 11.00 | 11.28 | 11.47 | 11.12 |

| All Securities | 19.39 | 18.47 | 18.30 | 17.77 |

| Effective bid-ask spread (bps) | ||||

| Top 200 securities by turnover | 9.87 | 10.05 | 10.27 | 9.74 |

| All Securities | 18.82 | 17.41 | 17.52 | 16.78 |

| Best depth ($) | ||||

| Top 200 securities by turnover | 440,063.99 | 610,698.73 | 585,112.37 | 595,806.33 |

| All Securities | 545,519.92 | 579,498.70 | 557,351.60 | 567,184.40 |

Note: BLD in July 2021, SYD in February 2022, and CIM in March 2022 are excluded when computing depth metrics.

Figure 1: Market share – December quarter 2022

Figure 2: Average daily turnover

Figure 3: Average trade size by execution venue

Figure 4: Dark liquidity proportion of total value traded

Figure 5: Order-to-trade ratio

Figure 6: Intraday trading profile – December quarter 2022

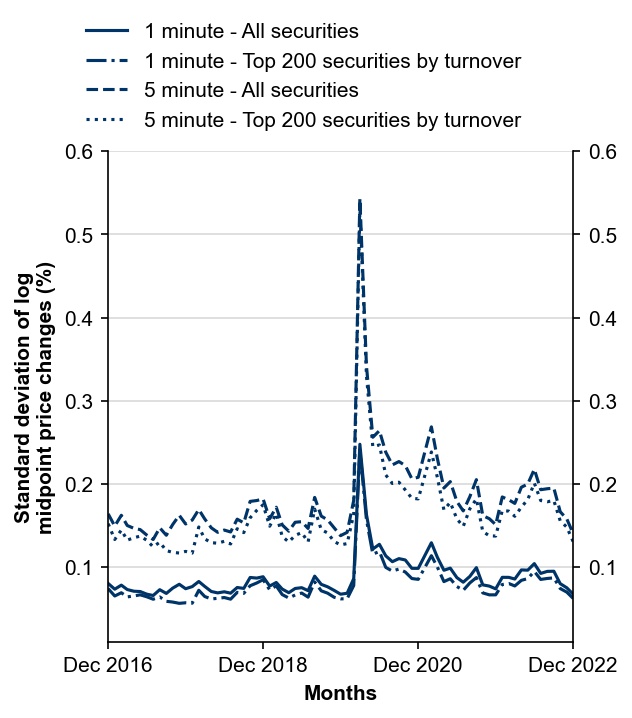

Figure 7: Intraday volatility

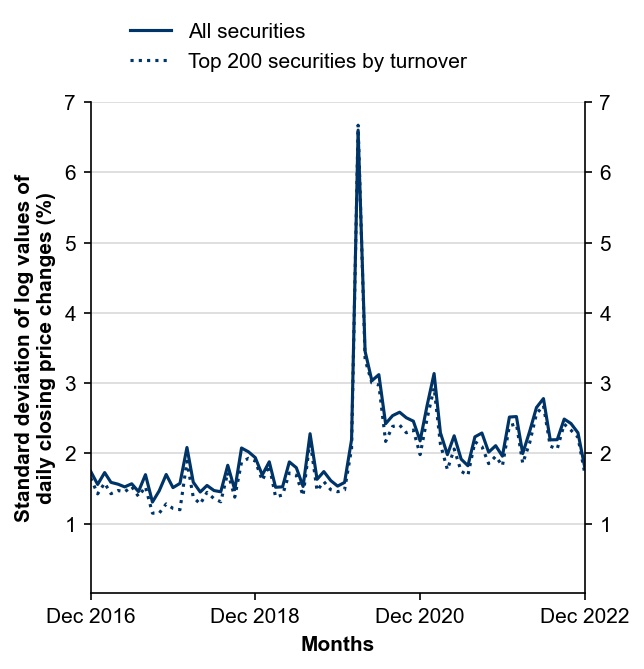

Figure 8: Interday Volatility

Figure 9: Herfindahl index

Figure 10: Effective bid-ask spreads

Figure 11: Quoted bid-ask spreads

Figure 12: Depth at best bid and ask prices

Note: BLD in July 2021, SYD in February 2022, and CIM in March 2022 are excluded when computing depth metrics.